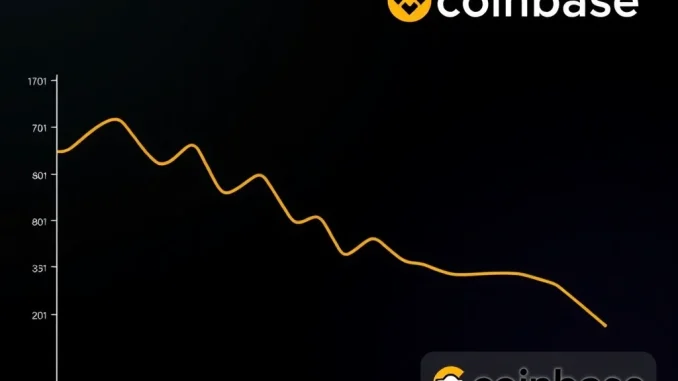

Is the cryptocurrency market losing steam? Recent data reveals a dramatic slump in crypto exchange volume, raising eyebrows and sparking concern among investors. The weekly average trading volume across prominent platforms like Binance and Coinbase has plummeted to a startling $32 billion. This figure, as of April 20th, marks the lowest point since October 2023, according to insights from The Block. Let’s delve deeper into this significant downturn and explore what it signals for the future of crypto trading and market sentiment.

Why is Crypto Exchange Volume Experiencing Such a Drastic Drop?

The numbers paint a stark picture. A mere $32 billion in weekly average crypto exchange volume is a far cry from the exuberant highs seen just months ago. To put it into perspective, this represents a staggering 75% decrease from the peak of $132 billion witnessed in December 2024. This rapid descent begs the question: what factors are contributing to this chilling market cool-off?

Several potential catalysts could be at play:

- Market Correction After Frenzy: The crypto market is known for its volatile cycles. The peak in December 2024 might have been an unsustainable frenzy, followed by a natural correction. What goes up, must come down, and perhaps we are witnessing the pendulum swing back.

- Reduced Retail Investor Participation: Retail investors often drive trading volume. Economic uncertainties, coupled with market corrections, could be deterring smaller investors from actively trading, leading to lower overall volumes.

- Regulatory Scrutiny: Ongoing regulatory discussions and actions globally can create uncertainty and dampen market enthusiasm. Traders might become more cautious amidst evolving regulatory landscapes.

- Shift to Long-Term Holding: Instead of active trading, investors might be adopting a long-term holding strategy (‘HODLing’). If more participants are holding rather than trading, volume naturally decreases.

Understanding these potential reasons is crucial for gauging the current pulse of the crypto market.

Bitcoin Trading Volume: Spot vs. Futures – What’s the Ratio Telling Us?

Analyzing the dynamics between spot and futures trading provides further insights into market behavior. The 30-day moving average of the spot-to-futures trading volume ratio for Bitcoin has dipped to a concerning 0.19. This is the lowest level since August 2023. Similarly, Ethereum’s ratio has fallen to 0.20, hitting its lowest mark since December 2023.

Bitcoin trading volume ratio decline suggests a significant shift. A lower ratio indicates that futures trading is becoming more dominant compared to spot trading. What does this mean in practical terms?

- Increased Speculation: Futures markets are often associated with higher leverage and speculative trading. A lower spot-to-futures ratio can signal a rise in speculative activity and potentially increased market risk.

- Reduced Real Demand: Spot trading is generally considered a better indicator of genuine demand for an asset. A shift towards futures might imply that the underlying demand for Bitcoin and Ethereum at their current prices is weakening.

- Market Sentiment Shift: This ratio can be a barometer of market sentiment. A move towards futures might indicate traders are seeking to profit from short-term price movements rather than long-term investment.

This shift in trading behavior warrants close attention, as it can offer clues about the prevailing crypto market sentiment and potential future price action.

Ethereum Trading Volume: Mirroring Bitcoin’s Trend?

Ethereum trading volume is also showing a similar pattern to Bitcoin. The drop in its spot-to-futures ratio to 0.20, a December 2023 low, reinforces the narrative of a broader market trend. While Bitcoin often leads market movements, Ethereum’s mirroring behavior suggests this isn’t an isolated incident but rather a wider phenomenon affecting major cryptocurrencies.

Is Ethereum simply following Bitcoin’s lead, or are there specific factors influencing Ethereum’s trading dynamics? Further analysis into on-chain metrics and Ethereum-specific news might reveal more nuanced insights.

Solana: An Outlier in the Trading Volume Downtrend?

Amidst the widespread decline, Solana emerges as an interesting exception. While Bitcoin and Ethereum experienced significant drops, Solana bucked the trend, showing a modest uptick in trading volume during the same period. Why is Solana defying the broader market trend?

Several factors could contribute to Solana’s resilience:

- Positive Ecosystem Developments: Solana might be experiencing positive developments within its ecosystem, such as new projects, partnerships, or technological upgrades, attracting trader interest.

- Specific Community Enthusiasm: Solana has a strong and active community. Specific events or announcements could be driving increased activity within its dedicated trader base.

- Rotation of Capital: Traders might be rotating capital from Bitcoin and Ethereum into alternative cryptocurrencies like Solana, seeking different opportunities within the market.

Solana’s counter-trend performance highlights the diverse and dynamic nature of the cryptocurrency market. While the overall market might be cooling, pockets of activity and opportunity can still emerge.

Exchange Weekly Volume: What Does the Future Hold?

The significant decrease in exchange weekly volume to a six-month low is undoubtedly a noteworthy event. While it could be a temporary dip, it also serves as a potential warning sign. What actionable insights can we glean from this data?

- Market Caution Advised: Traders and investors should exercise caution in the current market climate. Reduced volume and increased speculative trading can indicate higher volatility and potential risks.

- Monitor Key Ratios: Closely watching spot-to-futures ratios for Bitcoin and Ethereum can provide valuable signals about market sentiment and potential shifts in trader behavior.

- Diversification and Research: Exploring diverse crypto assets like Solana and conducting thorough research into specific ecosystem developments can help identify potential opportunities even in a cooling market.

- Long-Term Perspective: It’s essential to maintain a long-term perspective. Crypto markets are cyclical, and periods of reduced volume can be followed by renewed growth and activity.

In conclusion, the plunge in weekly average trading volume to a six-month low is a significant market development that demands attention. While the reasons behind this decline are multifaceted, the data underscores a shift in market dynamics. Whether this is a temporary breather or a sign of a deeper correction remains to be seen. Staying informed, exercising caution, and maintaining a balanced perspective are crucial for navigating the evolving cryptocurrency landscape. Keep a close watch on these trends as they unfold – they hold valuable clues to the market’s next move.