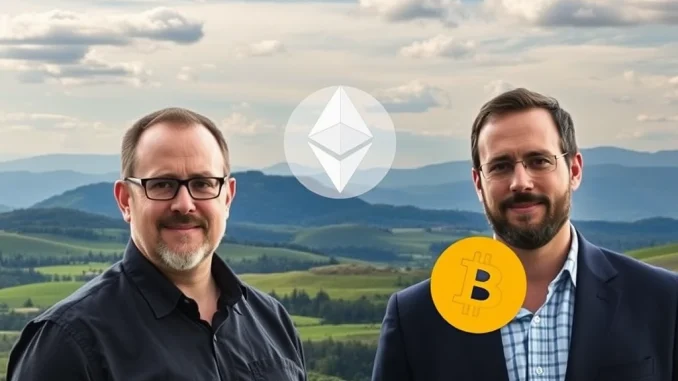

In a significant development for the crypto investment world, Ethereum co-founder Joe Lubin has revealed the launch of a dedicated ETH investment firm. This move, which quietly happened six months ago, signals a focused effort to accumulate and manage Ether (ETH) assets on a larger scale. The inspiration behind this venture? None other than Michael Saylor, the founder of MicroStrategy, known for his aggressive Bitcoin acquisition strategy.

Inspired by Michael Saylor, Focused on Ethereum

Joe Lubin, who also serves as the CEO of ConsenSys, a leading Ethereum software company, shared that a conversation with Michael Saylor provided the spark for his new firm. Saylor’s approach of using leveraged investments to build a substantial Bitcoin treasury for MicroStrategy captured Lubin’s attention. While inspired by the *strategy* of significant asset accumulation, Lubin is charting a distinct course for his Ethereum venture.

Unlike MicroStrategy’s extensive use of leverage, Lubin’s new firm aims to raise capital specifically for purchasing more Ethereum while consciously avoiding excessive leverage. This suggests a more cautious, long-term accumulation play, potentially targeting institutional investors or high-net-worth individuals looking for direct exposure to ETH.

Why a Dedicated ETH Investment Firm Now?

Launching a new crypto investment firm, especially one focused on a single asset like Ethereum, indicates a strong conviction in ETH’s future potential. With Ethereum’s transition to Proof-of-Stake, its deflationary mechanics, and its central role in decentralized finance (DeFi), NFTs, and web3, proponents see significant growth opportunities. A dedicated firm allows for focused expertise, capital raising, and strategic positioning within the Ethereum ecosystem.

Key aspects of this strategy:

- **Targeted Accumulation:** The firm’s sole focus is acquiring and holding Ethereum.

- **Capital Raising:** Actively seeking external capital to increase buying power.

- **Risk Management:** A deliberate decision to limit leverage, contrasting with some other large-scale crypto buyers.

- **Long-Term View:** Positioning ETH as a core digital asset for the future.

Joe Lubin’s Vision for ETH Investment

Joe Lubin has been a foundational figure in the Ethereum world since its inception. His leadership at ConsenSys has been instrumental in building much of the infrastructure and applications that run on the network. Launching an investment firm dedicated to ETH aligns with his long-standing belief in the network’s value and future dominance.

This move could be seen as a strategic effort to provide a structured vehicle for larger investors to gain exposure to Ether, potentially mirroring the impact MicroStrategy has had on providing traditional investors indirect access to Bitcoin via its stock. By raising capital specifically for ETH, the firm could contribute to increased demand and potentially influence market dynamics.

Challenges and Opportunities in Crypto Investment

While the inspiration from Michael Saylor‘s success is clear, Lubin’s venture faces its own set of challenges. The current crypto market, while recovering, remains volatile. Raising significant capital in this environment requires demonstrating a robust strategy and clear value proposition. Furthermore, managing large pools of digital assets comes with unique security and operational complexities.

However, the opportunities are substantial. As institutional interest in digital assets matures, a dedicated ETH investment firm led by a figure as prominent as Joe Lubin could attract significant flows. Ethereum’s ongoing development, including scaling solutions and protocol improvements, provides a compelling narrative for investors looking beyond just Bitcoin.

In summary, Joe Lubin’s new firm marks a notable development in the crypto investment landscape. Inspired by the scale of Michael Saylor’s ambition but adopting a distinct, lower-leverage approach, the firm is poised to become a significant player in the Ethereum market. Its success in raising capital and executing its accumulation strategy will be closely watched by investors and the wider crypto community, potentially paving a new path for institutional engagement with Ether.