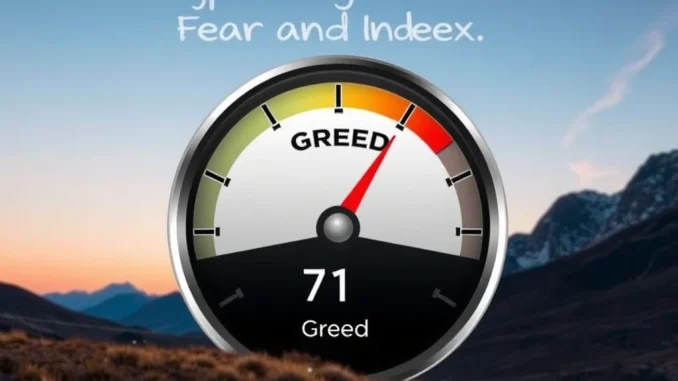

Are you trying to understand the current mood of the cryptocurrency market? The Crypto Fear and Greed Index is a popular tool that offers a snapshot of investor sentiment. As of June 12, this index, provided by Alternative, sits at 71, showing a slight dip from the previous day but firmly remaining within the ‘Greed’ zone. This reading suggests that while euphoria isn’t at peak levels, the market sentiment is still overwhelmingly positive, pushing many participants towards optimistic or even speculative behavior.

What is the Crypto Fear and Greed Index?

The Crypto Fear and Greed Index is designed to measure the general emotional state of the crypto market. Think of it as a barometer for whether investors are feeling overly cautious (Fear) or overly enthusiastic (Greed). The scale runs from 0 to 100:

- 0-24: Extreme Fear (Investors are worried, potentially a buying opportunity)

- 25-49: Fear (Caution is high, prices may be undervalued)

- 50-54: Neutral (Market is balanced, sentiment is neither strongly fearful nor greedy)

- 55-74: Greed (Investors are optimistic, prices may be overvalued)

- 75-100: Extreme Greed (Euphoria is high, market is potentially due for a correction)

A high reading in the ‘Greed’ zone often signals that the market could be overheating, while a low reading in the ‘Fear’ zone might indicate panic selling and potential buying opportunities, following the famous quote from Warren Buffett: “Be fearful when others are greedy, and greedy when others are fearful.”

How is This Crypto Index Explained? Breaking Down the Factors

The calculation of the Crypto Fear and Greed Index is not based on a single metric but aggregates data from several sources to provide a comprehensive view of Crypto Market Sentiment. The index currently considers six factors, though one is paused:

| Factor | Weighting | Description |

|---|---|---|

| Volatility | 25% | Measures the current volatility and maximum drawdowns of Bitcoin compared to its average values. High volatility can indicate a fearful market. |

| Market Momentum / Volume | 25% | Compares the current market volume and momentum (especially for Bitcoin) with the average values of the last 30 and 90 days. High buying volume in a positive market suggests greed. |

| Social Media | 15% | Analyzes social media posts (currently mainly Twitter) for sentiment and engagement rate on specific crypto-related hashtags. High positive sentiment and rapid interaction can signal greed. |

| Surveys | 15% | Weekly sentiment surveys (currently paused) where participants predict market direction. |

| Bitcoin Dominance | 10% | Examines Bitcoin Fear and Greed relative to the altcoin market. Rising Bitcoin dominance can sometimes indicate fear as investors move to the perceived safety of BTC, while falling dominance might suggest greed as money flows into riskier altcoins. |

| Google Trends | 10% | Looks at search queries related to Bitcoin and other cryptocurrencies on Google Trends. Rising search volume for terms like “Bitcoin price manipulation” suggests fear, while terms like “buy crypto” or specific coin names indicate interest and potentially greed. |

By combining these diverse data points, the index aims to provide a balanced view of the prevailing Crypto Market Sentiment.

Why is the Index in the ‘Greed Zone Crypto’ at 71?

A reading of 71 firmly places the market in the ‘Greed’ territory. This level suggests that despite the one-point drop, the factors contributing to the index calculation are still pointing towards strong positive sentiment. High market momentum, significant volume, and optimistic social media buzz likely outweigh any recent minor price corrections or volatility spikes that might have caused the slight dip. It indicates that the market is not yet showing signs of widespread panic or extreme caution; instead, investors are generally confident and willing to buy, potentially chasing gains.

Navigating the Market When the Index Shows Greed

What does a reading of 71 mean for you? The ‘Greed Zone Crypto’ is often seen as a time for caution. While it doesn’t predict the future, historically, periods of extreme greed have preceded market corrections. Key considerations:

- Increased Risk: Prices may be inflated, making investments more susceptible to sharp pullbacks.

- Profit Taking: Many experienced traders use high greed readings as a signal to consider taking some profits off the table.

- Avoid FOMO: The fear of missing out (FOMO) is strong in a greedy market. Avoid making impulsive decisions based purely on rising prices.

- Focus on Long-Term: If you are a long-term investor, short-term fluctuations indicated by the index might be less critical, but understanding the sentiment can still inform strategy.

Understanding the Bitcoin Fear and Greed component is also vital, as Bitcoin’s movement often dictates the broader market trend reflected in the overall index.

Conclusion: Staying Informed on Crypto Market Sentiment

The Crypto Fear and Greed Index at 71, holding in the ‘Greed’ zone, serves as a valuable indicator of the current market mood. While it’s not a crystal ball, it helps investors gauge whether the market is driven by rational decisions or emotional extremes. By understanding how this Crypto Index Explained, and paying attention to its components and historical context, you can make more informed decisions, potentially avoiding the pitfalls of excessive fear or irrational greed. Always combine insights from the index with thorough research and your own risk tolerance.