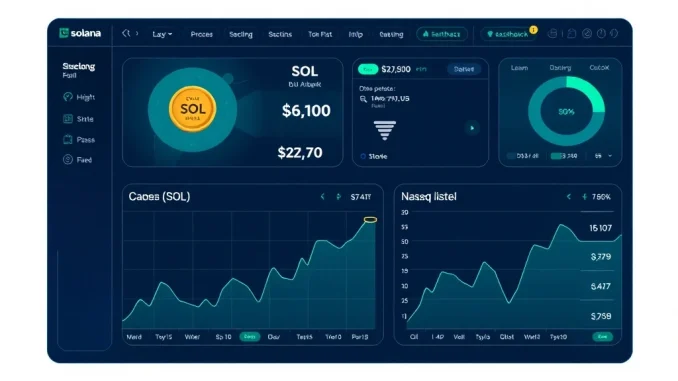

In a bold move that underscores the growing intersection of traditional finance and cryptocurrency, DeFi Development Corp (DFDV) has raised $112.5 million to fuel its ambitious plans. The Nasdaq-listed firm, known for its crypto treasury strategy focused on Solana, is making waves with this latest funding round. But what does this mean for the future of DeFi and Solana? Let’s dive in.

DeFi Development’s $112.5M Funding: A Strategic Play

DeFi Development Corp has increased its convertible note offering to $112.5 million, with an additional $25 million upsize option. This funding will be allocated as follows:

- $75 million for a stock buyback deal

- The remainder for general purposes, including expanding its Solana (SOL) holdings

The company has already acquired over 600,000 SOL this year, signaling strong confidence in the Solana ecosystem.

Why Solana? The Crypto Treasury Strategy

DeFi Development Corp’s focus on Solana is no accident. Here’s why Solana stands out:

- Scalability: Solana’s high throughput makes it ideal for DeFi applications.

- Cost-efficiency: Low transaction fees compared to Ethereum.

- Growing ecosystem: A thriving DeFi and NFT landscape.

By doubling down on Solana, DFDV is positioning itself at the forefront of the next wave of DeFi innovation.

The Stock Buyback: What It Means for Investors

The $75 million allocated for stock buybacks is a strategic move to enhance shareholder value. Stock buybacks can:

- Boost earnings per share (EPS)

- Signal confidence in the company’s future

- Provide liquidity to shareholders

This move could make DFDV an even more attractive investment in the crypto-focused financial space.

Challenges and Risks in DeFi Development’s Strategy

While the funding and strategy are impressive, there are risks to consider:

- Market volatility: Crypto prices can swing dramatically.

- Regulatory uncertainty: Changing laws could impact crypto holdings.

- Execution risk: Success depends on effective deployment of funds.

Investors should weigh these factors carefully.

Actionable Insights: What’s Next for DeFi Development?

Here’s what to watch for in the coming months:

- Further acquisitions of Solana (SOL) tokens

- Progress on the stock buyback program

- Potential partnerships or expansions in the DeFi space

The company’s moves could set a precedent for other traditional firms exploring crypto treasuries.

Conclusion: A Bold Step Forward

DeFi Development Corp’s $112.5 million funding round marks a significant milestone in the convergence of traditional finance and cryptocurrency. By focusing on Solana and stock buybacks, the company is charting a unique path that could reshape the DeFi landscape. Whether you’re an investor, a crypto enthusiast, or simply curious about the future of finance, this is a story worth watching.

Frequently Asked Questions (FAQs)

1. What is DeFi Development Corp (DFDV)?

DeFi Development Corp is a Nasdaq-listed company with a crypto treasury strategy focused on Solana (SOL). It recently raised $112.5 million for stock buybacks and expanding its Solana holdings.

2. Why is Solana a focus for DFDV?

Solana offers scalability, low transaction fees, and a growing DeFi ecosystem, making it an attractive asset for DFDV’s crypto treasury strategy.

3. How will the $112.5 million funding be used?

$75 million will go toward stock buybacks, with the remainder used for general purposes, including expanding Solana holdings.

4. What are the risks of DFDV’s strategy?

Risks include market volatility, regulatory uncertainty, and execution challenges in deploying the funds effectively.

5. How many SOL tokens has DFDV acquired this year?

DFDV has acquired over 600,000 SOL tokens this year, according to CoinDesk.

6. What does the stock buyback mean for investors?

Stock buybacks can boost earnings per share, signal confidence in the company, and provide liquidity to shareholders.