A sudden and **massive crypto futures liquidation** event has sent shockwaves across the cryptocurrency landscape. In the past hour alone, a staggering $193 million worth of futures contracts vanished from major exchanges. This immediate wipeout highlights the inherent volatility and high stakes present in the digital asset markets. Furthermore, the broader picture reveals an even more dramatic scenario: a colossal $9.575 billion in futures liquidations occurred over the last 24 hours. This significant sum underscores the intense pressure faced by leveraged traders.

Understanding Crypto Futures Liquidation Dynamics

What exactly does **crypto futures liquidation** entail? Simply put, it occurs when a trader’s position is automatically closed by an exchange due to insufficient margin to cover potential losses. Traders often use leverage to amplify their potential returns. However, this also magnifies potential losses. When the market moves sharply against a highly leveraged position, the trader’s collateral, or margin, quickly depletes. The exchange then liquidates the position to prevent further losses for both the trader and the exchange itself. This process ensures market stability by preventing individual accounts from falling into negative equity.

This automated closing mechanism is crucial for the health of derivative markets. It protects exchanges from absorbing massive debts. However, it can also trigger a domino effect. Large liquidations can push prices further, leading to more liquidations. This creates a cascade, exacerbating market downturns.

The Immediate Impact on Bitcoin Futures and Beyond

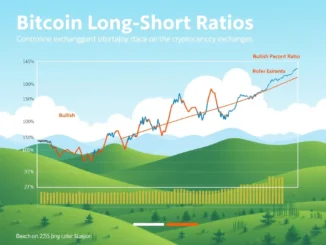

The recent liquidation wave significantly impacted **Bitcoin futures**. As the largest cryptocurrency, Bitcoin often leads market sentiment. Consequently, a substantial portion of the liquidated contracts involved BTC. When Bitcoin’s price experiences rapid shifts, its futures market reacts intensely. This affects traders holding both long (betting on price increases) and short (betting on price decreases) positions. Both can be liquidated if the market moves unexpectedly against them.

However, the impact extends beyond Bitcoin. Many altcoins also saw significant liquidations. Ethereum, Solana, and other major cryptocurrencies also contribute to the overall derivatives volume. This broad market participation means that price swings in one asset can trigger liquidations across various digital assets. Therefore, the ripple effect is felt throughout the entire crypto ecosystem.

What Drives Such Intense Market Volatility?

Periods of extreme **market volatility** are not uncommon in the cryptocurrency space. Several factors contribute to these rapid price swings. Macroeconomic events, such as interest rate changes or global economic data, often influence investor sentiment. Regulatory news, positive or negative, can also trigger swift market reactions. Furthermore, large institutional trades or ‘whale’ movements can significantly impact liquidity and price. Unexpected news or technical breakouts/breakdowns can also initiate sharp price movements. These events create uncertainty, causing traders to make quick decisions. Consequently, this fuels price fluctuations.

The 24-hour liquidation figure of $9.575 billion underscores the widespread nature of this volatility. It indicates a period of sustained price instability. Such figures are a stark reminder of the unpredictable nature of crypto markets. Traders must remain vigilant during these times.

The Perils of Leveraged Crypto Trading

**Leveraged crypto trading** allows participants to control a large position with a relatively small amount of capital. For instance, with 10x leverage, a trader can open a $10,000 position with just $1,000 of their own funds. While this can lead to substantial profits if the market moves favorably, it also dramatically increases risk. A small price movement against the position can quickly wipe out the initial margin. This leads to liquidation. The higher the leverage, the smaller the price movement needed to trigger a liquidation.

Many traders, especially newcomers, underestimate these risks. They chase high returns without fully grasping the potential for rapid capital loss. This often results in significant financial setbacks. Education and a thorough understanding of risk management are paramount for anyone engaging in leveraged trading. Exchanges typically provide warnings about these risks. Still, the allure of quick gains often overshadows caution.

Broader Derivative Market Impact and Investor Sentiment

The recent liquidation event has a notable **derivative market impact**. It affects overall market confidence. When such large sums are liquidated, it can signal a period of fear or uncertainty among investors. This may lead to reduced trading activity or a shift towards less risky assets. The health of the derivatives market often reflects broader sentiment in the underlying spot markets. Significant liquidations can create a negative feedback loop. This further depresses prices and dampens investor enthusiasm. Therefore, monitoring these metrics is essential for market observers.

Moreover, these events can attract regulatory scrutiny. Authorities worldwide are increasingly examining crypto derivatives due to their inherent risks. Regulators aim to protect retail investors from excessive leverage. They also seek to ensure market integrity. Future regulations could potentially impact the accessibility and structure of these products. Therefore, market participants should stay informed about potential policy changes. These changes could reshape the landscape of crypto trading.

In conclusion, the past hour’s $193 million in crypto futures liquidations, part of a larger $9.575 billion over 24 hours, serves as a powerful reminder of the inherent risks in the cryptocurrency derivatives market. This massive event underscores the critical importance of understanding market dynamics, the dangers of excessive leverage, and the unpredictable nature of digital asset prices. Traders must approach these markets with caution, employing robust risk management strategies to navigate periods of extreme volatility effectively. The broader impact on investor sentiment and potential regulatory responses will likely shape the market’s trajectory in the coming weeks.

Frequently Asked Questions (FAQs)

Q1: What is crypto futures liquidation?

Crypto futures liquidation is the automatic closing of a leveraged position by an exchange. This occurs when a trader’s margin falls below a required threshold. It prevents further losses and protects the exchange.

Q2: Why did such a large liquidation event happen?

Large liquidation events typically result from sudden, significant price movements in the underlying cryptocurrency. Factors include high market volatility, macroeconomic news, and widespread use of high leverage by traders.

Q3: How does Bitcoin futures liquidation affect the market?

Bitcoin futures liquidation can trigger cascading effects. When many Bitcoin positions are closed, it can push BTC’s price further. This impacts other altcoins and overall market sentiment, leading to broader instability.

Q4: What are the risks of leveraged crypto trading?

Leveraged crypto trading carries substantial risks. While it amplifies potential profits, it also magnifies losses. Even small price movements against a position can lead to complete loss of initial capital and liquidation.

Q5: How can traders protect themselves from liquidation?

Traders can protect themselves by using lower leverage, setting stop-loss orders, and managing their risk exposure. They should avoid over-committing capital and always understand market conditions before trading.