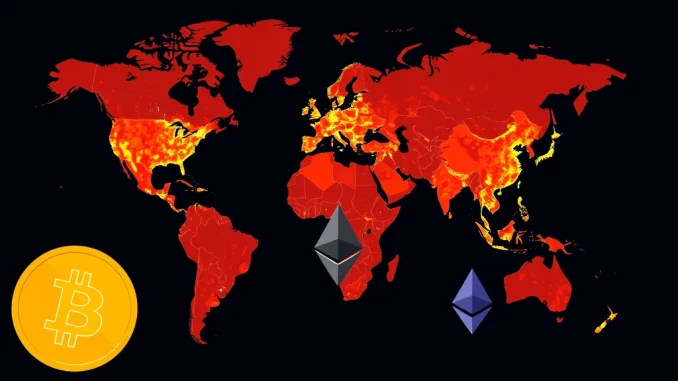

Is the real crypto action happening where you least expect it? Forget Wall Street for a moment. Bitcoin trading volume and Ethereum trading volume statistics are painting a fascinating picture, one where the majority of the digital asset trade is taking place far beyond the borders of the United States. This revealing data from Kaiko, highlighted by Unfolded, shines a light on the true global nature of cryptocurrency and the surprising distribution of its trading activity.

The Surprising Scale of International Crypto Exchanges

For many, especially in the West, it’s easy to assume that the U.S., with its mature financial markets and tech-forward culture, is at the heart of the cryptocurrency world. However, the numbers tell a different story. According to recent data, a significant majority of both Bitcoin trading volume and Ethereum trading volume is concentrated on international crypto markets, leaving US exchanges with a surprisingly small piece of the pie.

Let’s break down the key figures to understand the scale of this global shift:

- Bitcoin (BTC): Only 11.5% of the total global Bitcoin trading volume is processed through US exchanges. This means a staggering 88.5% of Bitcoin trades are happening outside of the United States.

- Ethereum (ETH): The situation is even more pronounced for Ethereum. A mere 8.6% of global Ethereum trading volume occurs on US exchanges, leaving a massive 91.4% to international crypto markets.

[ /caption]

[ /caption]

These statistics are not just numbers; they represent a fundamental characteristic of the crypto market – its global and decentralized nature. But what are the underlying reasons driving this trend? Why are international crypto markets becoming such dominant forces in Bitcoin trading volume and Ethereum trading volume?

Factors Fueling International Crypto Market Dominance

Several interconnected factors contribute to the impressive Bitcoin trading volume and Ethereum trading volume observed outside of the US. Understanding these factors is key to grasping the global crypto landscape:

Regulatory Clarity (or Lack Thereof): The regulatory environment in the United States for cryptocurrencies is still in a state of flux. While some progress has been made, uncertainty and varying state-level regulations can create hurdles for crypto exchanges and traders. In contrast, some international crypto markets benefit from more defined or, in some cases, more lenient regulatory frameworks, attracting both exchanges and users seeking clarity and operational ease.

Global Crypto Adoption Rates: Cryptocurrency adoption is not uniform across the globe. Many regions outside the US, particularly in Asia, Latin America, and parts of Africa, have witnessed rapid and widespread crypto adoption, driven by factors such as less developed traditional financial infrastructure, higher mobile penetration, and a greater appetite for alternative financial solutions. This organic adoption naturally translates into higher Bitcoin trading volume and Ethereum trading volume in these international crypto markets.

The Rise of Major International Exchanges: Some of the world’s largest and most active crypto exchanges, such as Binance and OKX, are not based in the United States. These platforms cater to a vast global user base and facilitate massive trading volumes, significantly contributing to the dominance of international crypto markets. Their global reach and diverse service offerings attract users from regions where US exchanges might have limited presence or accessibility.

Market Maturity and Liquidity: In certain international crypto markets, particularly those in Asia, cryptocurrency trading has been established for a longer period. This maturity often leads to deeper liquidity, more sophisticated trading infrastructure, and a wider range of crypto-related services. Higher liquidity attracts larger trading volumes, further solidifying the dominance of these markets in Bitcoin trading volume and Ethereum trading volume.

Implications of Global Trading Dominance for the Crypto Space

The fact that the vast majority of Bitcoin trading volume and Ethereum trading volume is happening outside of the US has significant implications for the cryptocurrency ecosystem and its future trajectory:

Decentralization in Action: This data vividly illustrates the decentralized nature of cryptocurrency. Trading activity isn’t geographically confined; it’s distributed globally, reinforcing the borderless and permissionless ethos of crypto. This truly global distribution reduces reliance on any single jurisdiction and enhances the resilience of the crypto network.

Shifting Power Dynamics: The traditional financial dominance of the US might not fully translate into the crypto world. The center of gravity for crypto trading activity is demonstrably shifting towards international crypto markets. This could influence regulatory approaches globally, as different jurisdictions compete to attract crypto innovation and business.

Opportunities for Global Investors: The global distribution of Bitcoin trading volume and Ethereum trading volume opens up opportunities for investors worldwide. They are not limited to US exchanges but can access a diverse and vibrant global market, potentially benefiting from different market dynamics and arbitrage opportunities.

Regulatory Competition and Innovation: The competition to attract crypto trading and businesses can spur regulatory innovation. Countries might strive to create more favorable and clearer regulatory frameworks to become hubs for crypto activity, potentially leading to more user-friendly regulations and fostering innovation within the crypto space.

Navigating the Globally Distributed Crypto Trading Landscape

For anyone involved in the cryptocurrency space – whether as a trader, investor, developer, or regulator – understanding the global distribution of Bitcoin trading volume and Ethereum trading volume is paramount. Here are some actionable insights to consider:

Expand Your Market Perspective: Don’t solely focus on US exchanges. Explore international crypto markets and platforms to gain a comprehensive understanding of the global crypto trading landscape. This broader perspective can reveal new opportunities and insights.

Stay Informed on Global Regulations: Keep abreast of regulatory developments in various jurisdictions. Regulatory changes in key international crypto markets can significantly impact market sentiment and trading activity. Understanding these global regulatory trends is crucial for informed decision-making.

Consider Diversification Across Exchanges: For traders and investors, diversifying across reputable international crypto exchanges can provide access to a wider range of assets, deeper liquidity, and potentially better trading opportunities. However, always prioritize security and due diligence when choosing exchanges.

Understand Regional Market Dynamics: Recognize that different international crypto markets may exhibit unique characteristics, trading preferences, and popular cryptocurrency pairs. Tailoring your approach to specific regional market dynamics can enhance trading effectiveness.

Conclusion: Embracing the Truly Global Nature of Crypto Trading

The data is compelling: the lion’s share of Bitcoin trading volume and Ethereum trading volume takes place outside of the United States. This unseen dominance of international crypto markets is a testament to the truly global and decentralized nature of the cryptocurrency revolution. As the crypto space matures and expands, this global distribution of trading activity will likely become even more pronounced. Embracing this global perspective is essential for anyone seeking to navigate and thrive in the exciting and rapidly evolving world of digital assets. The future of crypto is undeniably global, and the trading data is emphatically proving it.