The pulse of the cryptocurrency market is often measured not just by price charts, but by the collective emotional state of participants. One key indicator for this is the Crypto Fear and Greed Index. Recently, this index has seen a notable rise, entering the ‘Greed’ territory. What does this shift in market sentiment crypto tell us about the current state and potential future movements?

Understanding the Crypto Fear and Greed Index

Developed by Alternative, the Crypto Fear and Greed Index is designed to provide a snapshot of the prevailing emotions in the crypto market. It operates on a simple principle: extreme fear can indicate that investors are too worried, potentially presenting a buying opportunity, while extreme greed can suggest the market is due for a correction.

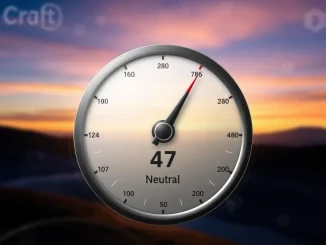

The index uses a scale from 0 to 100:

- 0-24: Extreme Fear

- 25-49: Fear

- 50-74: Greed

- 75-100: Extreme Greed

A score of 61, as recently reported, firmly places the market sentiment in the ‘Greed’ zone.

How the Market Sentiment Index is Calculated

The market sentiment index is not based on a single factor but aggregates data from multiple sources to provide a comprehensive view. The calculation currently takes into account the following weighted factors:

- Volatility (25%): Measures the current volatility and maximum drawdown of Bitcoin compared to its average values. Higher volatility in a positive direction can contribute to greed.

- Market Momentum/Volume (25%): Analyzes the current volume and market momentum, comparing it with the average values over the last 30 and 90 days. High buying volume in a rising market signals greed.

- Social Media (15%): Scans Twitter for specific hashtags related to cryptocurrencies and measures the speed and frequency of posts. High engagement and positive sentiment can push the index higher.

- Surveys (15%): Gathers data from weekly crypto polls. (Note: The original text states surveys are currently paused).

- Bitcoin Dominance (10%): Measures Bitcoin’s share of the total market capitalization. An increasing dominance often indicates a flight to safety (fear) from altcoins, or strong confidence in Bitcoin itself (can lean towards greed if combined with price rises).

- Google Trends (10%): Analyzes search queries related to Bitcoin and other cryptocurrencies. Rising search interest, especially for terms like ‘Bitcoin price manipulation’ or ‘crypto bubble’, can indicate fear, while searches for ‘buy Bitcoin’ or ‘crypto rally’ suggest greed.

Navigating the Fear and Greed Zone

Entering the ‘Greed’ zone, as the index at 61 indicates, suggests that investors are becoming increasingly optimistic and potentially overconfident. Historically, periods of extreme greed have often preceded market pullbacks or corrections as the market becomes overheated. Conversely, periods of extreme fear have often been seen as potential bottoms, presenting opportunities for those brave enough to buy when others are selling.

This doesn’t mean a crash is imminent simply because the index is in ‘Greed’. It’s a signal to exercise caution. When Bitcoin sentiment and overall market sentiment crypto are high, it can fuel further price increases, but it also increases the risk of a sharp reversal if sentiment shifts.

The Role of Bitcoin Sentiment

Given Bitcoin’s significant market dominance, its performance and the sentiment surrounding it heavily influence the overall index. Strong positive Bitcoin sentiment, driven by price increases and positive news, naturally pulls the entire market sentiment index higher. Monitoring Bitcoin’s price action and related news is crucial for understanding why the index is moving.

Using the Index for Crypto Market Analysis

While the Crypto Fear and Greed Index is a valuable tool for gauging emotional temperature, it should not be used in isolation as a definitive buy or sell signal. Think of it as a complementary indicator for your crypto market analysis.

Here’s how it can be useful:

- Confirming Trends: Is a price rally happening alongside increasing greed? This might suggest the rally is sentiment-driven and potentially unsustainable in the long term.

- Identifying Potential Reversals: Extreme readings (above 75 or below 25) can alert you to potential turning points where market psychology might be stretched thin.

- Managing Psychology: Understanding the prevailing sentiment can help you counter emotional trading biases. If the market is extremely greedy, it might be time to trim positions or take profits, rather than getting swept up in FOMO (Fear Of Missing Out). If the market is extremely fearful, it might be a time to look for undervalued assets, rather than panic selling.

Remember, the index reflects current sentiment based on past data. It doesn’t predict the future with certainty.

Conclusion

The rise of the Crypto Fear and Greed Index to 61 signifies a shift towards increased optimism and ‘Greed’ in the market. This elevated market sentiment crypto, heavily influenced by Bitcoin sentiment, is a signal for traders and investors to remain vigilant. While not a direct trading instruction, this key market sentiment index provides valuable context for your crypto market analysis, reminding us that emotional extremes in the market often warrant careful consideration and a disciplined approach.