Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

Key Takeaways

Ethereum recorded its largest outflows since August 2022, totaling $61 million.

Positive shifts in Bitcoin and multi-asset ETPs suggest changing investor sentiment.

Share this article

![]()

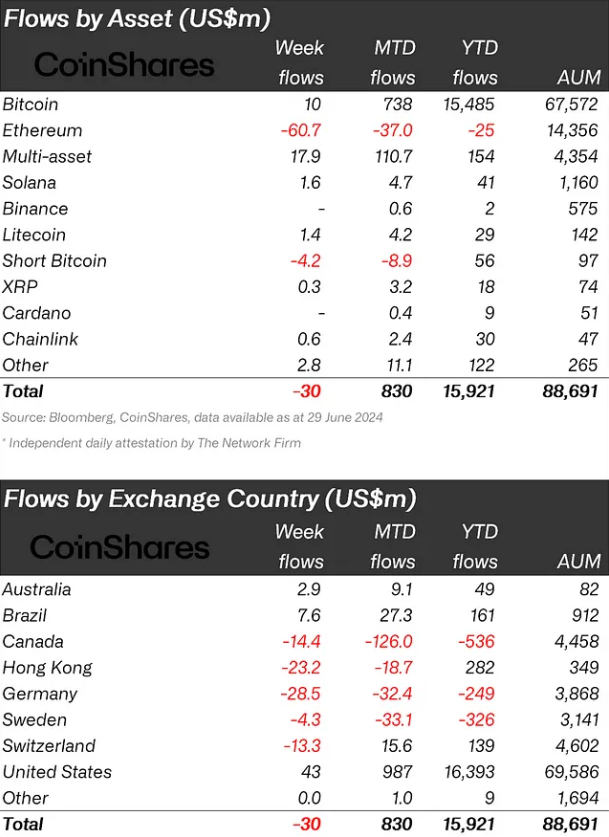

Crypto exchange-traded products (ETF) experienced their third consecutive week of net outflows, totaling $30 million. Notably, Ethereum-indexed ETPs saw over $60 million in outflows last week, their largest outflows since August 2022, according to asset management firm CoinShares. This makes Ethereum (ETH) the year’s worst-performing asset in terms of net flows.

Additionally, ETH’s total outflows to $119 million over the past two weeks. In contrast, multi-asset and Bitcoin ETPs saw inflows of $18 million and $10 million, respectively. The outflows from short Bitcoin positions totaled $4.2 million, indicating a potential shift in market sentiment.

Despite the grim weekly performance for Ethereum ETPs, the rate of outflows has slowed compared to previous weeks.

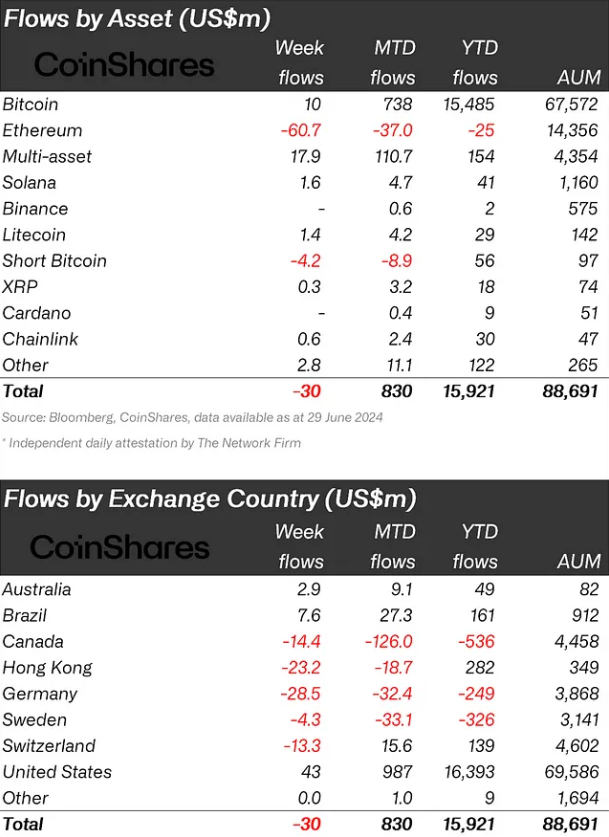

Regionally, the US, Brazil, and Australia recorded inflows of $43 million, $7.6 million, and $3 million, respectively. Conversely, Germany, Hong Kong, Canada, and Switzerland faced outflows of $29 million, $23 million, $14 million, and $13 million, respectively.

While many providers reported minor inflows, these were overshadowed by a significant $153 million in outflows from Grayscale. Weekly trading volumes surged by 43% to $6.2 billion, though this figure is still below the $14.2 billion average for the year.

Yet, although a generally positive sentiment towards crypto could be seen this year, blockchain equities have suffered, with outflows reaching $545 million, accounting for 19% of assets under management.

Share this article

![]()

[ad_2]

Source link