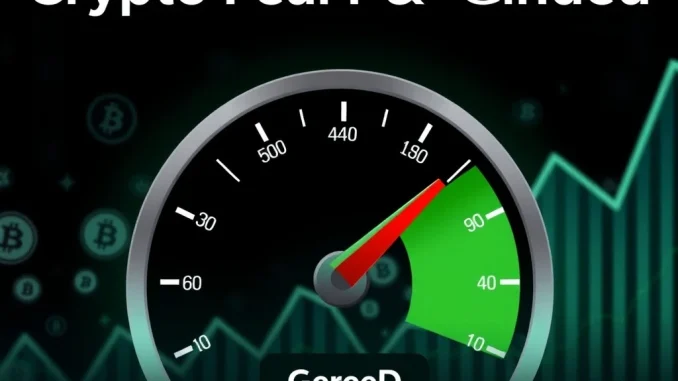

The cryptocurrency market is a dynamic landscape, constantly shifting between highs and lows, optimism and caution. For investors navigating these choppy waters, understanding the prevailing mood is as crucial as analyzing price charts. That’s where the Crypto Fear & Greed Index comes into play, offering a fascinating snapshot of collective investor emotion. As of July 10, this vital indicator, provided by software development platform Alternative, has climbed five points to a robust 71, firmly entrenching itself in the ‘Greed’ zone. But what does this significant shift truly mean for your crypto strategy?

Decoding the Crypto Fear & Greed Index: What Does 71 Mean?

The Crypto Fear & Greed Index serves as a barometer for the cryptocurrency market, ranging from 0 (extreme fear) to 100 (extreme greed). A reading of 71, as we’re seeing now, signals a strong sentiment of ‘Greed’ among market participants. This isn’t just a random number; it’s a calculated metric designed to help investors gauge whether the market is overheating due to excessive buying or paralyzed by widespread selling fear. Historically, periods of extreme fear often present buying opportunities, while extreme greed can precede a market correction.

The index’s current position at 71 suggests that investors are feeling confident, perhaps even euphoric, about future price movements. This can lead to increased buying pressure, pushing prices higher. However, it also carries a cautionary note: when greed becomes pervasive, it can lead to irrational exuberance and, eventually, a market pullback as smart money begins to take profits.

The Six Pillars of Sentiment: How is the Index Calculated?

Unlike a simple poll, the Crypto Fear & Greed Index is a sophisticated tool that aggregates data from six different factors, each weighted to reflect its impact on overall market sentiment. Understanding these components provides a deeper insight into the index’s readings:

- Volatility (25%): This component measures the current volatility and maximum drawdowns of Bitcoin compared to its average over the last 30 and 90 days. High volatility, especially downwards, can indicate fear, while stable or upward volatility might signal confidence.

- Market Momentum/Volume (25%): This factor analyzes the current volume and market momentum of Bitcoin. Strong, sustained buying volume typically indicates a greedy market, whereas low volume or significant selling pressure suggests fear.

- Social Media (15%): The index scans various social media platforms, primarily Twitter, for specific keywords and hashtags related to cryptocurrency. It analyzes the number of posts, interactions, and sentiment around these terms. A surge in positive, excited discussions often points to greed.

- Surveys (15%): (Currently paused) In the past, this component involved weekly polls to gauge public sentiment directly. While currently inactive, it historically provided a direct snapshot of investor expectations.

- Bitcoin Dominance (10%): This measures Bitcoin’s share of the total cryptocurrency market capitalization. An increasing Bitcoin dominance can indicate a flight to safety (fear) as investors consolidate into the largest, most stable asset. Conversely, a decreasing dominance might suggest that altcoins are gaining traction, often a sign of increasing risk appetite and greed.

- Google Trends (10%): By analyzing search queries related to Bitcoin and other cryptocurrencies on Google Trends, the index gauges public interest. A spike in searches for terms like ‘Bitcoin price manipulation’ or ‘crypto crash’ might signal fear, while terms like ‘how to buy Bitcoin’ during a rally could indicate growing public interest and potential greed.

Each of these factors contributes to the overall score, providing a holistic view of the market’s emotional state.

Navigating the ‘Greed’ Zone: What’s Next for Crypto Investors?

The current ‘Greed’ reading of 71 prompts important questions for investors. While it reflects strong positive sentiment and potential for continued upward price movement, it also serves as a reminder of the market’s cyclical nature. Historically, extended periods of extreme greed have often been followed by corrections as early investors take profits. This doesn’t mean a crash is imminent, but it does suggest a need for caution and strategic planning.

For those holding positions, it might be a time to review your portfolio and consider taking some profits, especially on assets that have seen significant gains. For those looking to enter the market, waiting for a slight pullback or exercising extreme caution with dollar-cost averaging could be prudent. Remember, the index is a tool, not a crystal ball. It reflects sentiment, which can be fickle and change rapidly.

Beyond the Index: Understanding Broader Crypto Market Sentiment

While the Crypto Fear & Greed Index is an excellent indicator, it’s just one piece of the puzzle. To truly understand the broader crypto market sentiment, it’s essential to consider other factors. Macroeconomic trends, regulatory news, technological advancements within the blockchain space, and major institutional adoption announcements all play significant roles. For instance, a positive regulatory framework could fuel long-term optimism, even if the index shows temporary fear. Conversely, negative news could dampen spirits despite a high greed reading.

Keeping an eye on trading volumes across major exchanges, analyzing on-chain data for large whale movements, and staying informed about global economic indicators can provide a more comprehensive view. The index is a fantastic starting point, but always combine it with your own research and risk assessment.

Managing Crypto Volatility in a Greed-Driven Market

One of the inherent characteristics of the cryptocurrency market is its crypto volatility. While a ‘Greed’ phase often implies upward price movements, it doesn’t eliminate volatility. In fact, periods of intense greed can sometimes lead to sharper, more unpredictable price swings as speculative trading increases. Investors should be prepared for potential rapid price changes, both up and down, even when the overall sentiment is positive.

Effective risk management strategies, such as setting stop-loss orders, diversifying your portfolio, and only investing what you can afford to lose, become even more critical during periods of high greed. Don’t let the fear of missing out (FOMO) drive irrational decisions. Instead, use the index as an informative guide to make calculated moves.

The rise of the Crypto Fear & Greed Index to 71, firmly in the ‘Greed’ zone, is a clear signal of strong positive sentiment permeating the cryptocurrency market. This is driven by various factors, including market momentum, social media buzz, and Bitcoin dominance trends. While this optimism can be exhilarating and lead to further gains, it’s crucial for investors to approach the market with a balanced perspective. Use the index as a valuable tool to gauge the collective mood, but always combine it with thorough research, sound risk management, and an understanding of the broader market dynamics. Happy investing, and stay informed!

Frequently Asked Questions (FAQs)

1. What is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is a tool that measures the current sentiment of the cryptocurrency market. It ranges from 0 (extreme fear) to 100 (extreme greed), helping investors understand if the market is overly optimistic or pessimistic.

2. How is the Crypto Fear & Greed Index calculated?

The index is calculated using six key factors: volatility (25%), market momentum/volume (25%), social media (15%), surveys (15% – currently paused), Bitcoin dominance (10%), and Google Trends (10%). Each factor contributes to the overall score.

3. What does it mean when the index is in the ‘Greed’ zone (e.g., 71)?

A reading in the ‘Greed’ zone, like 71, indicates that investors are feeling confident and optimistic about the market’s future performance. While this can lead to further price increases, it also suggests that the market might be due for a correction as greed can lead to overvaluation.

4. Should I buy or sell based solely on the Crypto Fear & Greed Index?

No, the index should be used as one of many tools for market analysis, not as the sole basis for investment decisions. It provides insight into market sentiment, but it’s crucial to combine it with fundamental analysis, technical analysis, and your own risk assessment.

5. How does Bitcoin dominance affect the index?

Bitcoin dominance measures BTC’s market cap share. When it rises, it often signals a flight to safety (fear) as investors move into Bitcoin. When it falls, it can indicate increased risk appetite and a shift to altcoins (greed).

6. Is the index always accurate in predicting market moves?

The index is a sentiment indicator, not a predictive tool. While it often correlates with market tops and bottoms, it’s not foolproof. Market sentiment can change rapidly, and other external factors can influence price movements independently of the index’s reading.