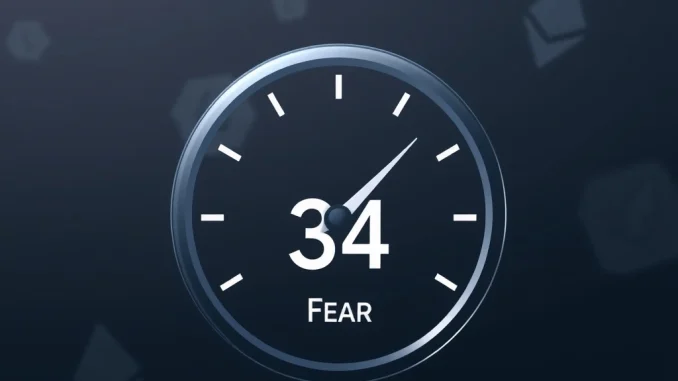

The **Crypto Fear & Greed Index** recently slipped to 34. This drop signals continued **crypto market fear** among investors. Such a reading places the market firmly in the ‘Fear’ category. This key indicator helps gauge the prevailing mood in the cryptocurrency space.

Understanding the Crypto Fear & Greed Index

The **Crypto Fear & Greed Index** serves as a vital barometer for investor psychology. It consolidates various data points into a single, digestible score. This score ranges from 0 (extreme fear) to 100 (extreme greed). The index provides insights into whether the market is overly anxious or excessively optimistic. A low score, like the current 34, suggests caution. Conversely, a high score often precedes market corrections. Alternative.me, a prominent **cryptocurrency analytics** firm, compiles this data daily. Therefore, many traders and analysts watch it closely.

Decoding Market Sentiment: Key Components

This comprehensive index relies on several weighted factors. Each component contributes to the overall **market sentiment** score. Understanding these elements clarifies how the index reflects the market’s mood:

- Volatility (25%): This measures how much Bitcoin’s price fluctuates. High volatility often signals a fearful market.

- Trading Volume (25%): Strong buying volume during price increases indicates greed. High selling volume during drops suggests fear.

- Social Media Mentions (15%): Analysis of crypto-related hashtags and sentiment on platforms like X (formerly Twitter). Increased negative mentions contribute to fear.

- Surveys (15%): Polls conducted to gather direct investor opinions on market direction.

- Bitcoin’s Market Dominance (10%): An increasing dominance often indicates investors are fleeing altcoins for the perceived safety of Bitcoin. This can signal fear in the broader market.

- Google Search Volume (10%): Tracking search trends for terms like ‘Bitcoin price manipulation’ or ‘crypto crash’. High search volume for such terms suggests growing anxiety.

Navigating Crypto Market Fear at 34

A reading of 34 firmly places the market in the ‘Fear’ category. This suggests that investors are generally hesitant. They may be selling assets or avoiding new investments. Historically, periods of extreme fear can present opportunities for long-term investors. However, they also signal potential for further price declines. This is why careful analysis of the **crypto market fear** is crucial. The current sentiment reflects a cautious approach from the broader investor base. Furthermore, it highlights a lack of confidence in immediate upward price movements. Traders often use this index as a contrarian indicator. They might buy when others are fearful, and sell when others are greedy. Nevertheless, this requires a well-defined strategy.

Leveraging Cryptocurrency Analytics for Informed Decisions

Effective decision-making in the crypto space relies on robust **cryptocurrency analytics**. Tools like the Fear & Greed Index are just one piece of the puzzle. They provide a psychological snapshot. However, investors also consider technical analysis, fundamental analysis, and macroeconomic factors. The index offers a quick overview of crowd psychology. For example, if **Bitcoin dominance** is rising alongside a low Fear & Greed score, it might indicate a flight to safety. This suggests altcoins could face more pressure. Therefore, integrating this index with other metrics offers a more complete picture. Savvy investors do not rely on a single indicator. They use a combination to form their market outlook. This comprehensive approach helps mitigate risks and identify potential entry or exit points.

The Role of Bitcoin Dominance in Sentiment

Bitcoin’s **market dominance** plays a significant role in the index’s calculation. When Bitcoin’s share of the total crypto market capitalization increases, it often signals a shift. Investors frequently move funds from smaller, more volatile altcoins into Bitcoin. This movement is typically a defensive play during uncertain times. It reflects a preference for Bitcoin’s relative stability. Therefore, a rising dominance often correlates with increased market fear. Conversely, a declining dominance can indicate growing confidence. Investors might then rotate funds into altcoins for higher potential returns. This interplay between Bitcoin’s market share and overall sentiment is a crucial dynamic to monitor.

Conclusion: What the Current Fear Means for You

The current **Crypto Fear & Greed Index** score of 34 underscores a prevailing cautious **market sentiment**. This indicator, derived from various **cryptocurrency analytics**, reflects widespread **crypto market fear**. While fear can be a precursor to buying opportunities, it also suggests potential continued downward pressure. Investors should consider this index alongside other research. A balanced approach, combining psychological indicators with technical and fundamental analysis, is always recommended. Staying informed and avoiding impulsive decisions remains paramount in volatile markets.

Frequently Asked Questions (FAQs)

Q1: What does a Crypto Fear & Greed Index score of 34 mean?

A score of 34 indicates that the market is currently in a state of ‘Fear’. This suggests investors are feeling cautious, hesitant, and potentially selling their assets. It is a mid-range fear level, not extreme fear (0-24) but still significant.

Q2: How is the Crypto Fear & Greed Index calculated?

The index is calculated using a weighted average of several factors: volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin’s market dominance (10%), and Google search volume (10%).

Q3: Can the Crypto Fear & Greed Index predict market movements?

While the index is a strong indicator of current market sentiment, it is not a direct predictor of future price movements. It often acts as a contrarian indicator; extreme fear can precede a market bottom, and extreme greed can precede a market top. However, it should be used in conjunction with other analytical tools.

Q4: Why is Bitcoin’s market dominance included in the index?

Bitcoin’s market dominance is included because it often reflects investor behavior. A rising dominance suggests investors are moving capital into Bitcoin, perceived as a safer asset, away from altcoins. This movement typically indicates fear in the broader altcoin market.

Q5: Where can I find the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is publicly available from several cryptocurrency analytics platforms, most notably Alternative.me, which is cited as the source for this data.