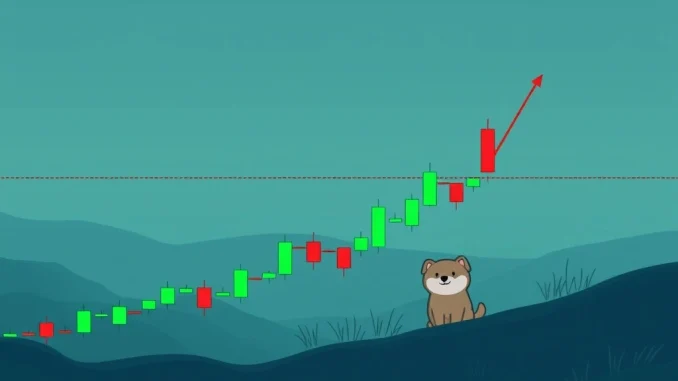

Are you tracking the dynamic world of meme coins? Then you’ve likely noticed the recent action around Dogwifhat (WIF). Despite a modest 3.99% dip in the past 24 hours, this popular token has once again demonstrated a remarkable ability to hold its ground, retesting a critical trendline that could define its immediate future. This article dives deep into the technical patterns and market sentiment influencing the Dogwifhat WIF trajectory, offering insights for both seasoned traders and curious enthusiasts.

Decoding the Dogwifhat WIF Retest: A Crucial Juncture

The recent price action of Dogwifhat WIF has captivated market watchers. After breaking out of a descending wedge formation in late June, the token moved into an ascending channel in July, signaling a shift towards bullish momentum. The key event recently was its retest of a critical descending trendline near the $1.20 mark. This retest is not just a random fluctuation; it’s a classic technical pattern where former resistance levels transform into dynamic support. The fact that WIF touched this line and held, despite the dip, reinforces the strength of this newfound support. It suggests that buyers are stepping in at these crucial levels, preventing a deeper decline and affirming the underlying bullish sentiment that emerged from the wedge breakout.

Analyzing WIF Price Movements: Patterns and Potential

Understanding the historical context of WIF price movements provides valuable perspective. Since early 2025, WIF underwent a prolonged consolidation from January to late April, establishing a stable base before a sharp upward move in early May. This breakout laid the groundwork for the subsequent patterns we’re observing. The descending wedge in June, characterized by converging trendlines, was ultimately resolved with upward pressure. This pattern is often seen as a bullish reversal signal, and WIF’s subsequent movement into an ascending channel in July further reinforced this outlook. While the current trading data shows WIF at $1.04, with intraday price swings failing to surpass $1.07, the overall pattern suggests a potential for continued upward trajectory. Technical analysts are eyeing a projected target range of $2.00–$2.20, contingent on sustained bullish momentum and market conviction.

Key WIF Price Patterns:

- January-April 2025: Prolonged consolidation phase, building a stable base.

- Early May: Sharp upward breakout, signaling renewed interest.

- June: Formation of a descending wedge, a classic bullish reversal pattern.

- Mid-July: Validation of the $1.20 trendline as support after breakout.

- July Onwards: Movement into an ascending channel, indicating higher highs and higher lows.

Is the Bullish Structure Holding Strong?

Despite the recent 3.99% dip, the overarching bullish structure of Dogwifhat (WIF) appears largely intact. The retest of the $1.20 trendline as support, combined with the formation of an ascending channel, are strong indicators. However, a closer look at recent trading volume reveals a decline of 29.15% to $542.62 million. Market capitalization also saw a 3.98% drop, settling at $1.04 billion. The volume-to-market-cap ratio of 51.99% points to active trading, but the dip in volume alongside the price decline suggests that while the structure holds, the immediate buying pressure isn’t as robust as bulls might hope. Sell pressure has dominated recent candlestick formations, and brief rebounds have struggled to sustain above key resistance levels. This indicates a tug-of-war between buyers and sellers, where the bullish thesis needs stronger confirmation through increased buying volume.

Navigating the Crypto Trendline Volatility: What Traders Need to Know

The world of crypto is inherently volatile, and crypto trendline analysis becomes paramount in such conditions. Dogwifhat’s recent performance is a prime example. The asset’s inability to reclaim $1.07, its previous intraday high, signals cautious optimism among traders. While the ascending channel pattern typically suggests a continuation of bullish bias with higher highs and higher lows, the absence of a strong volume surge to confirm recent price action raises a yellow flag. Traders are keenly monitoring whether WIF can reestablish control above $1.10. A sustained move above this threshold, ideally accompanied by increased trading volume, could trigger renewed momentum and validate the continuation of the bullish trend. Conversely, a break below the established trendline support could signal a shift in market dynamics.

Actionable Insights from WIF Analysis

For those performing their own WIF analysis, several actionable insights emerge from the current market data. The retest of the trendline is a positive sign, but the reduced trading volume and struggle to break immediate resistance levels indicate caution is warranted. Here are some points to consider:

- Monitor Key Levels: Keep a close eye on the $1.10 resistance level and the trendline support (currently around $1.00-$1.02 based on the $1.04 price and $1.20 retest context).

- Volume Confirmation: Any significant upward move should ideally be accompanied by a substantial increase in trading volume to confirm its sustainability.

- Market Sentiment: The ‘tug-of-war’ suggests mixed sentiment. Look for sustained buying pressure rather than brief rebounds.

- Risk Management: Given the volatility, implementing stop-loss orders below key support levels is crucial to protect capital.

- Broader Market: Always consider the broader cryptocurrency market sentiment, as WIF’s performance can be influenced by Bitcoin and Ethereum’s movements.

In conclusion, Dogwifhat (WIF) has demonstrated resilience by holding a crucial trendline despite a recent dip. Its underlying bullish structure, characterized by a wedge breakout and ascending channel, remains largely intact. However, the decline in trading volume and struggle to clear immediate resistance levels highlight the ongoing battle between buyers and sellers. While the long-term technical outlook suggests potential for further gains towards the $2.00-$2.20 range, sustained bullish momentum will require a clear breakout above key resistance levels, supported by robust trading volume. As the market continues to evolve, keeping a close watch on these indicators will be essential for navigating WIF’s journey.

Frequently Asked Questions (FAQs)

Q1: What does Dogwifhat (WIF) retesting a trendline mean?

A1: When Dogwifhat (WIF) retests a trendline, especially one that was previously resistance and has now been broken, it means the price is returning to confirm that the former resistance has effectively turned into new support. If the price bounces off this line, it validates the strength of the trendline and reinforces the bullish structure.

Q2: Why is the declining trading volume a concern for WIF’s bullish structure?

A2: While WIF’s price action shows a bullish structure, declining trading volume suggests that the buying interest behind the recent price moves isn’t as strong or broad. For a sustained upward trend, significant price movements are ideally confirmed by high volume, indicating strong conviction from traders. Low volume on a retest or dip can signal caution.

Q3: What is the significance of the ascending channel for Dogwifhat (WIF)?

A3: An ascending channel is a bullish continuation pattern formed by two parallel upward-sloping trendlines. It indicates that the asset is consistently making higher highs and higher lows, suggesting a strong underlying uptrend. For WIF, entering this channel in July reinforces the bullish bias that emerged from its earlier wedge breakout.

Q4: What price levels should traders monitor for Dogwifhat (WIF)?

A4: Traders should closely monitor the immediate resistance level around $1.07-$1.10. A sustained break above this, especially with increased volume, could signal renewed momentum. On the downside, the retested trendline support (around $1.00-$1.02) is crucial. A break below this could invalidate the current bullish structure.

Q5: Is Dogwifhat (WIF) considered a good investment based on this analysis?

A5: This analysis focuses on technical patterns and current market behavior, suggesting a resilient bullish structure. However, it is not financial advice. Investing in meme coins like WIF carries significant risk due to high volatility and speculative nature. Always conduct your own thorough research (DYOR) and consider your risk tolerance before making investment decisions.