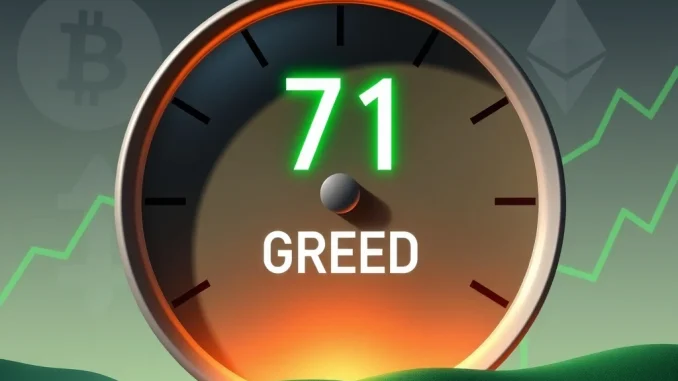

The pulse of the cryptocurrency market is often measured not just by price charts, but by the collective emotional state of its participants. This is where the Crypto Fear & Greed Index steps in, offering a fascinating snapshot of investor sentiment. As of July 21, this crucial barometer, provided by software development platform Alternative, registered a reading of 71. While it marks a slight dip from the previous day, the index firmly remains within the ‘Greed’ zone, prompting many to ask: what does this sustained optimism truly signify for the volatile world of digital assets?

Understanding the Crypto Fear & Greed Index: What Does it Measure?

At its core, the Crypto Fear & Greed Index is designed to distill the complex emotional landscape of the crypto market into a single, digestible number. Ranging from 0 to 100, it paints a clear picture: 0 represents ‘Extreme Fear,’ suggesting investors are overly worried and selling off assets, potentially signaling a buying opportunity. Conversely, 100 signifies ‘Extreme Greed,’ indicating the market might be due for a correction as investors become overly enthusiastic and buy at inflated prices.

This index isn’t just a random guess; it’s a sophisticated calculation that aggregates data from six distinct factors, each weighted to reflect its impact on overall crypto market sentiment. These factors include:

- Volatility (25%): Measures the current volatility and maximum drawdowns of Bitcoin compared to its average over the last 30 and 90 days. High volatility often signals a fearful market.

- Market Momentum/Volume (25%): Analyzes the current volume and market momentum, comparing it with average values. High buying volumes in a rising market indicate greedy behavior.

- Social Media (15%): Scans various social media platforms (like Twitter) for crypto-related hashtags, looking at the number of posts and how quickly they are being engaged with. A high volume of positive mentions can signal greed.

- Surveys (15%): Historically, this factor involved polling investors on their market sentiment. However, it’s important to note that currently, this component is paused, meaning the index relies on the other five factors for its calculation.

- Bitcoin Dominance (10%): Assesses Bitcoin’s share of the total crypto market capitalization. An increasing Bitcoin dominance often indicates a shift from altcoins to Bitcoin, which can signal fear as investors seek the perceived safety of the largest cryptocurrency.

- Google Trends (10%): Analyzes search queries related to Bitcoin and other cryptocurrencies. A sudden surge in search terms like ‘Bitcoin price manipulation’ might indicate fear, while terms like ‘how to buy crypto’ during a bull run might indicate growing greed.

Decoding the ‘Greed’ Zone: What Does a Score of 71 Imply?

A reading of 71 firmly places the market in the ‘Greed’ zone. But what exactly does this mean for you, the investor? Essentially, it suggests that market participants are feeling optimistic, perhaps even euphoric. When the index leans heavily towards greed, it often indicates that prices have risen significantly, attracting more buyers who fear missing out on further gains (FOMO). This can lead to overvaluation, as people might be buying based on emotion rather than fundamental analysis.

Historically, periods of extreme greed have often preceded market corrections. It’s a classic contrarian indicator: when everyone is greedy, it might be time to be cautious. Conversely, when everyone is fearful, it might present a prime buying opportunity. The current 71 score, while not ‘Extreme Greed’ (which would be 80-100), still signals a strong bullish sentiment pervading the crypto market sentiment.

The Pillars of Sentiment: Factors Driving the Index

Understanding the individual components that contribute to the Crypto Fear & Greed Index offers deeper insights into the current market dynamics.

Navigating Crypto Volatility

Crypto volatility is a double-edged sword. While it presents opportunities for quick gains, it also carries significant risk. The index uses volatility as a key indicator because sharp price swings, especially downwards, can trigger panic and fear. Conversely, sustained upward volatility can fuel greed. When the index is at 71, it implies that while there might be some price fluctuations, the overall trend has been positive enough to maintain investor confidence and buying interest, overriding immediate fears of downturns.

Market Momentum & Volume: The Engine of Growth

High trading volumes accompanying price increases are a strong sign of positive momentum. It shows that there’s genuine interest and capital flowing into the market. When the index registers high greed, it often correlates with robust trading volumes, indicating that many participants are actively buying, pushing prices higher and reinforcing the positive sentiment.

The Power of Social Media: Whispers and Roars

In the decentralized world of crypto, social media plays an outsized role in shaping sentiment. A flurry of positive tweets, viral memes, and enthusiastic discussions about ‘to the moon’ or ‘HODL’ can quickly amplify greedy sentiment. The index captures this by analyzing the sheer volume and sentiment of crypto-related conversations online. A 71 reading suggests that the collective online chatter is predominantly bullish.

The Influence of Bitcoin Dominance

Bitcoin dominance refers to Bitcoin’s market capitalization as a percentage of the total cryptocurrency market cap. When Bitcoin dominance rises, it can sometimes indicate that investors are moving out of altcoins and into Bitcoin, often perceived as a safer, more stable asset during uncertain times. However, in a ‘greed’ phase, a stable or slightly increasing Bitcoin dominance might also suggest that Bitcoin is leading the charge, pulling the rest of the market up with it, and maintaining overall confidence.

Google Trends and Public Interest

What people are searching for on Google can reveal a lot about their intentions and fears. A surge in searches for ‘how to buy Bitcoin’ or ‘best crypto to invest’ during a price rally points to increasing public interest and potential new money entering the market, fueling the greed component of the index. Conversely, searches for ‘is crypto dead’ would indicate fear.

Actionable Insights: How to Use the Index Wisely

The Crypto Fear & Greed Index is a tool, not a crystal ball. Here’s how you can leverage it:

- Contrarian Thinking: When the index is high in the ‘Greed zone’ (like 71), it might be a signal to exercise caution, take some profits, or at least re-evaluate your portfolio. Don’t let FOMO drive your decisions.

- Identify Opportunities: Conversely, when the index plummets into ‘Extreme Fear,’ it could present a strategic buying opportunity for long-term investors, assuming you believe in the underlying assets.

- Complement Other Analysis: Never rely solely on this index. Combine it with fundamental analysis (researching projects, technology, teams) and technical analysis (chart patterns, indicators) to make informed decisions.

- Understand Your Risk Tolerance: A high greed score might tempt you to take on more risk. Always remember your personal financial goals and risk appetite.

- Long-Term vs. Short-Term: For long-term holders, daily fluctuations in the index might be less critical. For short-term traders, it can offer insights into potential market reversals.

Challenges and Nuances: Beyond the Numbers

While the Crypto Fear & Greed Index is a valuable tool, it’s not without its limitations:

- Lagging Indicator: It often reflects sentiment that has already developed based on price action, rather than predicting future movements with absolute certainty.

- Bitcoin-Centric: Although it incorporates Bitcoin dominance, the index is heavily weighted towards Bitcoin’s performance and sentiment, which might not always perfectly reflect the entire altcoin market.

- No Surveys: The temporary pause on the ‘Surveys’ component means one aspect of direct investor sentiment is missing, potentially affecting its comprehensiveness.

- Market Manipulation: Sentiment can sometimes be influenced by large players or ‘whales’ through various tactics, making it important to look beyond just the index.

Conclusion: Staying Informed in a Dynamic Market

The sustained reading of 71 on the Crypto Fear & Greed Index serves as a powerful reminder of the current optimistic mood within the cryptocurrency space. While this ‘Greed zone’ indicates robust investor confidence and potential for further growth, it also subtly whispers a word of caution. The crypto market is inherently dynamic, characterized by rapid shifts in sentiment and price. By understanding the factors that drive this index – from crypto volatility and Bitcoin dominance to social media buzz – investors can gain a more nuanced perspective.

Ultimately, the index is a guide, not a gospel. It empowers you to think critically, challenge prevailing sentiment, and make decisions that align with your personal investment strategy. In a market where emotions can run high, a clear-eyed understanding of tools like the Fear & Greed Index is invaluable for navigating the exciting, yet often unpredictable, journey of cryptocurrency investing.

Frequently Asked Questions (FAQs)

1. What does a high Crypto Fear & Greed Index score mean?

A high score, particularly above 50 and into the ‘Greed’ zone (like 71), indicates that investors are feeling optimistic and potentially overconfident about the market. This can lead to increased buying activity, higher prices, and sometimes, overvaluation, which might precede a market correction.

2. How often is the Crypto Fear & Greed Index updated?

The Crypto Fear & Greed Index is typically updated daily, providing a fresh snapshot of market sentiment based on the aggregated data from its various components.

3. Can the Crypto Fear & Greed Index predict market crashes?

While the index is a useful indicator of market sentiment, it is not a predictive tool for crashes. Historically, periods of ‘Extreme Greed’ (scores above 80) have often preceded significant market pullbacks, acting as a contrarian signal. However, it should always be used in conjunction with other forms of analysis.

4. Why are surveys currently paused in the index calculation?

The original content states that surveys are currently paused. The exact reasons for this pause are not always publicly disclosed by Alternative. It could be due to logistical challenges, data quality concerns, or a re-evaluation of its weighting or relevance compared to other real-time market data points.

5. Does the Crypto Fear & Greed Index only apply to Bitcoin?

While the index is heavily influenced by Bitcoin’s performance and includes ‘Bitcoin Dominance’ as a factor, it aims to reflect the overall sentiment of the broader cryptocurrency market. Bitcoin’s movements often set the tone for altcoins, so its sentiment is generally indicative of the wider crypto ecosystem.

6. How can I use the index to make better investment decisions?

Use the index as a contrarian indicator: consider buying when the index is in ‘Extreme Fear’ (low scores) and consider taking profits or exercising caution when it’s in ‘Extreme Greed’ (high scores). Always combine its insights with thorough research, fundamental analysis of projects, and your personal risk tolerance.