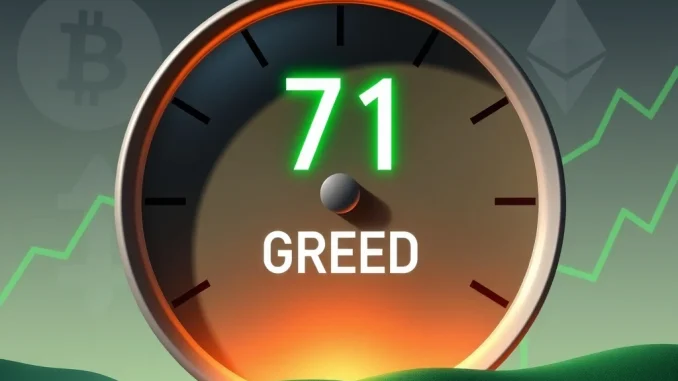

The cryptocurrency market often feels like a rollercoaster, driven by rapid shifts in investor emotions. Recently, a significant shift occurred: the **Crypto Fear & Greed Index** surged to 60. This marks its entry into the ‘Greed’ zone. This movement signals a palpable change in **crypto market sentiment**, moving away from neutral feelings. Investors are now showing increased optimism and enthusiasm. Understanding this index is crucial for anyone navigating the volatile world of digital assets.

Understanding the Crypto Fear & Greed Index

The **Crypto Fear & Greed Index**, provided by software development platform Alternative, serves as a vital barometer for investor sentiment. It measures the prevailing emotions in the cryptocurrency market. The index ranges from 0 to 100. A score of 0 signifies ‘Extreme Fear,’ indicating widespread panic and selling pressure. Conversely, a score of 100 represents ‘Extreme Greed,’ suggesting that investors are overly optimistic and the market might be due for a correction. This **cryptocurrency index** helps market participants gauge the general mood. It offers a snapshot of whether the market is acting irrationally due to fear or greed.

On August 23, the index registered a notable rise to 60. This was an increase of 10 points from the prior day. This upward movement pushed the index from the ‘Neutral’ zone directly into the ‘Greed’ territory. Such a rapid shift often captures the attention of traders and analysts alike. It suggests growing confidence among market participants. However, it also prompts a closer look at the underlying factors contributing to this sentiment.

The Shift to the Greed Zone Explained

Moving into the **greed zone** is a significant development for the crypto market. When the index sits in the ‘Neutral’ zone, sentiment is balanced. Investors are neither overly fearful nor excessively greedy. A shift to ‘Greed’ indicates a strong buying interest. It also shows a potential for prices to rise further. Historically, periods of extreme greed can precede market corrections. Therefore, investors often use this signal with caution. They understand that heightened optimism can lead to impulsive decisions. This index helps temper those emotions with data.

The index’s rise to 60 suggests that more people are feeling positive about crypto investments. This positive outlook can stem from various market developments. It could be due to specific project news or broader economic factors. However, it is important to remember that sentiment can change quickly. Investors must remain vigilant. They should always conduct their own research.

Diving Deeper: Factors Influencing the Cryptocurrency Index

The **Crypto Fear & Greed Index** is not based on a single metric. Instead, it aggregates data from six key factors. Each factor contributes to the overall score. This comprehensive approach provides a robust measure of **crypto market sentiment**. Understanding these components helps investors interpret the index more accurately. They can then make more informed decisions.

- Volatility (25%): This factor measures the current volatility and maximum drawdowns of Bitcoin. High volatility often indicates fear or uncertainty.

- Market Momentum/Volume (25%): This compares current market volume and momentum with average values. Strong buying volume typically indicates a greedy market.

- Social Media (15%): The index analyzes specific hashtags and keywords on social media platforms. High engagement and positive sentiment can signal greed.

- Surveys (15%): While currently paused, these surveys previously gathered opinions directly from crypto investors.

- Bitcoin Dominance (10%): An increasing Bitcoin dominance often indicates a flight to safety, suggesting fear. A decreasing dominance can suggest greed, as altcoins gain traction.

- Google Trends (10%): This factor looks at search queries related to cryptocurrencies. Rising search interest for terms like ‘Bitcoin price manipulation’ might indicate fear.

These factors combine to create a nuanced picture of the market’s emotional state. The current reading of 60 reflects a strong influence from these positive indicators. The index provides a data-driven approach to an otherwise emotional market.

Volatility and Market Momentum

Volatility is a double-edged sword in the crypto market. High volatility can signify both opportunity and risk. When the market experiences significant price swings, it can trigger fear. However, sustained upward volatility, coupled with strong trading volume, often signals a confident market. This contributes positively to the **cryptocurrency index**. Market momentum and volume are crucial indicators. They reflect the strength of buying or selling pressure. A surge in trading volume alongside rising prices indicates robust market health. This suggests that more participants are actively engaging, pushing the index towards greed.

Social Media and Google Trends Insights

Social media platforms are powerful amplifiers of sentiment. The index monitors mentions, hashtags, and overall tone related to cryptocurrencies. A surge in positive conversations, particularly around specific projects or the market as a whole, can push the index higher. Similarly, Google Trends data offers insights into public interest. Increased searches for general crypto terms, or even specific ‘buy’ related queries, contribute to a higher greed score. Conversely, searches for terms like ‘crypto crash’ or ‘sell Bitcoin’ would indicate fear. These digital footprints provide real-time insights into collective investor psychology.

Bitcoin News and its Dominance in Sentiment Analysis

Bitcoin’s role in the **Crypto Fear & Greed Index** is particularly significant. As the largest cryptocurrency by market capitalization, Bitcoin often sets the tone for the entire market. Its price movements, trading volume, and overall dominance heavily influence the collective **crypto market sentiment**. Positive **Bitcoin news**, such as institutional adoption or favorable regulatory developments, typically fuels optimism across the board. This pushes the index higher. Conversely, negative news can quickly trigger fear.

Bitcoin dominance, one of the index’s components, specifically tracks Bitcoin’s market cap relative to the total crypto market cap. When Bitcoin’s dominance rises, it often means investors are moving capital from altcoins into Bitcoin. This usually happens during periods of uncertainty, indicating fear. When Bitcoin dominance falls, it can suggest investors are more willing to take risks on altcoins, signaling greed. Therefore, Bitcoin’s performance and perception are central to the index’s calculation and interpretation.

Historical Context of Fear and Greed

Observing the **Crypto Fear & Greed Index** over time reveals fascinating patterns. During bull markets, the index frequently resides in the ‘Greed’ or ‘Extreme Greed’ zones. Investors become overly confident, and FOMO (Fear Of Missing Out) drives buying. Conversely, bear markets see the index plunge into ‘Fear’ or ‘Extreme Fear’. This is when many investors panic sell. Understanding these cycles helps investors manage expectations. It also helps them recognize potential buying or selling opportunities. The index serves as a reminder that market psychology is a powerful force. It can often overshadow fundamental analysis in the short term.

While the index is a valuable tool, it is not a standalone predictor. Savvy investors combine its insights with other analytical methods. They look at technical analysis, fundamental analysis, and macroeconomic factors. This holistic approach provides a more complete picture. It helps to avoid making decisions based solely on emotion.

Implications for Investors: Navigating the Greed Zone

The **greed zone** presents both opportunities and risks for investors. When the **Crypto Fear & Greed Index** indicates greed, it suggests that the market is currently optimistic. Prices may continue to rise in the short term. However, this period also often precedes market corrections. It becomes crucial for investors to exercise caution. Avoiding impulsive buying driven by FOMO is essential. Instead, they should focus on their long-term investment strategies.

This is a time to re-evaluate portfolios. Consider taking profits on highly appreciated assets. Also, prepare for potential downturns. For new investors, entering the market during periods of extreme greed can be risky. Prices might be inflated. A disciplined approach, based on thorough research and risk management, remains paramount. Do not let market euphoria dictate your decisions. Always prioritize a well-thought-out investment plan.

Beyond the Index: A Holistic View of Crypto Market Sentiment

While the **Crypto Fear & Greed Index** offers a valuable snapshot, it represents just one piece of the puzzle. A comprehensive understanding of **crypto market sentiment** requires looking at multiple indicators. These include on-chain metrics, derivatives market data, and macroeconomic trends. On-chain data, for example, tracks transactions directly on the blockchain. It can reveal investor behavior like accumulation or distribution. Derivatives markets, such as futures and options, provide insights into institutional interest and hedging strategies.

Furthermore, global economic conditions, interest rates, and regulatory news significantly impact the crypto market. Combining these diverse data points offers a more robust and reliable assessment. This helps investors make informed decisions. It allows them to navigate the complexities of the cryptocurrency landscape effectively. Relying on a single indicator can lead to incomplete conclusions. A multi-faceted approach is always best.

The recent surge of the **Crypto Fear & Greed Index** to 60, pushing it into the ‘Greed’ zone, marks a significant shift in market psychology. This indicates growing optimism among investors, driven by factors like volatility, market momentum, social media buzz, and Bitcoin’s influence. While this newfound enthusiasm can be exciting, it also serves as a crucial reminder for investors to proceed with caution. The index is a powerful tool for gauging **crypto market sentiment**, but it functions best when combined with a broader analysis of market fundamentals and personal risk tolerance. As the market continues to evolve, understanding these emotional indicators remains vital for making rational and strategic investment decisions.

Frequently Asked Questions (FAQs)

What is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is a tool that measures the prevailing emotions and sentiment in the cryptocurrency market. It uses various data points to generate a score from 0 (Extreme Fear) to 100 (Extreme Greed).

How is the Crypto Fear & Greed Index calculated?

The index combines six weighted factors: volatility (25%), market momentum/volume (25%), social media (15%), surveys (15% – currently paused), Bitcoin dominance (10%), and Google Trends (10%).

What does it mean when the index enters the ‘Greed’ zone?

Entering the ‘Greed’ zone (typically above 50) indicates increasing optimism and buying interest among investors. It suggests that market participants are feeling confident, and prices may continue to rise, though it can also precede a market correction.

How does Bitcoin news affect the index?

Bitcoin’s performance and news significantly influence the index. Positive Bitcoin news often boosts overall crypto market sentiment, pushing the index towards greed. Bitcoin dominance, a component of the index, also reflects shifts in investor risk appetite.

Should I invest when the Crypto Fear & Greed Index is in the ‘Greed’ zone?

While ‘Greed’ can indicate upward price momentum, it’s often a time for caution. High greed levels can precede market corrections. Investors should avoid FOMO-driven decisions, conduct thorough research, and stick to their investment strategy, considering taking profits or rebalancing portfolios.

Where can I find the Crypto Fear & Greed Index?

The index is provided by Alternative, a software development platform. You can typically find it on their website or various cryptocurrency news and data aggregation platforms.