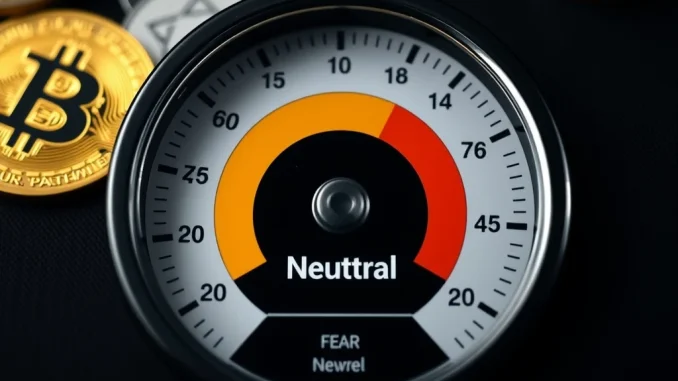

The crypto market is known for its wild swings, and keeping a pulse on investor sentiment is crucial. In a noteworthy shift, the Crypto Fear & Greed Index has just signaled a move towards calmer waters. Provided by Alternative.me, this key indicator has edged up to 47, as of March 26th, breaking free from the grip of ‘Fear’ and entering the coveted ‘Neutral’ zone. This one-point rise from the previous day suggests a subtle but significant improvement in overall market sentiment. But what exactly does this mean for you, the crypto enthusiast or investor? Let’s dive into the details.

Understanding the Crypto Fear & Greed Index: Your Sentiment Compass

Think of the Crypto Fear & Greed Index as a compass for navigating the often turbulent seas of the cryptocurrency market. It’s not about predicting price movements directly, but rather about gauging the prevailing emotions driving those movements. Are investors panicking and selling off, or are they enthusiastically buying in? This index helps quantify those feelings.

The index operates on a scale from 0 to 100. Here’s a quick breakdown:

- 0-24: Extreme Fear – This zone typically indicates a market oversold, where investors are overly worried, potentially presenting buying opportunities for the brave.

- 25-49: Fear – Still in bearish territory, suggesting caution and potential further downside.

- 50-75: Greed – Market sentiment is shifting towards bullishness, with investors becoming more optimistic and potentially driving prices up.

- 76-100: Extreme Greed – This is where things can get frothy. Extreme greed can signal a market bubble, where prices may be inflated and a correction could be looming.

- 47 (Currently): Neutral – The sweet spot of balance! A neutral reading suggests the market is neither overly fearful nor excessively greedy. It indicates a period of equilibrium, where investors are perhaps taking a ‘wait and see’ approach, or where bullish and bearish forces are relatively balanced.

The move to ‘Neutral’ from ‘Fear’ is often seen as a positive sign. It suggests that some of the anxieties gripping the market might be easing, paving the way for potential stability or even upward momentum.

Decoding the Factors: What Drives Crypto Market Sentiment?

The Crypto Fear & Greed Index isn’t based on guesswork. It’s a data-driven tool that aggregates information from six key market indicators. Let’s break down these components:

| Factor | Weightage | Description |

|---|---|---|

| Volatility | 25% | Measures the current and maximum drawdowns of Bitcoin and other major cryptocurrencies, comparing them with historical averages. High volatility often contributes to fear. |

| Market Momentum/Volume | 25% | Analyzes market volume and momentum compared to recent averages. Strong buying volume can indicate greed, while low volume during price drops might signal fear. |

| Social Media | 15% | Tracks sentiment and engagement on social media platforms, primarily Twitter and Reddit, related to cryptocurrencies. High positive social media buzz can suggest greed. |

| Surveys | 15% | Periodically conducts crypto market surveys to directly gauge investor sentiment and expectations. |

| Bitcoin Dominance | 10% | Measures Bitcoin’s market capitalization relative to the total cryptocurrency market. Increased Bitcoin dominance can sometimes indicate fear as investors flock to the perceived safety of Bitcoin during market uncertainty. |

| Google Trends | 10% | Analyzes Google Trends data for Bitcoin-related search queries. Spikes in searches like “Bitcoin” or “crypto crash” can reflect fear, while general interest indicates neutral to greedy sentiment. |

Why is Neutral Sentiment a Significant Shift for Crypto?

After periods of heightened fear in the crypto market, a move to neutral market sentiment can be a breath of fresh air. Here’s why it matters:

- Reduced Panic Selling: Fear often drives impulsive selling, which can exacerbate market downturns. Neutral sentiment suggests this panic is subsiding, potentially leading to more stable price action.

- Opportunity for Strategic Investing: In neutral conditions, investors are more likely to make calculated decisions rather than emotionally driven ones. This can be a good time to research projects, analyze fundamentals, and strategically position yourself for potential future growth.

- Foundation for Growth: Sustained neutral sentiment can build a base for renewed bullishness. As confidence gradually returns, it can attract more investment and drive positive price movements.

- Indicates Market Maturation: The shift towards neutral could also be interpreted as a sign of increasing market maturity. As the crypto market evolves, it may become less prone to extreme emotional swings and more attuned to fundamental factors.

Navigating the Neutral Zone: Actionable Insights for Crypto Investors

So, the Crypto Fear & Greed Index is neutral – what should you do? Here are some actionable insights:

- Don’t Get Complacent: Neutral doesn’t mean risk-free. The crypto market remains volatile. Continue to practice risk management and diversify your portfolio.

- Do Your Research: Neutral periods are excellent times to deep-dive into projects you’re interested in. Understand their technology, use cases, and long-term potential.

- Consider Dollar-Cost Averaging (DCA): If you believe in the long-term prospects of crypto, DCA can be a prudent strategy during neutral phases. It involves investing a fixed amount regularly, regardless of short-term price fluctuations.

- Monitor the Index: Keep an eye on the Crypto Fear & Greed Index and other market indicators. A move back into ‘Fear’ or a surge into ‘Extreme Greed’ can provide valuable signals for adjusting your strategy.

Conclusion: Cautious Optimism in the Crypto Air?

The Crypto Fear & Greed Index entering the ‘Neutral’ zone is indeed a noteworthy development. It suggests a potential easing of market anxieties and a shift towards a more balanced sentiment. While it’s not a guarantee of immediate price surges, it does offer a glimmer of cautious optimism. For crypto investors, this neutral phase presents an opportunity to reassess, strategize, and prepare for what the ever-evolving crypto landscape holds next. Remember, informed decisions, based on both sentiment analysis and fundamental research, are key to navigating the exciting, yet unpredictable, world of cryptocurrencies.