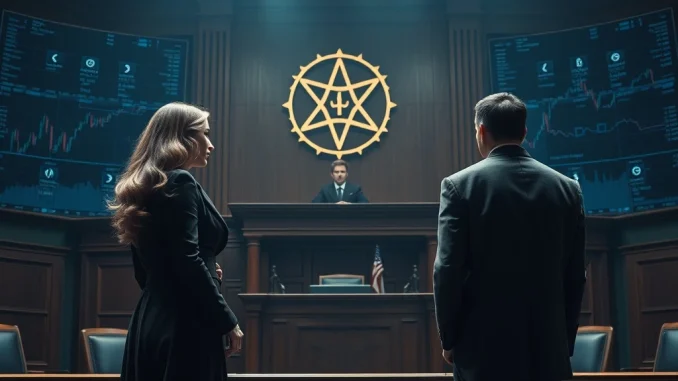

A staggering **$80 million crypto loss** forms the core of a sensational legal battle. Billionaire heiress Taylor Thomson has launched a lawsuit against her former friend, Ashley Richardson. This dramatic case highlights the volatile nature of cryptocurrency investments. Furthermore, it introduces an unusual element: the alleged influence of psychic advice on investment decisions. Investors and legal experts are closely watching this unfolding **cryptocurrency legal battle**.

The Heart of the Thomson Heiress Lawsuit

Taylor Thomson, an heiress to the Thomson Reuters fortune, reportedly lost a significant portion of her crypto portfolio. She claims these losses stem from the actions of her former friend, Ashley Richardson. Richardson managed more than $140 million for Thomson during the peak of the 2021 bull run. However, the subsequent 2022 market downturn severely impacted the portfolio’s value. Thomson now seeks to recover her substantial financial setback through legal action. This marks a pivotal moment in the ongoing **Thomson heiress lawsuit**.

Unraveling the $80M Crypto Loss

The alleged **$80 million crypto loss** represents a dramatic financial reversal. Thomson’s investments were initially managed by Richardson, her close confidante. During the bullish market of 2021, many investors saw their crypto holdings soar. Consequently, Richardson’s management during this period saw Thomson’s portfolio reach impressive heights. Yet, the sharp market correction in 2022 proved devastating. This downturn wiped out a large portion of the initial gains, leading to the current legal dispute. The sheer scale of the losses underscores the inherent risks in the cryptocurrency market.

Thomson alleges that Richardson engaged in unauthorized trades. She also claims Richardson misrepresented the investments’ status. These accusations form the basis of her lawsuit. Conversely, Richardson vehemently denies any wrongdoing. She has since filed a countersuit against Thomson. This legal back-and-forth further complicates an already intricate financial dispute. Both parties present starkly different accounts of the events leading to the significant **crypto loss**.

Allegations of Crypto Investment Fraud

The lawsuit brought by Taylor Thomson explicitly alleges **crypto investment fraud**. Thomson asserts that Richardson acted beyond her authorized scope. She also claims Richardson failed to provide accurate information regarding the investments. Such allegations, if proven, could have severe consequences for Richardson. Investment fraud cases often involve complex financial forensics. They require detailed analysis of trading records and communication logs. Ultimately, the court will need to determine if Richardson breached her fiduciary duties. This legal process will scrutinize every transaction made on Thomson’s behalf. Furthermore, it will examine the nature of their professional and personal relationship.

The Peculiar Role of Psychic Crypto Advice

Perhaps the most unusual aspect of this case involves **psychic crypto advice**. Thomson claims her investment decisions were influenced by advice from a psychic. This advice was allegedly relayed through Ashley Richardson. The inclusion of a psychic’s guidance in high-stakes financial dealings is highly unconventional. It raises questions about judgment and accountability in wealth management. Legally, the role of such advice could be a contentious point. It might impact how the court views the reasonableness of investment decisions. Moreover, it highlights the often-unpredictable factors influencing personal finance. This element certainly adds a unique dimension to the ongoing legal proceedings.

Navigating a Cryptocurrency Legal Battle

This ongoing **cryptocurrency legal battle** underscores the growing pains of a nascent industry. Disputes over digital assets are becoming more common. They often involve complex technical and financial concepts. Furthermore, the lack of clear regulatory frameworks can complicate these cases. For example, proving unauthorized trades in a decentralized environment presents unique challenges. Legal teams must navigate these complexities. They must also present their arguments clearly to a court system often unfamiliar with crypto specifics. Ultimately, the outcome of this case could set important precedents. It might influence how future crypto investment disputes are handled. Investors, therefore, should remain vigilant about their asset management. They must understand the terms of any investment agreement.

The legal fight between Thomson and Richardson continues to unfold. It serves as a cautionary tale for high-net-worth individuals. It also reminds us of the inherent risks of delegating significant financial control. The case highlights the importance of due diligence. It also stresses the need for clear, documented agreements. Both parties face a long and potentially costly legal process. The resolution of this dispute will undoubtedly draw significant attention across financial and legal sectors.

Conclusion

The lawsuit involving Taylor Thomson and Ashley Richardson is a compelling narrative. It features a massive **$80M crypto loss** and allegations of fraud. The unique element of psychic advice further complicates matters. As the **cryptocurrency legal battle** progresses, it will offer crucial insights. It will inform discussions around investment responsibility, wealth management, and the volatile crypto market. Investors should always exercise caution. They must prioritize transparent and well-regulated investment strategies. The outcome of this case will surely resonate throughout the crypto community.

Frequently Asked Questions (FAQs)

1. What is the core of the Thomson heiress lawsuit?

The core of the lawsuit involves Taylor Thomson, a billionaire heiress, suing her former friend Ashley Richardson. Thomson alleges an **$80M crypto loss** due to Richardson’s management and unauthorized trades, supposedly influenced by psychic advice.

2. How much money did Taylor Thomson reportedly lose?

Taylor Thomson reportedly lost over $80 million from her cryptocurrency portfolio. This significant loss occurred during the 2022 market downturn, following a period where her investments had grown to over $140 million.

3. What role did psychic advice play in the crypto loss?

Thomson claims that her investment decisions were influenced by advice from a psychic. This advice was allegedly communicated to her by her former friend and portfolio manager, Ashley Richardson. This unusual detail is a key point of contention in the lawsuit.

4. What are Ashley Richardson’s defenses against the allegations?

Ashley Richardson has denied all wrongdoing. She disputes Thomson’s claims of unauthorized trades and misrepresentation. Furthermore, Richardson has filed a countersuit against Thomson, though the details of her countersuit are not fully public.

5. What are the broader implications of this cryptocurrency legal battle?

This **cryptocurrency legal battle** highlights the risks and complexities of digital asset investments. It underscores the importance of clear investment agreements and due diligence. The case may also set precedents for future disputes involving wealth management, fraud allegations, and the often-unregulated nature of crypto markets.

6. What advice can be taken from this crypto investment fraud case?

This case serves as a cautionary tale. Investors should always conduct thorough due diligence on their financial advisors. They should also maintain clear, written agreements detailing investment strategies and authorization limits. Avoiding reliance on unconventional or unverified advice for significant financial decisions is also crucial to prevent potential **crypto investment fraud**.