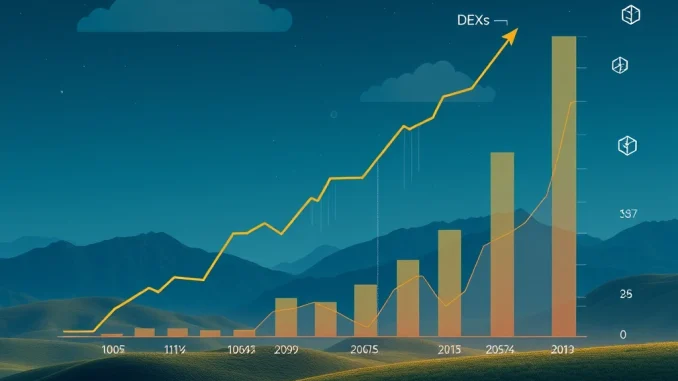

The cryptocurrency trading landscape is constantly evolving, and recent data highlights a significant shift. Automated decentralized exchanges (DEXs) have reached a remarkable milestone, capturing a record 25% share of the total spot trading volume when compared to centralized exchanges (CEXs) in May. This data, reported by @cryptounfolded, underscores the growing prominence of DEX platforms in the broader crypto market share conversation.

Understanding the Rise in DEX Trading Volume

The 25% figure for DEX trading volume isn’t just a number; it represents increasing user trust and adoption of decentralized protocols. While CEXs have historically dominated volume due to their user-friendly interfaces and deep liquidity, DEXs offer distinct advantages that appeal to a segment of the crypto community. This surge suggests that more traders are prioritizing aspects like self-custody and permissionless access.

Key factors contributing to this rise include:

- Increased sophistication and liquidity on major DEX platforms.

- Growing concerns over regulatory scrutiny and potential restrictions on CEXs.

- The proliferation of new tokens often launching first on DEXs.

- Enhanced user interfaces making DEXs more accessible than in the past.

CEX vs DEX: A Shifting Balance in Spot Trading

The traditional model involves CEX vs DEX comparisons focusing on trade-offs. CEXs provide ease of use, high liquidity, and often offer a wider range of services (like margin trading, lending, etc.). However, they require users to give up control of their private keys and undergo Know Your Customer (KYC) verification.

Decentralized exchanges, on the other hand, allow users to trade directly from their wallets, maintaining control of their assets. They operate on blockchain technology, using smart contracts to execute trades automatically. While they once lagged significantly in volume and user experience, innovation has narrowed this gap, making them viable alternatives for spot trading.

Here’s a simple comparison:

| Feature | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|---|

| Asset Control | Custodial (Exchange holds keys) | Non-custodial (User holds keys) |

| KYC/Identity | Required | Generally Not Required |

| Trading Speed/Fees | Often Faster, Varying Fees | Can be Slower, Gas Fees Apply |

| Asset Availability | Wide Range | Often Focus on Newer/DeFi Tokens |

| Complexity | Simpler for Beginners | Can be More Complex |

What This Means for Crypto Market Share

This 25% crypto market share for DEXs in spot trading signals a maturing market. It shows that decentralized finance (DeFi) is not just a niche sector but is increasingly integrated into core trading activities. While CEXs still hold the majority, a quarter of the volume flowing through DEXs is a substantial figure that cannot be ignored by institutional players or regulators.

The growth in decentralized exchanges volume reflects evolving user preferences and the inherent advantages of decentralized systems for certain types of trading and assets. This trend could continue as DEX technology improves and more users seek alternatives to centralized platforms.

Challenges and the Road Ahead

Despite the impressive growth in DEX trading volume, challenges remain. User experience can still be less intuitive than on CEXs, and gas fees on certain blockchains can make small trades uneconomical. Liquidity, while improving, can still be fragmented compared to top-tier CEXs.

However, ongoing developments like Layer 2 scaling solutions, cross-chain interoperability, and improved DEX designs are addressing these issues. The competition between CEX vs DEX is ultimately beneficial for users, driving innovation on both sides.

The 25% spot trading volume share is a significant milestone, validating the decentralized model’s potential. It indicates that a substantial portion of active traders are comfortable using DEXs for their transactions, contributing to the overall crypto market share shift.

Conclusion

The record 25% DEX trading volume share in May is a powerful indicator of the increasing adoption and maturity of decentralized exchanges. While CEX vs DEX debates will continue, this data confirms that DEXs are now a major force in spot trading, carving out a significant portion of the overall crypto market share. This trend highlights the ongoing evolution of the crypto ecosystem and the growing demand for decentralized alternatives.