Is the party over for the crypto bulls? A stark warning from Coinbase Institutional’s latest report suggests that the cryptocurrency market might be bracing itself for a prolonged downtrend. For investors and enthusiasts who’ve enjoyed the recent surges, this news might feel like a bucket of ice water. Let’s dive into the key takeaways from this report and understand what it means for the future of your crypto portfolio. Is this just a temporary dip, or are we looking at a more significant shift in the crypto market downtrend?

Why Coinbase Signals a Potential Crypto Market Downtrend

Coinbase Institutional, a leading voice in the crypto space, has raised eyebrows with its recent market analysis. The core of their concern stems from several key technical indicators and market behaviors. Let’s break down the critical points from their report:

- Bitcoin’s SMA Breakdown: A significant red flag is Bitcoin’s fall below its 200-day Simple Moving Average (SMA) on March 9th. For seasoned traders, the 200-day SMA is a crucial line in the sand. Breaching it often signals a shift from bullish to bearish sentiment, suggesting a potential crypto market downtrend.

- Altcoin Index in Decline: It’s not just Bitcoin feeling the pressure. An index tracking the top 50 altcoins by market cap has been trending downwards since late February. This broader market weakness reinforces the idea that the bullish momentum seen earlier in the year may have dissipated.

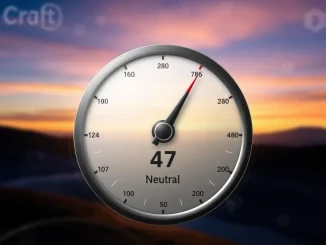

- Z-Score Analysis: Coinbase’s report uses a Z-score analysis of this altcoin index to suggest that the recent bull cycle likely peaked and ended around late February. Z-score is a statistical measure indicating how many standard deviations an event is from the mean. In this context, it points to an unusual deviation from the norm, signaling a cycle shift.

- Venture Capital Dip: Despite Bitcoin hitting new all-time highs earlier in the year, venture capital investment in the crypto space remains significantly lower. It’s currently 50% to 60% below the levels seen during the 2021-2022 boom. This reduced influx of capital can be a leading indicator of a cooling market.

In essence, the Coinbase report paints a picture of a market losing steam, with technical indicators and investment trends aligning to suggest a possible prolonged period of lower prices.

Bitcoin’s Technical Tumble: What Does the 200-day SMA Mean?

The 200-day Simple Moving Average (SMA) might sound like technical jargon, but it’s a pretty straightforward concept with significant implications in trading. Imagine the 200-day SMA as the average closing price of an asset over the last 200 days. Traders and analysts use it to gauge the long-term trend.

When an asset price, like Bitcoin, falls below its 200-day SMA, it’s often interpreted as a sign of weakening momentum and a potential shift to a bear market. Think of it like this: if the average price over the long term is now higher than the current price, it suggests that the overall trend might be turning downwards.

However, it’s crucial to remember that the 200-day SMA is just one indicator. It’s not a crystal ball. Market analysis is complex and involves considering a range of factors. But the fact that Coinbase highlighted this in their report underscores its significance as a warning sign.

Altcoins Under Pressure: Is the Z-Score Telling the Full Story?

The Coinbase report also emphasizes the downward trend in an index tracking the top 50 altcoins. The use of the Z-score adds another layer of analysis. The Z-score helps to determine if a particular data point is statistically unusual. In this case, a high Z-score in late February, followed by a decline, suggests that the bull run for altcoins may have been statistically significant in its peak but has now likely concluded.

But what does this mean for your altcoin portfolio? It’s a signal to exercise caution. Altcoins, being generally more volatile than Bitcoin, can experience sharper price swings during market downturns. While some altcoins might still buck the trend, a broad market downtrend can put significant pressure on the entire altcoin ecosystem.

Key Considerations for Altcoin Investors:

- Risk Management: Now might be the time to review your risk tolerance and portfolio allocation. Are you comfortable with potentially deeper drawdowns in your altcoin holdings?

- Project Fundamentals: Focus on altcoins with strong fundamentals, active development teams, and real-world use cases. These projects are more likely to weather a market storm.

- Diversification: Diversification across different types of cryptocurrencies can help mitigate risk. Don’t put all your eggs in one basket, especially during uncertain times.

Venture Capital: A Lagging Indicator or a Sign of Deeper Trouble?

The reduced venture capital investment in the crypto space is another concerning point raised by the Coinbase report. Venture capital often acts as fuel for growth and innovation in emerging sectors like crypto. A significant drop in VC funding can indicate a lack of confidence in near-term growth prospects, or at least a more cautious approach from investors.

However, it’s important to consider that venture capital can be a lagging indicator. VC investment decisions are often made over longer time horizons. A dip now might reflect concerns from several months ago. It doesn’t necessarily guarantee a prolonged crypto market downtrend, but it does add weight to the overall bearish narrative.

Venture Capital & Crypto Market Cycles:

| Market Phase | Venture Capital Activity | Market Sentiment |

|---|---|---|

| Bull Market Peak (2021-2022) | High VC Investment | Extreme Greed, Optimism |

| Bear Market (2022-2023) | Reduced VC Investment | Fear, Pessimism |

| Early Bull Market (Early 2024) | Slight VC Increase (but below peak) | Cautious Optimism |

| Potential Downtrend (Mid-2024?) | Continued Low VC Investment | Uncertainty, Concern |

What’s Next? Navigating the Potential Downtrend

According to the Coinbase report, the market could potentially bottom out in the latter half of Q2, with a gradual recovery beginning in Q3. While forecasts are never guarantees, this timeline offers a potential roadmap for investors to consider.

Actionable Insights for Navigating the Downtrend:

- Stay Informed: Keep abreast of market news, technical analysis, and reports from reputable sources like Coinbase Institutional.

- Manage Risk: Adjust your portfolio risk according to your personal risk tolerance. Consider reducing exposure if you are uncomfortable with potential further declines.

- Dollar-Cost Averaging (DCA): If you believe in the long-term potential of crypto, consider using DCA to gradually buy into the market during the downtrend.

- Focus on Fundamentals: Research and invest in projects with strong fundamentals that are likely to survive and thrive regardless of short-term market fluctuations.

- Prepare for Volatility: Downtrends are often accompanied by increased volatility. Be prepared for price swings and avoid emotional trading decisions.

Conclusion: A Time for Caution, Not Panic

The Coinbase report‘s signal of a potential prolonged crypto market downtrend is undoubtedly a serious warning. However, it’s crucial to approach this information with caution, not panic. Market cycles are a natural part of the crypto ecosystem. Downtrends provide opportunities for learning, re-evaluation, and strategic positioning for the next bull run.

By staying informed, managing risk, and focusing on the long-term potential of blockchain technology, investors can navigate this potential downturn and emerge stronger on the other side. The key takeaway? Be prepared, be prudent, and remember that even in the crypto market downtrend, opportunities exist for those who are well-informed and patient.