In a swift and sharp move across major cryptocurrency exchanges, the market witnessed a significant event that left many traders reeling. Within a single hour, approximately $119 million worth of cryptocurrency futures positions were forcefully closed, or ‘liquidated’. This rapid unwinding highlights the inherent volatility and leveraged risks present in the digital asset space. Over the past 24 hours, the total figure for futures liquidation across the market climbed to a staggering $340 million. These numbers serve as a stark reminder of how quickly market sentiment and price action can impact traders using leverage.

What is Crypto Liquidation and Why Does it Happen?

Understanding crypto liquidation is crucial for anyone participating in or observing the futures market. In simple terms, liquidation occurs when a trader’s leveraged position is forcibly closed by the exchange because they can no longer meet the margin requirements to keep the trade open. This usually happens when the price of the underlying asset moves significantly against their position.

Here’s a quick breakdown:

- Leverage: Traders use leverage to open positions larger than their initial capital. For example, 10x leverage means a trader can control $1000 worth of crypto with just $100 of their own money.

- Margin: The initial capital (e.g., $100) acts as margin. The exchange sets a minimum margin level that must be maintained.

- Price Movement: If the price goes against the leveraged position, the unrealized loss eats into the margin.

- Liquidation: If the margin falls below the minimum required level, the exchange automatically closes the position to prevent further losses (which the trader cannot cover) and protect its own capital. The trader loses their initial margin and any associated funds used for the position.

The recent surge in futures liquidation is a direct consequence of price volatility. When prices swing rapidly, leveraged positions are particularly vulnerable, leading to cascading liquidations as price drops trigger more forced selling.

Analyzing the Scale: $119 Million vs $340 Million

The figures reported are significant. $119 million liquidated in just one hour indicates an extremely sharp price movement or a cluster of highly leveraged positions hitting their liquidation price simultaneously. The 24-hour figure of $340 million provides broader context, showing the sustained pressure over a full day, but the hourly number highlights the intensity of a specific market event.

Comparing the two:

| Timeframe | Approximate Liquidation Value | Significance |

|---|---|---|

| Past Hour | $119 million | Indicates rapid, intense price swing or concentrated liquidation cascade. |

| Past 24 Hours | $340 million | Represents total market pressure over a full day, including the peak hourly event. |

While $340 million over 24 hours is a substantial amount, $119 million occurring within 60 minutes points to a particularly violent market reaction during that specific hour. This could be triggered by a major news event, a large sell-off, or even algorithmic trading hitting stop losses and liquidation points.

Which Assets Saw the Most Bitcoin and Ethereum Liquidation?

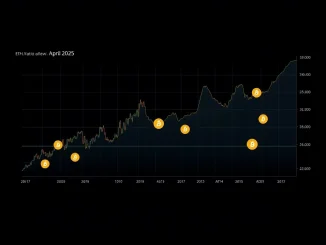

While the report doesn’t specify which cryptocurrencies accounted for the majority of the liquidations, historical data shows that bitcoin liquidation and ethereum liquidation typically dominate these events. As the two largest cryptocurrencies by market cap and with deep futures markets, BTC and ETH positions often make up the bulk of liquidated volume during periods of volatility. Sharp price drops in Bitcoin and Ethereum are the most common catalysts for widespread liquidations across the broader crypto market.

What Does This Mean for the Crypto Market?

Massive liquidation events have several implications for the crypto market:

- Increased Volatility: Liquidations can exacerbate price swings. Forced selling adds downward pressure, potentially triggering more liquidations in a cascade effect.

- Risk Awareness: These events serve as a harsh reminder of the risks associated with high leverage. Traders who were over-leveraged face significant losses.

- Market Reset: Large liquidations can sometimes ‘cleanse’ the market of excessive leverage, potentially setting the stage for more stable price action afterward, although this is not guaranteed.

- Sentiment Impact: News of significant liquidations can impact overall market sentiment, potentially leading to fear among less experienced traders.

Actionable Insights for Traders

Given the frequency of such events, what can traders learn?

- Manage Leverage Prudently: Avoid excessively high leverage, especially during uncertain market conditions. Lower leverage gives your position more room to withstand price swings.

- Use Stop-Loss Orders: Implement stop-loss orders to automatically close your position at a predetermined price, limiting potential losses before liquidation occurs.

- Understand Margin Requirements: Be aware of the margin levels required by your exchange and monitor your positions closely.

- Don’t Trade Emotionally: High volatility and rapid liquidations can be stressful. Stick to your trading plan and risk management strategy.

Conclusion: Navigating the Volatile Crypto Market

The liquidation of $119 million in crypto futures within an hour, contributing to a $340 million total over 24 hours, underscores the dynamic and often unpredictable nature of the leveraged cryptocurrency market. While futures trading offers opportunities for amplified gains, it comes with the significant risk of rapid liquidation. Events like these are powerful lessons in risk management, highlighting the importance of cautious leverage, strategic planning, and emotional control. As the crypto market continues to evolve, understanding the mechanics and implications of futures liquidation remains essential for anyone navigating this exciting yet challenging space.