Navigating the volatile world of cryptocurrency investments can feel like riding a rollercoaster. One moment you’re soaring with gains, the next you’re bracing for a dip. Wouldn’t it be helpful to have a compass to gauge the overall market sentiment? Enter the Crypto Fear & Greed Index, a valuable tool for understanding the emotional currents driving the crypto market. Let’s delve into the latest reading and what it signals for your crypto strategy.

Decoding the Crypto Fear & Greed Index: What Does ‘Neutral’ Mean?

The Crypto Fear & Greed Index, provided by Alternative.me, is a sentiment analysis tool that measures the emotional temperature of the cryptocurrency market. As of February 18th, the index stands at 47, a slight decrease of four points from the previous day. Despite this dip, the index remains firmly in the ‘Neutral’ zone. But what exactly does this ‘Neutral’ reading signify, and how can it inform your crypto decisions?

To truly grasp the significance of the Fear and Greed Index, it’s essential to understand its scale. Ranging from 0 to 100, the index paints a clear picture of market emotions:

- 0 – 24: Extreme Fear – This zone indicates a market gripped by significant anxiety. Investors are likely selling off their holdings, anticipating further price drops.

- 25 – 49: Fear – While not extreme, ‘Fear’ suggests caution prevails. Investors are wary and may be hesitant to enter the market or may be reducing their exposure.

- 50 – 75: Greed – ‘Greed’ signals growing market optimism. Investors are becoming more bullish, anticipating price increases and actively buying.

- 76 – 100: Extreme Greed – This is the peak of market exuberance, often associated with a ‘bubble’ territory. Investors are overly confident, and there’s a high risk of a market correction.

- 50 (approximately): Neutral – A ‘Neutral’ reading, like the current 47, suggests a market in equilibrium. Neither fear nor greed dominates, indicating a period of uncertainty or consolidation.

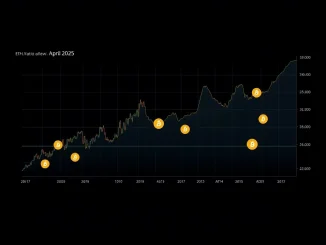

[caption]Understanding the Crypto Fear & Greed Index Scale

Unpacking the Factors: What Drives the Fear and Greed Index?

The Fear and Greed Index isn’t just a random number; it’s calculated based on a weighted analysis of six key market factors. These factors provide a holistic view of market sentiment, moving beyond just price action. Let’s break down each component:

- Volatility (25%): Measures the current and maximum drawdowns of Bitcoin, comparing it with the corresponding average values of the last 30 and 90 days. Unusually high volatility can indicate fear in the market.

- Market Momentum/Volume (25%): Examines market momentum and trading volume in relation to the past 30 and 90-day averages. High buying volume can signal greed, while low volume during price drops might suggest fear.

- Social Media (15%): Analyzes sentiment on social media platforms, primarily Twitter, for crypto-related hashtags. A high volume of positive posts can indicate greed, while negative sentiment can reflect fear.

- Surveys (15%): Conducts weekly crypto polls to gauge investor sentiment. These surveys directly measure the feelings of crypto traders and investors.

- Bitcoin Dominance (10%): Tracks Bitcoin’s dominance in the overall crypto market. Increased Bitcoin dominance might suggest a ‘flight to safety’ during fearful times, while a decrease could indicate higher risk appetite and greed in altcoins.

- Google Trends (10%): Analyzes Google Trends data for Bitcoin-related search queries. Surges in searches like “Bitcoin price prediction” or “buy Bitcoin” can indicate growing interest and potential greed.

By combining these diverse data points, the Crypto Fear & Greed Index offers a comprehensive snapshot of the prevailing market sentiment.

Neutral Sentiment: Is It a Pause or a Pivot Point?

The current ‘Neutral’ reading of the Crypto Fear & Greed Index raises an important question: Is this just a temporary pause in market sentiment, or could it be a pivotal moment signaling a potential shift in direction? A neutral zone can be interpreted in several ways:

- Consolidation Phase: Neutral sentiment often emerges during periods of market consolidation. After a period of strong upward or downward movement, the market may be taking a breather, seeking equilibrium before the next major trend emerges.

- Uncertainty and Indecision: A neutral reading can also reflect market uncertainty. Investors may be unsure of the next market direction, leading to a balance between buying and selling pressures. This indecision can stem from various factors, such as macroeconomic news, regulatory developments, or technological advancements in the crypto space.

- Opportunity for Strategic Positioning: For savvy investors, a ‘Neutral’ zone can present a strategic opportunity. It’s a time to analyze market fundamentals, identify undervalued assets, and prepare for potential future movements, whether bullish or bearish. It’s a period to research and strategize rather than react impulsively to extreme fear or greed signals.

Actionable Insights: Navigating the Neutral Zone

So, how should crypto investors interpret and act upon a ‘Neutral’ reading in the Crypto Fear & Greed Index? Here are some actionable insights:

- Conduct Thorough Research: A neutral market is an excellent time to dive deep into research. Analyze specific cryptocurrencies, their underlying technology, adoption rates, and potential for future growth. Don’t get swayed by short-term sentiment; focus on long-term fundamentals.

- Review Your Portfolio Allocation: Assess your current crypto portfolio and ensure it aligns with your risk tolerance and investment goals. A neutral market provides a stable environment to rebalance your portfolio if needed, without the pressure of extreme market swings.

- Stay Informed on Market Catalysts: Keep a close watch on potential market catalysts that could shift sentiment. This includes regulatory news, technological breakthroughs, macroeconomic indicators, and institutional adoption updates. Understanding these factors will help you anticipate future market movements.

- Consider Dollar-Cost Averaging (DCA): In a neutral market, where future direction is uncertain, DCA can be a prudent strategy. By investing a fixed amount at regular intervals, you can mitigate the risk of investing a lump sum at the wrong time and average out your entry price over time.

- Manage Risk Prudently: Regardless of market sentiment, effective risk management is crucial. Use stop-loss orders, diversify your holdings, and never invest more than you can afford to lose. A neutral market is a reminder that market conditions can change rapidly.

Conclusion: Embrace the Nuance of Neutrality

The Crypto Fear & Greed Index‘s current ‘Neutral’ reading of 47 offers a valuable perspective on the crypto market sentiment. It signals a period of equilibrium, where neither extreme fear nor unbridled greed dominates. While a slight dip from the previous day indicates a weakening of positive sentiment, the market remains in a state of balance. For investors, this ‘Neutral’ zone isn’t a signal to be passive; instead, it’s an opportune moment for strategic planning, in-depth research, and prudent portfolio management. By understanding the nuances of market sentiment and utilizing tools like the Fear and Greed Index, you can navigate the crypto landscape with greater confidence and make informed decisions, regardless of whether the market is gripped by fear or fueled by greed. Embrace the neutrality – it’s often in these moments of balance that the most astute investment strategies are forged.