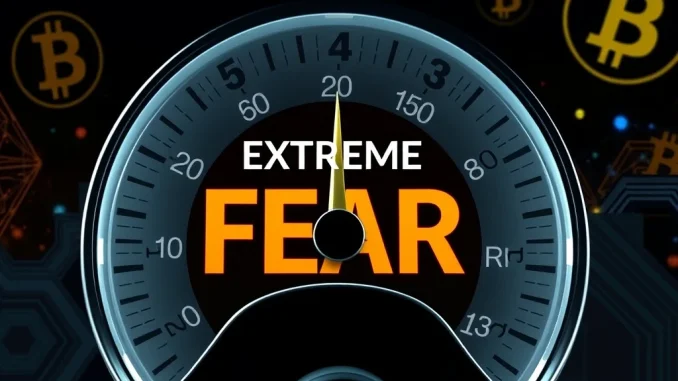

The **Crypto Fear & Greed Index** currently registers a score of 23, signaling a period of **extreme fear crypto** in the market. This reading, though a slight increase from yesterday’s 21, firmly places overall **market sentiment crypto** in a pessimistic zone. Investors and traders closely monitor this index to gauge prevailing emotions. Ultimately, understanding these sentiments can offer valuable insights into potential market movements. Let’s delve deeper into what this number truly signifies for the broader crypto landscape.

Understanding the Crypto Fear & Greed Index

The **Crypto Fear & Greed Index** acts as a crucial barometer for the cryptocurrency market. It aggregates various data points to provide a single, digestible score from 0 (extreme fear) to 100 (extreme greed). This index offers a snapshot of the collective emotional state of market participants. Furthermore, it helps identify potential overreactions or irrational exuberance. For instance, a low score like 23 suggests widespread panic or strong selling pressure.

Alternative.me, the data provider, meticulously calculates this index using several key factors:

- Volatility (25%): This component measures the current volatility and maximum drawdowns of Bitcoin. High volatility often indicates a fearful market.

- Market Volume (25%): Trading volume provides insight into market activity. Low volumes during price drops can signal a lack of confidence.

- Social Media Mentions (15%): Analyzing sentiment from various social media platforms, particularly Twitter, helps gauge public perception. Increased negative mentions contribute to fear.

- Surveys (15%): Weekly polls ask thousands of users about their market outlook. These direct responses offer a qualitative view of sentiment.

- Bitcoin Dominance (10%): An increasing Bitcoin dominance often suggests investors are moving away from altcoins into the perceived safety of Bitcoin, indicating fear.

- Google Search Trends (10%): Search queries related to Bitcoin and cryptocurrencies reveal public interest and sentiment. A rise in ‘Bitcoin price manipulation’ searches, for example, signals fear.

Each factor contributes to the overall score, painting a comprehensive picture of current market psychology. Therefore, the index provides a multi-faceted view beyond simple price action.

Decoding Market Sentiment Crypto: What the Numbers Mean

A score of 23 falls squarely within the ‘Extreme Fear’ category. This range typically signals a market where investors are highly anxious. Often, they fear further price drops. Consequently, many traders may panic-sell their assets. Historically, periods of **extreme fear crypto** have sometimes preceded market reversals. Conversely, moments of ‘Extreme Greed’ (scores above 75) can indicate an overheated market ripe for a correction.

Understanding **market sentiment crypto** is vital for informed decision-making. Here is a general breakdown:

- 0-24 (Extreme Fear): Investors are highly worried, often leading to panic selling. This period can present buying opportunities for contrarian investors.

- 25-49 (Fear): A cautious market. Investors are hesitant, and prices may be consolidating or experiencing slight declines.

- 50-74 (Greed): The market shows optimism. Prices are rising, and investors feel confident. However, this can also lead to overvaluation.

- 75-100 (Extreme Greed): Euphoria dominates. Investors may be overly optimistic, often ignoring risks. This phase can signal a market top.

The current 23 reading reflects a prevailing bearish outlook. Many investors are likely liquidating positions or staying on the sidelines. This sustained low score indicates that underlying concerns persist across the crypto ecosystem.

Bitcoin Fear and Greed: A Dominant Factor

While the index considers the broader crypto market, **Bitcoin Fear and Greed** plays an outsized role. Bitcoin, as the largest cryptocurrency by market capitalization, significantly influences overall market sentiment. Its price movements often dictate the direction of altcoins. Therefore, the index dedicates a specific component (10%) to Bitcoin’s market dominance.

When Bitcoin’s dominance rises, it suggests investors are consolidating their holdings into BTC. They perceive Bitcoin as a safer haven during uncertain times. This flight to safety often indicates a bearish outlook for altcoins. Conversely, when Bitcoin dominance falls, it can signal renewed interest in altcoins, often during bullish phases. The current **Crypto Fear & Greed Index** reading of 23 heavily reflects the sentiment surrounding Bitcoin. Price stagnation or downward pressure on BTC can quickly pull the entire market into fear. Investors frequently use Bitcoin’s performance as a benchmark for the health of the entire digital asset space. Therefore, tracking Bitcoin’s specific sentiment indicators alongside the broader index offers a more nuanced view.

Navigating Extreme Fear Crypto: Strategies for Investors

Periods of **extreme fear crypto** can be challenging for investors. Emotional decisions often lead to losses. However, experienced traders often view these times differently. They see opportunities amidst the panic. Warren Buffett’s famous quote, “Be fearful when others are greedy and greedy when others are fearful,” resonates strongly in such market conditions. Nevertheless, this strategy requires careful consideration and a long-term perspective.

Here are some general approaches investors might consider during periods of extreme fear:

- Dollar-Cost Averaging (DCA): Regularly investing a fixed amount, regardless of price, can mitigate risk. This strategy smooths out entry prices over time.

- Research and Due Diligence: Use this time to identify strong projects with solid fundamentals. Lower prices can present attractive entry points for high-quality assets.

- Risk Management: Do not over-extend financially. Only invest what you can afford to lose. Diversification across different asset classes remains crucial.

- Avoid Panic Selling: Emotional reactions often lead to selling at the bottom. Consider your original investment thesis before making impulsive decisions.

- Rebalance Portfolios: Use market downturns to rebalance your holdings according to your risk tolerance and investment goals.

It is important to remember that past performance does not guarantee future results. Every investment decision carries inherent risks. Investors should always conduct their own research and consult with financial professionals.

Broader Crypto Market Analysis and Future Outlook

The current **Crypto Fear & Greed Index** reading of 23 aligns with broader **crypto market analysis** suggesting a cautious environment. Several macroeconomic factors contribute to this sentiment. For example, global inflation concerns and rising interest rates often impact risk assets like cryptocurrencies. Regulatory uncertainties in various jurisdictions also add to investor apprehension. Moreover, specific industry events or hacks can further depress sentiment. The current market conditions demand a pragmatic approach.

While the index points to fear, it does not predict the future. Instead, it reflects the current emotional state. Historically, markets often recover from periods of extreme fear. However, the timing and extent of such recoveries remain uncertain. Therefore, investors should focus on fundamental analysis rather than purely emotional indicators. The long-term potential of blockchain technology and decentralized finance continues to attract innovation and development. Ultimately, this underlying progress may drive future growth, regardless of short-term sentiment fluctuations. Monitoring key developments in regulation, adoption, and technological advancements offers a more holistic view of the market’s trajectory.

Conclusion

The **Crypto Fear & Greed Index** at 23 clearly indicates a prevailing sentiment of **extreme fear crypto**. This metric, compiled from various data points, serves as a valuable tool for gauging market psychology. While **Bitcoin Fear and Greed** remains a primary driver, the index reflects the collective anxiety across the entire digital asset space. Savvy investors often view such periods as potential opportunities, emphasizing the importance of a well-researched strategy over emotional reactions. Ultimately, the index provides context for current market behavior, reminding us that sentiment can shift rapidly. A comprehensive **crypto market analysis** always combines emotional indicators with fundamental and technical insights.

Frequently Asked Questions (FAQs)

What is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is a tool that measures the current sentiment of the cryptocurrency market. It ranges from 0 (extreme fear) to 100 (extreme greed), indicating whether investors are feeling overly fearful or overly optimistic.

How is the index calculated?

The index is calculated using six weighted factors: volatility (25%), market trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin’s market dominance (10%), and Google search trends (10%).

What does an ‘Extreme Fear’ reading like 23 mean?

An ‘Extreme Fear’ reading, such as 23, indicates that investors are highly anxious and worried about further price drops. This often leads to panic selling. Historically, some investors see such periods as potential buying opportunities.

Does the index predict future market movements?

No, the Crypto Fear & Greed Index does not predict future market movements. It reflects the current emotional state of the market. While extreme readings can sometimes precede reversals, it is not a guaranteed predictive tool and should be used in conjunction with other forms of analysis.

How does Bitcoin’s sentiment affect the overall index?

Bitcoin’s sentiment significantly influences the overall index because Bitcoin is the largest cryptocurrency. Its price movements and market dominance are key components of the index calculation, often setting the tone for the entire crypto market.

What strategies can investors consider during periods of extreme fear?

During periods of extreme fear, investors might consider strategies like dollar-cost averaging, conducting thorough research on strong projects, managing risk carefully, and avoiding impulsive panic selling. Always prioritize your financial goals and risk tolerance.