Are you keeping a close eye on the crypto venture landscape? Recent reports are signaling a significant shift in momentum. While the crypto world is known for its volatility, the latest data on crypto venture deals reveals a trend that’s making even seasoned investors pause. Let’s dive into the numbers and understand what’s driving this market caution.

Why Did Crypto Venture Deals Take a Plunge?

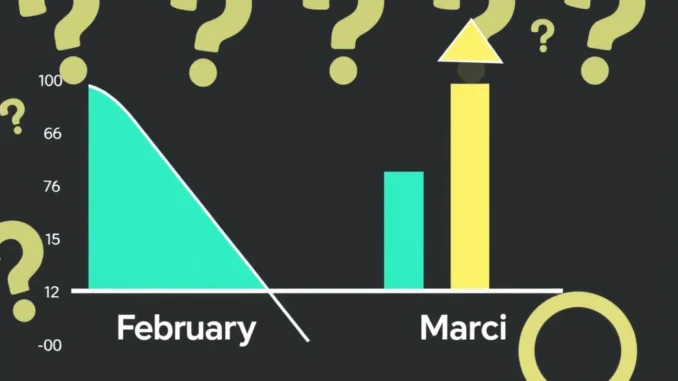

February 2024 marked a noticeable cooling period for crypto venture deals. According to a report by The Block, the number of private transactions plummeted to just 116. To put this into perspective, this figure is a staggering 60% decrease from October 2023, which saw over 300 deals inked. This dramatic dip isn’t just a minor fluctuation; it’s a clear indicator of a shift in investor sentiment. But what’s causing this pullback?

- Market-Wide Caution: The broader financial markets are experiencing a period of increased caution. Concerns about inflation, rising interest rates, and geopolitical uncertainties are leading investors to move away from riskier assets, and unfortunately, the crypto market is often perceived as falling into this category.

- Shift Away from Risk Assets: When economic winds turn uncertain, investors tend to flock towards safer havens. This ‘flight to safety’ phenomenon means that investments considered high-risk, such as emerging crypto projects, are often the first to experience reduced funding.

- Post-Bull Market Correction: After periods of explosive growth in the crypto market, corrections are natural. The exuberance of previous bull markets may be giving way to a more sober and realistic assessment of project valuations and long-term viability.

| Month | Number of Deals | Change |

|---|---|---|

| October 2023 | 300+ | — |

| February 2024 | 116 | -60% (Approx.) |

This table vividly illustrates the significant downturn in crypto venture deals between October and February. It’s a stark reminder of how quickly market sentiment can shift and impact investment flows within the crypto space.

Venture Capital Crypto: Navigating the New Landscape

So, what does this mean for venture capital crypto investments moving forward? While the February figures might seem concerning, it’s crucial to look beyond a single month’s data and understand the broader context. The venture capital landscape in crypto is dynamic and constantly evolving. Here’s what we are observing:

- Increased Due Diligence: Venture capital firms are likely becoming more discerning in their investment choices. The era of ‘spray and pray’ investing, where capital was readily deployed across numerous projects, may be waning. Instead, we might see a greater emphasis on projects with strong fundamentals, clear use cases, and robust teams.

- Focus on Sustainable Projects: Investors are increasingly interested in projects that demonstrate long-term sustainability and real-world utility, rather than just hype or short-term gains. This shift favors projects building solid infrastructure, addressing real-world problems, and demonstrating a clear path to revenue generation.

- Strategic Investments in Key Sectors: Even with overall caution, certain sectors within crypto might continue to attract significant venture capital crypto investment. Areas like decentralized finance (DeFi), layer-2 scaling solutions, and infrastructure projects that support the broader ecosystem could remain attractive.

Crypto Investment Trends: The Binance Exception

Just when the narrative seems overwhelmingly cautious, March 2024 threw a curveball. Abu Dhabi’s MGX made headlines with a massive $2 billion investment in the leading crypto investment exchange, Binance. This single transaction stands out as an exceptional case, defying the prevailing trend of decreased venture activity. What does this tell us about the current crypto investment landscape?

- Confidence in Market Leaders: The sheer size of the Binance investment signals continued confidence in established market leaders. Despite regulatory scrutiny and market fluctuations, Binance remains a dominant player in the crypto exchange space, and this investment reinforces its position.

- Strategic Geographic Focus: Abu Dhabi’s investment highlights the growing importance of the Middle East as a hub for crypto innovation and investment. Governments in the region are increasingly adopting pro-crypto policies, attracting significant capital and talent.

- Long-Term Vision: An investment of this magnitude is unlikely to be a short-term bet. It suggests a long-term vision for the crypto market and Binance’s role within it. MGX’s investment could be seen as a strategic move to capitalize on the future growth potential of the crypto industry.

Market Caution: A Temporary Dip or a New Normal?

The question on everyone’s mind is whether this market caution represents a temporary dip or a more prolonged shift in the crypto venture landscape. While predicting the future is impossible, here are a few factors to consider:

- Macroeconomic Factors: The trajectory of the global economy will significantly influence investor sentiment. Improvements in economic conditions, easing inflation, and a more stable interest rate environment could potentially lead to a resurgence in crypto venture deals.

- Regulatory Clarity: Increased regulatory clarity in major jurisdictions could boost investor confidence and attract more institutional capital into the crypto space. Conversely, continued regulatory uncertainty could prolong the period of market caution.

- Innovation and Adoption: Breakthroughs in crypto technology, wider adoption of blockchain solutions in various industries, and the emergence of compelling new use cases could reignite investor enthusiasm and drive renewed venture activity.

Binance Investment: A Glimmer of Hope Amidst Caution?

While February’s data paints a picture of cautious market caution, the significant Binance investment in March offers a contrasting perspective. It suggests that while the overall venture landscape may be cooling, strategic opportunities and confidence in market leaders still exist. The crypto market is known for its resilience and ability to surprise. This period of caution could be a healthy phase, allowing for more sustainable growth and a greater focus on quality projects.

Actionable Insights for Crypto Enthusiasts and Investors:

- Stay Informed: Keep a close watch on market trends, regulatory developments, and macroeconomic indicators.

- Focus on Fundamentals: When evaluating crypto projects, prioritize those with strong fundamentals, real-world use cases, and solid teams.

- Diversify Your Approach: Consider diversifying your crypto portfolio and investment strategies to mitigate risk during periods of market uncertainty.

- Long-Term Perspective: Remember that crypto is a long-term game. Short-term fluctuations are part of the journey, and patience can be key.

In conclusion, the dip in crypto venture deals in February serves as a reminder of the inherent volatility and cyclical nature of the crypto market. However, the exceptional Binance investment in March underscores the enduring potential and dynamism of this space. As the market navigates this period of caution, a focus on quality, innovation, and long-term vision will be crucial for both investors and projects seeking to thrive in the evolving crypto landscape. The story of crypto venture capital is far from over; it’s simply entering a new chapter.