The cryptocurrency market often experiences volatility, yet recent data highlights a significant shift. Digital asset funds have made a remarkable return to positive territory. Investment products in this sector saw substantial net inflows last week. This positive trend marks a strong rebound after a brief period of outflows. This resurgence signals renewed investor confidence in the digital asset space.

Digital Asset Funds Rebound: A Closer Look at Net Inflows

Last week, digital asset investment products recorded impressive net inflows. These inflows totaled an impressive $2.48 billion, according to a recent report by CoinShares. This figure represents a robust return to positive flows. It follows a single week of net outflows, demonstrating the market’s resilience. Investors are clearly re-engaging with the cryptocurrency market, pushing capital back into these products. This movement is a strong indicator of shifting sentiment.

The overall market sentiment appears to be strengthening. Furthermore, these significant inflows suggest growing institutional interest. Many market participants view this as a positive sign. It indicates a broader acceptance and integration of digital assets into traditional finance. Therefore, monitoring these trends provides valuable insights into market health.

Here’s a quick breakdown of last week’s performance:

- Total Net Inflows: $2.48 billion

- Leading Asset: Ethereum

- Following Asset: Bitcoin

- Source: CoinShares report

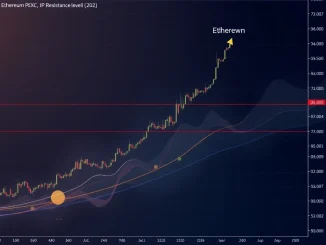

Ethereum Inflows Lead the Charge: A Dominant Performance

Ethereum investment products stood out, attracting the lion’s share of capital. Specifically, they drew in a substantial $1.4 billion in inflows. This figure highlights Ethereum’s growing appeal among investors. Ethereum’s robust ecosystem and ongoing developments likely contribute to this strong performance. The upcoming upgrades and its central role in decentralized finance (DeFi) make it a compelling asset. Consequently, its dominance in recent inflows is a testament to its market position.

Decoding Ethereum’s Appeal

Several factors explain the significant Ethereum inflows. Firstly, the Ethereum network continues to evolve. Its transition to a Proof-of-Stake consensus mechanism has enhanced its energy efficiency. This appeals to environmentally conscious investors. Secondly, Ethereum remains the backbone for countless decentralized applications. These include DeFi protocols, NFTs, and various Web3 projects. This widespread utility drives demand for ETH. Thirdly, staking opportunities offer attractive yields. These yields provide an incentive for long-term holding. Therefore, investors see significant potential in Ethereum’s future.

Looking at monthly figures, Ethereum’s performance is even more striking. For the month of August, Ethereum products accumulated a staggering $3.95 billion in net inflows. This consistent positive flow underscores sustained investor confidence. It also positions Ethereum as a leading contender in the digital asset space. Its ecosystem growth and technological advancements continue to attract substantial capital. This sustained interest suggests a bright outlook for the asset.

Bitcoin Funds Navigate Mixed Signals

While Ethereum led, Bitcoin products also experienced positive movement. Bitcoin funds saw net inflows of $748 million last week. This indicates continued interest in the flagship cryptocurrency. Bitcoin often serves as a primary entry point for institutional investors. Its status as a store of value attracts significant capital. Therefore, these inflows reflect ongoing institutional engagement.

Understanding Bitcoin’s Monthly Outflows

However, Bitcoin’s monthly performance presents a different picture. For August, Bitcoin products recorded net outflows of $301 million. This contrasts sharply with Ethereum’s strong monthly inflows. Several factors might explain these outflows. Investors may have engaged in profit-taking after recent price surges. Macroeconomic uncertainties could also prompt some to de-risk their portfolios. Additionally, some capital might be rotating into other altcoins, including Ethereum. Despite the monthly outflows, Bitcoin’s weekly inflows remain a positive sign. They confirm its enduring appeal and market presence.

Broader Implications for Crypto Investment

The return to net inflows for digital asset funds carries significant implications. It suggests a strengthening of investor sentiment across the board. Institutional players often drive these large-scale movements. Their renewed interest can stabilize the market. This stability is crucial for sustained growth. Moreover, the divergence between Ethereum and Bitcoin’s monthly performance is noteworthy. It indicates a potential shift in investment focus. Investors might be seeking assets with stronger growth narratives or unique utility. This dynamic environment encourages diversification in crypto investment strategies.

The overall market health benefits from these positive flows. Increased capital injection can support innovation. It also helps in the development of new projects. A healthy inflow environment fosters greater participation. This includes both retail and institutional investors. Thus, these trends provide valuable insights into market direction.

The Road Ahead for Digital Assets

The recent surge in net inflows highlights a resilient market. While Bitcoin remains a foundational asset, Ethereum’s leadership signals evolving preferences. Investors are increasingly recognizing the value of diverse blockchain ecosystems. This diversification is a healthy sign for the industry’s maturity. The ongoing institutional adoption of digital assets continues to drive these trends. We can expect further innovation and growth in this space. Monitoring these capital movements will remain essential for understanding market dynamics. The future of digital assets appears promising, driven by sustained investment and technological advancements.

This positive momentum could attract even more capital. As a result, the market may see further price appreciation. Regulatory clarity could also play a significant role. Clear regulations often boost investor confidence. Therefore, the current environment presents exciting opportunities for growth.

Conclusion

Digital asset investment products have demonstrated robust health with a significant return to net inflows. Ethereum’s dominant performance, attracting $1.4 billion last week and $3.95 billion in August, clearly indicates its growing influence. While Bitcoin funds also saw positive weekly inflows, their monthly outflows suggest a more nuanced picture. These trends collectively paint a hopeful outlook for crypto investment, showcasing renewed confidence and strategic shifts in the digital asset landscape.

Frequently Asked Questions (FAQs)

Q1: What were the total net inflows for digital asset funds last week?

Last week, digital asset investment products experienced total net inflows of $2.48 billion. This marked a strong return to positive flows after a brief period of outflows.

Q2: Which digital asset led the recent inflows?

Ethereum investment products led the way, attracting a significant $1.4 billion in inflows last week. This highlights Ethereum’s strong appeal and market position.

Q3: How did Bitcoin funds perform last week and over the month of August?

Bitcoin products saw net inflows of $748 million last week. However, for the entire month of August, Bitcoin products experienced net outflows totaling $301 million, contrasting with Ethereum’s strong monthly performance.

Q4: What does the term ‘net inflows’ mean in the context of digital asset funds?

Net inflows refer to the total amount of new money invested into digital asset products, such as exchange-traded products (ETPs) or trusts, minus any withdrawals during a specific period. Positive net inflows indicate more money is entering the market than leaving it.

Q5: What factors might be driving the significant Ethereum inflows?

Several factors contribute to strong Ethereum inflows, including its robust ecosystem for DeFi and NFTs, ongoing network upgrades (like the transition to Proof-of-Stake), attractive staking yields, and its increasing utility in the broader Web3 space.

Q6: What do these recent trends imply for the future of crypto investment?

These trends suggest renewed investor confidence and a potential shift in investment focus within the digital asset market. The strong net inflows indicate a healthy, growing market, while Ethereum’s leadership highlights the increasing importance of assets with strong utility and development narratives. This could lead to further institutional adoption and market diversification.