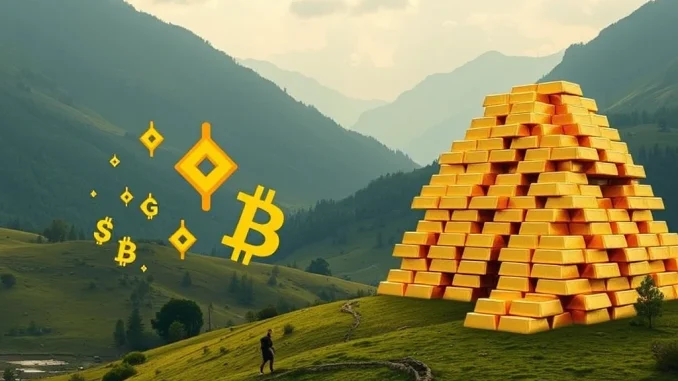

Imagine a world where the total value of cryptocurrencies rivals that of gold. This isn’t just speculation; it’s a future envisioned by prominent figures in the digital asset space. The potential for the crypto market cap to soar is a hot topic, and one veteran investor is putting a massive number on it.

Michael Novogratz’s Bold Prediction: Crypto Reaching Gold’s Market Cap

Michael Novogratz, the CEO of Galaxy Digital and a well-known figure in the cryptocurrency world, recently shared a compelling outlook during a CNBC interview. His prediction? That the collective market capitalization of cryptocurrencies, including leading assets like Bitcoin, could eventually ascend to the current valuation of gold. That’s a staggering figure, sitting today at roughly $22 trillion.

This isn’t just a hopeful wish; Novogratz grounds his forecast in a significant demographic and economic shift. He points to the impending transfer of wealth from older generations to younger ones. This is where the story gets interesting.

The Great Wealth Transfer: Fueling Digital Asset Adoption?

A major driver behind Novogratz’s prediction is the anticipated generational wealth transfer. Reports, such as Knight Frank’s 2024 Wealth Report, estimate that millennials alone are set to inherit an astonishing $90 trillion in assets over the next two decades. Why does this matter for crypto?

- Younger generations, particularly millennials and Gen Z, have demonstrated a higher propensity for adopting and understanding digital technologies.

- They are often more comfortable with intangible assets and less tied to traditional stores of value like physical gold.

- Cryptocurrencies represent innovation, decentralization, and a hedge against traditional financial systems, traits that resonate with many younger investors.

As this immense wealth shifts hands, a significant portion is expected to flow into assets that younger generations prefer. According to Novogratz, digital assets are high on that list.

What Does a $22 Trillion Crypto Market Cap Mean?

If the total crypto market cap were to reach the current gold market cap of $22 trillion, it would represent massive growth from today’s levels (which fluctuate but are significantly lower). What might this imply?

- Significant Price Appreciation: For individual assets like Bitcoin and Ethereum, reaching such a total market cap would necessitate substantial price increases. The Bitcoin market cap alone would need to grow dramatically to account for a large portion of that $22 trillion figure, assuming its dominance remains significant.

- Increased Institutional Adoption: Achieving such scale would likely require far greater involvement from large financial institutions, pension funds, and sovereign wealth funds.

- Mainstream Integration: Cryptocurrencies would likely become a more integrated part of global finance and everyday commerce.

- Regulatory Clarity: Such growth would almost certainly force clearer and more comprehensive regulatory frameworks worldwide.

Novogratz’s view suggests that the current market cap is just the beginning, and the structural shift in wealth could provide the necessary catalyst for exponential growth.

Are There Challenges on the Path to $22 Trillion?

While the potential is exciting, reaching a gold market cap equivalent is not without hurdles. What factors could influence this trajectory?

- Regulatory Environment: Unclear or restrictive regulations in major economies could slow adoption and investment.

- Market Volatility: The crypto market is known for its price swings, which can deter risk-averse investors.

- Technological Risks: Security breaches, protocol vulnerabilities, and the evolution of technology present ongoing challenges.

- Competition: The digital asset landscape is constantly evolving, with new projects and technologies emerging.

- Public Perception: Overcoming skepticism and educating the public about the value and utility of cryptocurrencies remains crucial.

Despite these challenges, figures like Michael Novogratz remain optimistic, viewing these as obstacles to navigate rather than insurmountable barriers.

What Can Investors Take Away?

Novogratz’s prediction highlights a long-term bullish perspective driven by fundamental demographic and economic shifts. It suggests that digital assets are not just a fleeting trend but potentially a significant component of future wealth portfolios.

- Consider the long-term potential of the asset class, looking beyond short-term volatility.

- Understand the macro trends, like the wealth transfer, that could support future growth.

- Research individual assets like Bitcoin and others to understand their role in the broader ecosystem.

- Recognize that while the potential is high, risks are also present. Diversification and careful risk management are essential.

Summary: A Golden Future for Crypto?

Michael Novogratz‘s forecast that the crypto market cap could eventually rival the gold market cap at $22 trillion is a powerful statement about the potential future of digital assets. Fueled by the coming wealth transfer to generations more comfortable with digital finance, this prediction underscores the potential for significant growth in the years ahead. While the path involves challenges, the vision of cryptocurrencies becoming a major store of value alongside, or even surpassing, traditional assets like gold, paints an intriguing picture for the future of finance and the potential scale of the Bitcoin market cap within that ecosystem.