Buckle up, crypto enthusiasts! March brought a chilling wind to the decentralized finance (DeFi) landscape, as major protocols across leading blockchains experienced a dramatic slump in revenues. Was it just a blip, or a sign of deeper shifts in the crypto market? Let’s dive into the numbers and uncover what triggered this significant downturn in DeFi revenues.

DeFi Revenues Plunge: What Happened in March?

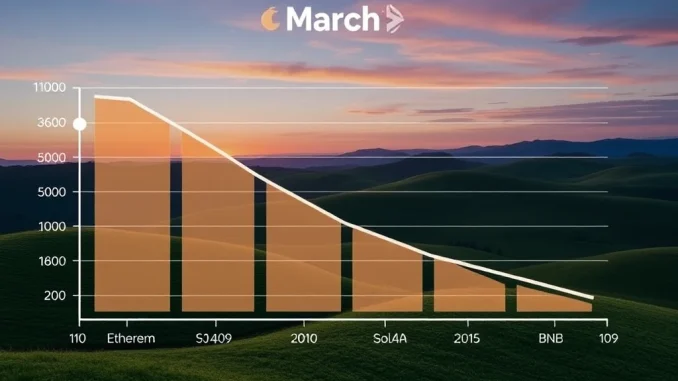

The numbers paint a stark picture. Across the board, key DeFi protocols witnessed a substantial drop in earnings during March. Let’s break down the revenue declines across different blockchain ecosystems:

- Solana: Protocols like Pump.fun, Jito, and Raydium, once riding high, saw their combined revenue plummet to approximately $42 million. This represents a staggering 55% decrease from February and a whopping 75% fall from January’s peak.

- BNB Chain: PancakeSwap, a DeFi staple on BNB Chain, wasn’t spared either. It experienced a 54% month-over-month revenue decrease, settling at $21 million.

- Ethereum: Even the giants of Ethereum-based DeFi, including Lido, Aave, and Curve, felt the squeeze. Their collective revenue dwindled to $24.5 million, marking a 52% drop from February and a 65% decline from January.

To put these figures into perspective, consider this table summarizing the revenue changes:

| Blockchain Network | Protocol Examples | March Revenue (Approx.) | Month-over-Month Change | Peak Month (January) Decline |

|---|---|---|---|---|

| Solana | Pump.fun, Jito, Raydium | $42 Million | -55% | -75% |

| BNB Chain | PancakeSwap | $21 Million | -54% | N/A |

| Ethereum | Lido, Aave, Curve | $24.5 Million | -52% | -65% |

These numbers clearly indicate a widespread contraction in decentralized finance activity across major blockchains during March. But what’s driving this downward trend?

Decoding the Decline in On-Chain Activity

The primary culprit behind the DeFi revenues slump is a significant decrease in on-chain activity. This encompasses various metrics, including:

- Trading Volumes: Lower trading volumes directly translate to reduced fees for DeFi protocols, impacting their revenue streams.

- Liquidity Provision: Reduced incentives or decreased market confidence can lead to less liquidity being provided to DeFi platforms, affecting overall activity.

- Borrowing and Lending: A cautious market sentiment might result in lower borrowing and lending activity, diminishing revenue for lending protocols.

Several factors could be contributing to this dip in on-chain activity:

- Market Correction: After a period of bullish momentum in the early months of the year, March might have witnessed a natural market correction, leading to reduced speculative trading and overall activity.

- Profit Taking: Investors who profited from the earlier price surges might have opted to take profits, reducing trading volumes and on-chain engagement.

- Broader Economic Factors: Macroeconomic uncertainties and global financial conditions can influence investor sentiment and risk appetite in the crypto market, impacting DeFi activity.

- Shifting Trends: The crypto space is dynamic. Capital and user attention might be shifting towards new narratives or sectors within the blockchain ecosystem, temporarily drawing away from established DeFi protocols.

Solana DeFi Protocols Hit Hard

Solana’s DeFi ecosystem, which had been experiencing rapid growth, appears to have been particularly affected by this downturn. The Solana DeFi protocols mentioned, Pump.fun, Jito, and Raydium, experienced the most dramatic percentage declines in revenue. This could be attributed to:

- High Volatility: Solana’s ecosystem, while innovative, can be more susceptible to volatility swings, potentially leading to sharper drops in activity during market corrections.

- Dependence on Memecoins: Protocols like Pump.fun, which are closely tied to the memecoin frenzy, might see significant revenue fluctuations based on memecoin market sentiment.

- Competitive Landscape: The DeFi landscape is increasingly competitive. New protocols and chains constantly emerge, potentially drawing users and liquidity away from established platforms.

Ethereum and BNB Chain Follow Suit in Crypto Market Decline

While Solana’s decline was steeper, even the established DeFi ecosystems on Ethereum and BNB Chain were not immune to the broader crypto market decline. The revenue drops experienced by protocols like PancakeSwap, Lido, Aave, and Curve highlight that the reduced on-chain activity was a widespread phenomenon, affecting even the most robust DeFi platforms. This suggests that the factors driving the downturn are systemic and not isolated to specific chains.

The fact that major Ethereum protocols, considered the bedrock of DeFi, also saw significant revenue decreases underscores the breadth and depth of this market shift.

MakerDAO: The Exception to the Crypto Market Decline

Amidst the sea of red, there was one notable exception: MakerDAO. This protocol stood out by recording an 11% revenue increase in March, reaching $10 million. What makes MakerDAO different? Several factors might have contributed to its resilience:

- Stablecoin Focus: MakerDAO is primarily focused on DAI, a decentralized stablecoin. In times of market uncertainty, stablecoins often see increased demand as investors seek safe havens.

- Real-World Asset Integration: MakerDAO has been exploring the integration of real-world assets (RWAs) into its protocol, potentially diversifying its revenue streams and making it less reliant on purely crypto-native activity.

- Strong Governance and Community: MakerDAO boasts a robust governance structure and a strong community, which can contribute to its stability and adaptability in changing market conditions.

MakerDAO’s performance highlights the potential for certain DeFi protocols, particularly those focused on stablecoins and diversification, to weather market downturns more effectively.

Navigating the Volatile Crypto Market: Actionable Insights for Decentralized Finance

The March DeFi revenues plunge serves as a stark reminder of the volatility inherent in the crypto market decline and the DeFi sector. What can DeFi users and investors learn from this experience?

- Diversification is Key: Don’t put all your eggs in one basket. Diversify your DeFi portfolio across different protocols, chains, and asset types to mitigate risk.

- Understand Protocol Fundamentals: Dig deeper into the fundamentals of the DeFi protocols you use. Understand their revenue models, risk factors, and governance mechanisms.

- Stay Informed: Keep abreast of market trends, macroeconomic developments, and regulatory changes that could impact the DeFi space.

- Manage Risk Actively: Implement risk management strategies, such as setting stop-loss orders and adjusting your positions based on market conditions.

- Consider Stablecoin Strategies: In times of market uncertainty, consider utilizing stablecoin-focused DeFi strategies to preserve capital and potentially earn yield in a less volatile manner.

Conclusion: A Wake-Up Call for Decentralized Finance?

The significant drop in DeFi revenues across major blockchains in March is undoubtedly a noteworthy event. While it reflects a decrease in on-chain activity and broader crypto market decline, it also presents an opportunity for reflection and strategic adjustments within the DeFi ecosystem. The resilience of protocols like MakerDAO offers a glimmer of hope and highlights the importance of innovation, diversification, and robust fundamentals. As the crypto market continues to evolve, understanding these fluctuations and adapting to changing conditions will be crucial for navigating the exciting yet volatile world of decentralized finance.