The cryptocurrency landscape continually evolves, introducing innovative financial instruments. A significant development recently emerged from Ethena, a prominent DeFi protocol. Specifically, Ethena has announced a major expansion for its synthetic stablecoin, USDe. This move directly impacts the stability and reach of **Ethena USDe**, signaling a new era of growth. The protocol officially approved BNB as a new asset to back USDe. This decision marks a pivotal moment for the stablecoin market. Furthermore, it highlights Ethena’s strategic vision for diversification.

Ethena USDe Welcomes BNB Collateral

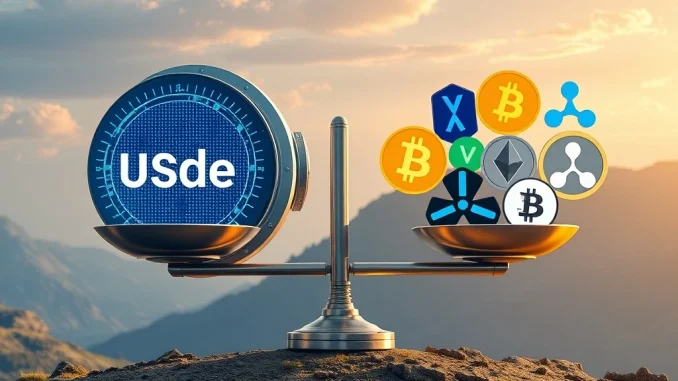

Ethena, a leading synthetic dollar protocol, recently made a landmark announcement. It officially approved Binance Coin (BNB) as the first new asset to back its USDe synthetic stablecoin. This integration follows the launch of Ethena’s innovative Eligible Asset Framework. This framework establishes clear quantitative and governance criteria. Consequently, it paves the way for future collateral additions beyond the existing Bitcoin (BTC) and Ethereum (ETH) holdings. The inclusion of **BNB collateral** significantly diversifies USDe’s backing. This development enhances the stablecoin’s robustness. Moreover, it strengthens its position within the competitive digital asset market.

USDe has rapidly ascended in market capitalization. It now stands as the third-largest stablecoin globally. Its supply has reached an impressive $11.75 billion. This rapid growth underscores the market’s confidence in Ethena’s model. The protocol’s success stems from its unique approach. It maintains its peg through delta-hedged perpetual futures. This sophisticated mechanism helps mitigate price volatility. Furthermore, it ensures the stability expected from a reliable synthetic dollar. The addition of BNB further solidifies this foundation. It also opens new avenues for liquidity and integration across various blockchain ecosystems.

Understanding the Eligible Asset Framework for Crypto Collateral

The introduction of the Eligible Asset Framework is a crucial step for Ethena. This framework provides a transparent and structured process. It governs the selection and integration of new **crypto collateral** assets. The framework outlines specific criteria. These include both quantitative metrics and governance considerations. Quantitative criteria often involve market capitalization, liquidity, and historical volatility. Governance criteria, on the other hand, focus on decentralization and community consensus. This structured approach minimizes risk. It also ensures the long-term stability of USDe.

The framework’s primary objective is to enhance USDe’s resilience. It achieves this by diversifying its backing assets. Before this framework, USDe relied primarily on BTC and ETH. While robust, this limited diversification. Now, Ethena can strategically onboard other high-quality digital assets. This process involves rigorous review by the protocol’s risk committee. They assess each potential asset against the established thresholds. This meticulous evaluation ensures only suitable assets are considered. Therefore, the framework represents a commitment to security and stability.

XRP Backing and HYPE: The Next Frontier for Ethena

Looking ahead, Ethena’s risk committee has already identified potential future additions. Specifically, XRP and HYPE meet the initial thresholds set by the framework. These assets are now under consideration for future integration. The prospect of **XRP backing** USDe is particularly noteworthy. XRP is a widely recognized cryptocurrency. It boasts a large market capitalization and significant liquidity. Its inclusion would further broaden USDe’s collateral base. This move could also attract new users and investors. Such expansion demonstrates Ethena’s ambition. It aims to become a truly multi-asset-backed synthetic stablecoin.

However, the journey for XRP and HYPE is not yet complete. Both assets require further in-depth review. This review will assess their suitability more thoroughly. It will consider factors like regulatory landscape and technical integration. The decision to explore XRP and HYPE highlights Ethena’s proactive strategy. The protocol constantly seeks to strengthen USDe’s foundation. It also aims to expand its utility. By adding diverse assets, Ethena mitigates concentration risk. This approach contributes to a more stable and robust synthetic dollar. It ensures continued confidence in USDe’s peg.

The Mechanics of Synthetic Stablecoins: Ethena’s USDe Model

Understanding how USDe maintains its peg is essential. Ethena employs a sophisticated mechanism known as delta-hedged perpetual futures. This strategy involves simultaneously holding a long position in a cryptocurrency (like BTC or ETH) and a short position in its perpetual futures contract. This combination effectively neutralizes price exposure. Therefore, the value of the collateral remains stable relative to the US dollar. This innovative approach differentiates USDe from traditional collateralized stablecoins. It provides a capital-efficient way to maintain a stable peg.

A **synthetic stablecoin** like USDe offers unique advantages. It does not rely on direct fiat currency reserves. Instead, it leverages decentralized financial instruments. This structure enhances transparency and reduces counterparty risk. The protocol actively manages its positions. This ensures the delta neutrality is maintained. Any fluctuations in the underlying asset’s price are offset. This careful management is critical for USDe’s reliability. It allows the stablecoin to function effectively within the volatile crypto market. Ethena’s model represents a significant advancement in stablecoin design.

Market Impact and Future Outlook for Ethena

Ethena’s recent announcements have generated considerable buzz. The addition of BNB collateral is a significant milestone. It reinforces USDe’s market presence. The exploration of XRP and HYPE signals continued innovation. This strategic expansion could further propel USDe’s growth. It may also attract a broader range of institutional and retail investors. As USDe expands its collateral base, its appeal grows. Its utility across various DeFi applications also increases. This growth solidifies Ethena’s position as a key player.

The broader stablecoin market is highly competitive. Ethena’s unique synthetic model offers a compelling alternative. Its delta-hedging strategy provides a distinct risk profile. This makes it attractive to those seeking diversified stablecoin exposure. However, regulatory scrutiny remains a constant factor. Ethena must navigate these evolving landscapes carefully. Its commitment to a robust framework is crucial. This will ensure long-term sustainability and trust. The future of **Ethena USDe** appears promising. Its innovative approach is set to reshape the stablecoin sector.

In conclusion, Ethena’s decision to add BNB as collateral marks a strategic expansion. It significantly strengthens USDe’s backing. The protocol’s Eligible Asset Framework ensures a rigorous process for future additions. With XRP and HYPE under review, USDe’s diversification continues. This commitment to a multi-asset collateral base enhances stability. It also positions Ethena USDe for sustained growth. The synthetic stablecoin is indeed carving out a significant niche. Its innovative model continues to gain traction in the decentralized finance ecosystem.

Frequently Asked Questions (FAQs)

What is Ethena USDe?

Ethena USDe is a synthetic stablecoin. It aims to maintain a stable peg to the US dollar. It achieves this through a unique delta-hedged perpetual futures strategy. This means it uses a combination of long spot positions and short perpetual futures positions in cryptocurrencies like BTC and ETH to remain stable.

Why is the addition of BNB collateral significant for Ethena USDe?

The addition of **BNB collateral** is significant for several reasons. Firstly, it diversifies USDe’s backing assets beyond BTC and ETH. This reduces concentration risk. Secondly, BNB is a highly liquid and widely used cryptocurrency. Its inclusion enhances USDe’s overall liquidity and market reach. It also strengthens its position as a major synthetic stablecoin.

What is the Eligible Asset Framework?

The Eligible Asset Framework is a structured system. Ethena uses it to evaluate and approve new assets for USDe backing. It sets clear quantitative and governance criteria. These criteria ensure that only suitable and robust cryptocurrencies are added as **crypto collateral**. This framework enhances transparency and risk management for the protocol.

Which cryptocurrencies are being considered next for USDe backing?

Ethena’s risk committee has identified XRP and HYPE as potential future collateral assets. These cryptocurrencies meet the initial thresholds of the Eligible Asset Framework. They are currently undergoing further review and assessment. The potential for **XRP backing** is particularly exciting for many in the crypto community.

How does Ethena’s USDe differ from traditional stablecoins?

Ethena’s USDe is a **synthetic stablecoin**. It differs from traditional stablecoins like USDT or USDC. These typically rely on direct fiat currency reserves or over-collateralization with crypto. USDe uses a delta-hedged perpetual futures strategy. This provides a capital-efficient and transparent method for maintaining its dollar peg. It does not hold traditional bank reserves.

What is the current market position of Ethena USDe?

Ethena USDe has rapidly grown to become the third-largest stablecoin by supply. Its market capitalization exceeds $11.75 billion. This impressive growth reflects increasing adoption and confidence in its innovative synthetic dollar model within the DeFi ecosystem.