The crypto world is buzzing with a development that could send ripples through the venture capital landscape: the U.S. Department of Justice (DOJ) is reportedly weighing criminal charges against a prominent figure from Dragonfly Capital related to an early Tornado Cash investment. This isn’t just another headline; it’s a significant move that could redefine accountability in the decentralized finance (DeFi) space and profoundly impact future crypto investment strategies.

The Storm Brews: DOJ Targets Dragonfly Capital Partner

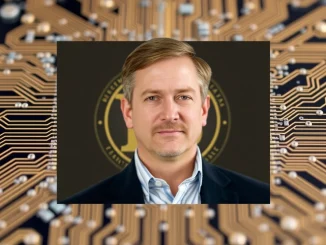

The DOJ is zeroing in on Tom Schmidt, a general partner at crypto VC giant Dragonfly Capital. The focus? A 2020 investment in Tornado Cash, a privacy tool now notorious for its alleged use in illicit financial activities. This news surfaced during the ongoing trial of Roman Storm, a Tornado Cash developer facing serious charges. Prosecutors revealed that Schmidt and another unnamed individual are under scrutiny, though they clarified the firm itself isn’t the primary target. The plot thickened when Schmidt invoked the Fifth Amendment, refusing to testify without immunity. This decision reportedly altered the defense’s strategy, which had hoped his testimony would contextualize the investment rationale.

Tornado Cash: A Privacy Tool Under Fire

For those new to the space, Tornado Cash is a decentralized mixer designed to enhance transaction privacy on the Ethereum blockchain. It pools various crypto assets, making it harder to trace the origin and destination of funds. While lauded by privacy advocates, its anonymity features have made it a magnet for bad actors, including ransomware groups and sanctioned entities. The U.S. Treasury Department sanctioned Tornado Cash in 2022, labeling it a significant national security threat due to its role in facilitating money laundering. This case underscores the dual-use nature of many blockchain technologies – powerful tools that can be leveraged for both legitimate and illicit purposes, posing a complex challenge for regulators and those involved in crypto investment.

The Perilous Path of Crypto Investment: What’s at Stake?

Dragonfly Capital has publicly defended its crypto investment, stating it cooperated with federal investigations since 2023. Haseeb Qureshi, Dragonfly’s managing partner, emphasized the firm’s belief in the investment’s legality, citing external legal opinions obtained before the 2020 transaction. He stressed that the firm had no contact with illicit users and is committed to portfolio compliance. However, the DOJ is reportedly scrutinizing internal communications to determine if the firm knowingly supported activities violating U.S. law, such as sanctions evasion. This situation highlights the increasing regulatory pressure on venture capital firms in the crypto space, forcing a re-evaluation of due diligence practices for projects with potential dual-use capabilities.

Navigating the Legal Labyrinth: Understanding Criminal Charges

The potential for criminal charges against a venture capital partner marks a significant shift in the DOJ’s enforcement strategy. Historically, actions against Tornado Cash focused on individual users. This case, however, extends accountability to investors, exploring their liability for funding decentralized technologies that later become entangled in financial crimes. Roman Storm, the Tornado Cash developer, faces up to 45 years in prison if convicted on charges including operating an unlicensed money transmitting business. Dragonfly Capital’s defense rests on the argument that Tornado Cash’s open-source nature absolves investors of direct culpability. Prosecutors, however, may argue that early-stage funders were aware of the inherent risks. The outcome of this case could set a precedent for investor responsibility in DeFi, blurring the lines between innovation and complicity.

The ongoing legal saga involving the DOJ, Dragonfly Capital, and Tornado Cash is more than just a single case; it’s a litmus test for the future of decentralized finance. It underscores the growing tension between rapid innovation in the crypto space and the imperative for regulatory compliance. As regulators grapple with the complexities of decentralized technologies, the industry must adapt, ensuring that investments are not only groundbreaking but also legally sound. This case will undoubtedly shape how venture capitalists approach due diligence in the DeFi sector, pushing for greater scrutiny and a clearer understanding of the potential legal ramifications of supporting projects with dual-use capabilities. The legal uncertainties surrounding DeFi are stark, and the industry watches closely as these lines between legitimate use and illicit activity continue to be defined.

Frequently Asked Questions (FAQs)

What are the main allegations against the Dragonfly Capital partner?

The U.S. Department of Justice (DOJ) is considering criminal charges against Tom Schmidt, a general partner at Dragonfly Capital, concerning a 2020 investment in Tornado Cash. The core allegation is that this investment is linked to illicit financial activity, and the DOJ is investigating whether the firm knowingly supported activities violating U.S. law, such as sanctions evasion.

What is Tornado Cash and why is it controversial?

Tornado Cash is a decentralized privacy tool designed to mix cryptocurrency transactions, making them anonymous. It’s controversial because while it enhances privacy, its features have also been exploited by bad actors, including ransomware groups and sanctioned entities, to launder illicit funds.

How has Dragonfly Capital responded to the allegations?

Dragonfly Capital has denied operational involvement with Tornado Cash and stated its cooperation with federal investigations since 2023. Haseeb Qureshi, a managing partner, publicly reiterated the firm’s belief in the investment’s legality, citing external legal opinions obtained before the transaction, and emphasized their commitment to portfolio compliance.

What are the potential implications for other crypto venture capital firms?

This case could significantly impact other crypto venture capital firms. It signals a broader DOJ strategy to hold investors accountable for funding decentralized technologies linked to financial crimes. It may force VCs to enhance their due diligence processes for projects with “dual-use” capabilities (legitimate and illicit uses) and re-evaluate risk assessments for DeFi investments.

What is the significance of Tom Schmidt invoking the Fifth Amendment?

Tom Schmidt, the Dragonfly Capital partner, invoked the Fifth Amendment, refusing to testify without immunity. This action prevented the defense in the Roman Storm trial from using his testimony to contextualize the investment rationale, thereby shifting their strategy. It also highlights the serious nature of the potential charges he faces.

Who is Roman Storm and what charges does he face?

Roman Storm is a developer of Tornado Cash. He is currently on trial facing conspiracy and money laundering charges, including operating an unlicensed money transmitting business. If convicted, he could face up to 45 years in prison.