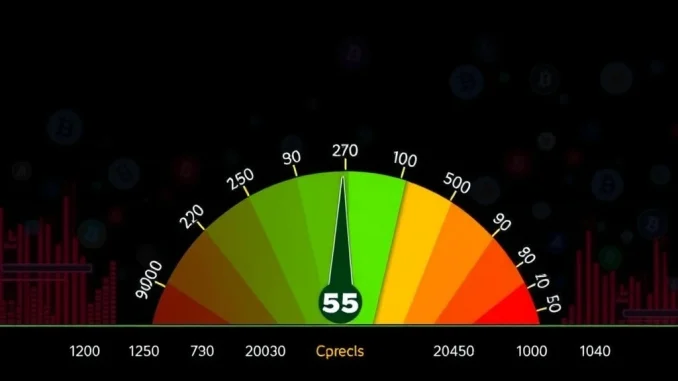

The cryptocurrency market often moves with significant emotional swings. Understanding these shifts is crucial for investors. Recently, the Crypto Fear & Greed Index made a notable move. It surged six points from its previous position. This pushed it firmly into ‘greed’ territory, landing at 55. This development signals a significant change. It offers fresh insights into current Bitcoin market sentiment and broader cryptocurrency sentiment. Investors worldwide are taking note of this shift.

Understanding the Crypto Fear & Greed Index and its Purpose

The Crypto Fear & Greed Index serves as a vital barometer for market psychology. Developed by Alternative.me, it distills complex market data into a single, easily understandable score. The index operates on a straightforward scale. It ranges from 0 to 100. A score of 0 represents extreme fear. Conversely, a score of 100 signifies extreme optimism, or greed. This tool helps investors gauge the prevailing emotional state of the market. It provides a quick snapshot of whether participants feel fearful or overly confident. Therefore, many consider it an essential resource for market analysis.

The index’s recent jump to 55 is particularly noteworthy. It indicates a clear shift from a neutral stance. This move suggests that market participants are becoming more optimistic. They are increasingly willing to take on risk. This change often accompanies rising prices. However, a high ‘greed’ reading can also signal potential overheating. Historically, extreme greed levels have sometimes preceded market corrections. Thus, understanding this market sentiment index is key. It helps investors make more informed decisions.

Decoding the Components: What Drives Cryptocurrency Sentiment?

The Crypto Fear & Greed Index is not based on a single factor. Instead, it aggregates data from six distinct metrics. Each metric contributes a specific weight to the final score. This multi-faceted approach provides a comprehensive view of cryptocurrency sentiment. Let’s explore these crucial components:

- Volatility (25%): This component measures the current volatility and maximum drawdowns of Bitcoin. High volatility, especially sudden drops, often indicates fear. Conversely, stable, upward movements can reflect growing confidence.

- Trading Volume (25%): The index analyzes current trading volume and market momentum. High trading volumes during price increases typically suggest strong buying pressure and potential greed. Low volumes, especially during dips, might indicate hesitation.

- Social Media Mentions (15%): This factor scans various social media platforms. It looks for specific cryptocurrency-related keywords and sentiment. A surge in positive mentions or widespread enthusiasm often boosts the index. Negative sentiment, however, can drag it down.

- Surveys (15%): The index incorporates results from weekly polls. These surveys directly ask investors about their market outlook. This direct feedback provides valuable insights into collective market psychology.

- Bitcoin’s Market Cap Dominance (10%): This metric assesses Bitcoin’s share of the total cryptocurrency market capitalization. A rising dominance can sometimes signal a flight to safety (fear), as investors move to the most established asset. However, in a strong bull market, it can also reflect confidence in the market leader.

- Google Search Volume (10%): This component tracks search trends for various crypto-related terms. For example, searches for phrases like “Bitcoin price manipulation” or “cryptocurrency bubble” might indicate fear. Increased searches for general crypto terms, however, can suggest growing public interest and optimism.

These diverse data points converge to form a holistic picture. They allow the Fear and Greed Index to capture the nuanced emotional state of the market. Consequently, it becomes a powerful tool for analysis.

What a “Greed” Reading Signifies for Bitcoin Market Sentiment

A reading of 55, now firmly in the ‘greed’ zone, carries significant implications for Bitcoin market sentiment. Generally, a higher score indicates increasing investor confidence. People are more willing to buy assets. They might even engage in “Fear Of Missing Out” (FOMO). This often happens during periods of rising prices. Investors see others profiting. They then jump in, hoping to capture similar gains. Such behavior can drive prices even higher in the short term. However, extreme greed can also be a cautionary signal. Markets tend to become overextended when sentiment is excessively bullish. This can create conditions ripe for a correction. Therefore, while a ‘greed’ reading reflects optimism, it also warrants careful consideration.

Conversely, extreme fear readings (scores closer to 0) often present potential buying opportunities. When the market is fearful, prices are typically low. Many investors sell their assets. This capitulation often marks market bottoms. As the famous adage suggests, “Be fearful when others are greedy, and greedy when others are fearful.” The current 55 score sits in a moderate ‘greed’ area. It is not yet extreme. This suggests growing positive momentum. Yet, it also reminds investors to remain vigilant. The market sentiment index offers a snapshot, not a crystal ball.

Navigating Market Cycles with the Fear and Greed Index

The Fear and Greed Index proves particularly useful when navigating different market cycles. During prolonged bear markets, the index typically hovers in the ‘extreme fear’ range. This reflects widespread pessimism and capitulation. Prices often stagnate or decline. As markets begin to recover, the index gradually moves towards ‘neutral.’ This indicates a slow return of confidence. The recent shift to 55 aligns with a more positive outlook. It suggests the market is building momentum. Bull markets, characterized by sustained price increases, often see the index residing in the ‘greed’ or ‘extreme greed’ territories for extended periods. This indicates robust investor enthusiasm.

However, it is crucial to remember that the index is a sentiment indicator. It does not dictate future price movements. Instead, it reflects the collective emotional temperature of the market. For long-term investors, the index can help identify opportune times. For example, periods of extreme fear might be ideal for dollar-cost averaging. Conversely, extreme greed might prompt a re-evaluation of portfolio allocations. Therefore, integrating the Fear and Greed Index into a broader investment strategy is beneficial. It adds a psychological dimension to market analysis.

Strategies for Investors: Beyond the Crypto Fear & Greed Index

While the Crypto Fear & Greed Index offers valuable insights, prudent investors combine it with other analytical tools. Relying solely on any single indicator can be risky. Technical analysis, for instance, provides insights into price patterns and trading volumes. Fundamental analysis evaluates the intrinsic value of cryptocurrencies. It considers factors like project utility, development activity, and adoption rates. Combining these approaches offers a more comprehensive market view. This helps in making well-rounded investment decisions.

Risk management remains paramount in the volatile cryptocurrency market. Diversification across different assets can mitigate risk. Setting clear investment goals is also essential. Do not make impulsive decisions based solely on market sentiment. Always consider your personal risk tolerance. Furthermore, understanding the underlying reasons for market movements is vital. The index provides a pulse. It does not dictate future prices. The Crypto Fear & Greed Index serves as a valuable barometer. It helps gauge collective cryptocurrency sentiment. However, it should complement, not replace, thorough research and a disciplined approach.

The shift of the Crypto Fear & Greed Index to 55 signifies a growing wave of optimism. It reflects a more positive Bitcoin market sentiment. This move from neutral to greed territory is a clear indicator of changing investor psychology. While encouraging, investors must maintain a balanced perspective. Use this information wisely. Combine it with comprehensive research. The index remains a powerful tool. It helps us understand the emotional landscape of the crypto market. It ultimately aids in navigating its inherent complexities.

Frequently Asked Questions (FAQs)

What is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is a tool that measures the current emotional state of the cryptocurrency market. It ranges from 0 (extreme fear) to 100 (extreme greed), providing a single score to reflect market sentiment.

How is the Crypto Fear & Greed Index calculated?

It is calculated using six key factors: volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin’s market cap dominance (10%), and Google search volume (10%).

What does a “greed” reading mean?

A “greed” reading (typically above 50) indicates increasing optimism and confidence among investors. It suggests a willingness to buy and take on more risk, often accompanying rising prices. However, extreme greed can sometimes signal an overextended market.

Should I buy when the index shows greed?

The index is a sentiment indicator, not a direct trading signal. While a greed reading shows market enthusiasm, it’s wise to combine this information with technical and fundamental analysis. Extreme greed can sometimes precede market corrections, so caution is advised.

Is the Fear & Greed Index only for Bitcoin?

While Bitcoin’s dominance is a factor in its calculation, the Crypto Fear & Greed Index aims to reflect overall cryptocurrency market sentiment. Bitcoin’s movements often influence the broader market, making it a key component.

How often is the Crypto Fear & Greed Index updated?

The index is typically updated daily, providing a fresh snapshot of market sentiment based on the latest available data.