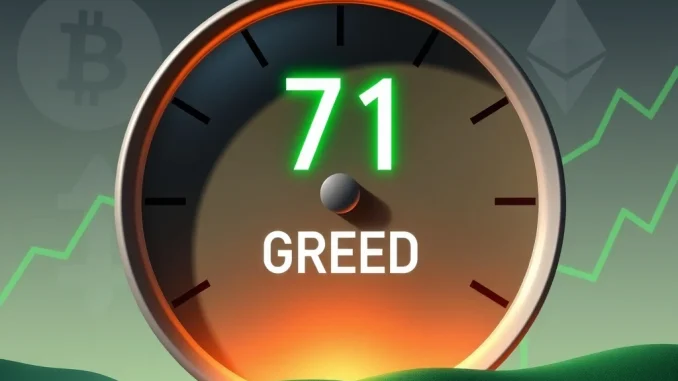

Get ready for a shift in the digital asset landscape! The latest update from Alternative, the software development platform behind the widely-watched Crypto Fear & Greed Index, reveals a significant leap. As of August 4th, the index has climbed to a robust 64, marking an impressive 11-point surge from the previous day. This jump has propelled the market out of its ‘Neutral’ phase and squarely into the ‘Greed’ zone, indicating a notable change in overall crypto market sentiment.

What Does the Crypto Fear & Greed Index Truly Tell Us?

The Crypto Fear & Greed Index serves as a powerful barometer for the emotional state of the cryptocurrency market. Ranging from 0 to 100, where 0 signifies ‘Extreme Fear’ and 100 represents ‘Extreme Greed,’ this index offers a snapshot of prevailing investor psychology. It’s designed to help us understand whether market participants are acting with caution or euphoria, often providing a counter-intuitive signal: extreme fear can indicate a buying opportunity, while extreme greed might suggest a correction is due.

But how exactly does this index arrive at its score? It meticulously aggregates data from six key factors, each weighted to reflect its influence on market sentiment:

- Volatility (25%): Measures the current volatility and maximum drawdowns of Bitcoin, comparing them to average values over 30 and 90 days. Higher volatility in an uptrend can suggest greed, while in a downtrend, it signals fear.

- Market Momentum/Volume (25%): Analyzes the current volume and market momentum, comparing them with average values over the last 30 and 90 days. Strong, consistent buying volume typically indicates positive sentiment.

- Social Media (15%): Scans various social media platforms for crypto-related hashtags and measures the speed and volume of discussions. High engagement and positive sentiment can indicate growing interest and potential greed.

- Surveys (15%): Gathers weekly polls from users to gauge their sentiment towards the market. (Note: This factor is currently paused, meaning its weight is redistributed among other factors).

- Bitcoin Dominance (10%): Assesses Bitcoin’s share of the total cryptocurrency market capitalization. A rising Bitcoin dominance can indicate a shift of funds from altcoins to Bitcoin, often seen as a safer haven during uncertainty, or as a sign of strong overall market confidence if Bitcoin is leading a rally.

- Google Trends (10%): Examines search queries related to Bitcoin and other cryptocurrencies. A surge in ‘Bitcoin price manipulation’ searches, for example, might signal fear, while ‘buy Bitcoin’ searches could indicate growing public interest and greed.

The Significance of ‘Greed’ in Investor Sentiment

The move to 64, firmly in the ‘Greed’ zone, is a significant psychological marker. When the index leans towards greed, it suggests that investors are becoming more optimistic, perhaps even overconfident, in the market’s upward trajectory. This heightened investor sentiment often fuels further buying, creating a positive feedback loop that can drive prices higher. However, it’s also a double-edged sword; historically, periods of extreme greed have often preceded market corrections, as irrational exuberance can lead to unsustainable price bubbles.

How Does Market Momentum Contribute to This Surge?

The 25% weighting given to market momentum and volume plays a crucial role in the index’s current reading. A consistent increase in trading volume, coupled with positive price movements across major cryptocurrencies, strongly indicates that buying pressure is dominating selling pressure. This isn’t just about price; it’s about the conviction behind those price movements. High volume on upswings suggests broad participation and belief in continued growth, directly contributing to the index’s climb into the ‘Greed’ territory. This metric reflects real-time investor activity, making it a powerful indicator of immediate market direction.

Understanding Bitcoin Dominance in the Current Climate

While the index is for the broader crypto market, Bitcoin dominance remains a key factor. When Bitcoin, the largest cryptocurrency by market cap, shows strength and attracts a larger share of the total crypto market, it often instills confidence across the entire ecosystem. A rising Bitcoin dominance during a period of increasing greed can suggest that investors are piling into the perceived safest, most liquid asset within the crypto space, indicating a strong foundational belief in the market’s overall health.

Navigating the ‘Greed’ Zone: Actionable Insights

For savvy investors, the ‘Greed’ signal isn’t just a headline; it’s a call to action – or perhaps, caution. While it’s exciting to see positive sentiment, it’s also a time for strategic thinking:

- Re-evaluate Your Portfolio: Are you overexposed? This might be a good time to take some profits, especially from assets that have seen significant gains.

- Avoid FOMO (Fear Of Missing Out): Don’t rush into buying simply because everyone else seems to be. Research thoroughly and stick to your investment strategy.

- Set Stop-Loss Orders: Protect your gains by setting stop-loss orders to automatically sell if prices drop beyond a certain point.

- Look for Value: Instead of chasing pumps, identify projects with strong fundamentals that might still be undervalued despite the overall positive sentiment.

- Stay Informed: Continue to monitor the Crypto Fear & Greed Index and other market indicators. Sentiment can shift rapidly.

Conclusion: A Cautious Optimism

The Crypto Fear & Greed Index rising to 64 and entering the ‘Greed’ zone is undoubtedly a positive sign for the cryptocurrency market, reflecting improved crypto market sentiment and renewed investor sentiment. It signifies a period where optimism is prevailing, driven by factors like strong market momentum and the foundational stability indicated by Bitcoin dominance. While this surge in confidence can be exhilarating, it’s crucial for investors to approach the market with a balanced perspective. History teaches us that extreme greed can be a precursor to market corrections. Therefore, while we celebrate the current positive trend, prudent risk management and informed decision-making remain paramount for navigating the exciting, yet volatile, world of cryptocurrencies.

Frequently Asked Questions (FAQs)

Q1: What is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is a tool that measures the current emotional state of the cryptocurrency market. It ranges from 0 (Extreme Fear) to 100 (Extreme Greed) and helps investors understand if the market is overly fearful or overly optimistic, using various data points like volatility, market momentum, and social media sentiment.

Q2: What does it mean when the index is in the ‘Greed’ zone?

When the index enters the ‘Greed’ zone (typically above 50), it indicates that investors are becoming more optimistic and confident in the market’s future performance. This can lead to increased buying pressure and rising prices, but also suggests that the market might be nearing a peak or becoming overvalued.

Q3: How often is the Crypto Fear & Greed Index updated?

The Crypto Fear & Greed Index is typically updated daily, providing a fresh snapshot of market sentiment based on the latest data points from its various contributing factors.

Q4: Should I buy when the index is in ‘Greed’?

The index is a sentiment indicator, not a direct buy/sell signal. While ‘Greed’ indicates strong positive sentiment, historically, periods of extreme greed can precede market corrections. It’s often advisable to exercise caution, consider taking some profits, and avoid impulsive buying driven by FOMO (Fear Of Missing Out).

Q5: What factors contribute to the Crypto Fear & Greed Index?

The index considers six main factors: volatility, market momentum/volume, social media activity, surveys (currently paused), Bitcoin dominance, and Google Trends data. Each factor is weighted differently to calculate the final index score.