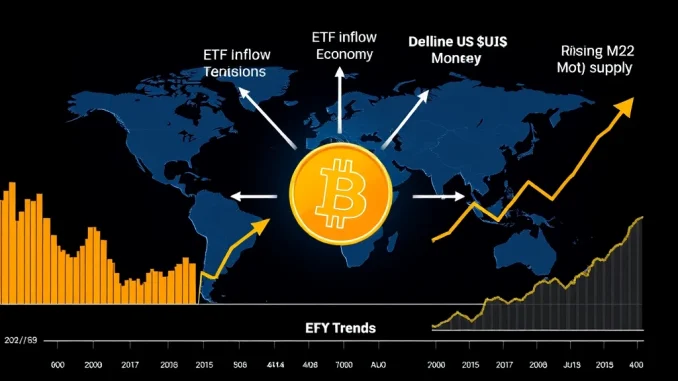

Get ready for another action-packed week in the crypto world! Bitcoin (BTC), the king of cryptocurrencies, is at a pivotal juncture. Cointelegraph has pinpointed five critical Bitcoin trends that could shape the market’s direction this week. Are you prepared to navigate these potential shifts and capitalize on emerging opportunities? Let’s dive into these essential factors that every crypto enthusiast and investor should be watching closely.

Is Bitcoin Finally Breaking Free from Its Downtrend?

For months, Bitcoin has been navigating a persistent downtrend, leaving many wondering when this bearish cycle might end. This week, all eyes are on whether BTC can decisively break free. A successful breakout could signal a significant shift in market sentiment and potentially usher in a new phase of bullish momentum.

Key points to consider regarding the Bitcoin downtrend:

- Technical Indicators: Analysts are closely monitoring key technical indicators like moving averages and trendlines to confirm a valid breakout. Keep an eye on trading volumes as increased volume during a breakout attempt often adds credibility to the move.

- Resistance Levels: Bitcoin faces several resistance levels that it needs to overcome to confirm a trend reversal. These levels act as potential barriers, and a sustained break above them is crucial.

- Market Sentiment: Overall market sentiment plays a vital role. Positive news and increased investor confidence can fuel a breakout, while negative news can quickly derail any upward momentum.

If Bitcoin manages to break free from this long-term downtrend, it could be a powerful signal for the broader crypto market trends, potentially leading to increased optimism and investment across the board. However, false breakouts are common in crypto, so vigilance and careful analysis are paramount.

Trade War Turbulence: Will Global Economic Fears Weigh on Bitcoin?

Geopolitical uncertainties and global economy anxieties are back in the spotlight, with ongoing concerns about a potential trade war casting a shadow over financial markets. Trade disputes can create economic instability, and investors often react by seeking safe-haven assets. But how does this affect Bitcoin?

Potential impacts of trade war fears on Bitcoin:

- Risk-Off Sentiment: Trade war anxieties can trigger a “risk-off” sentiment in traditional markets, leading investors to reduce exposure to perceived riskier assets. Historically, Bitcoin has sometimes been correlated with risk assets.

- Safe-Haven Appeal: Conversely, some argue that Bitcoin could benefit from trade war turmoil as investors seek alternative assets outside of traditional financial systems, viewing Bitcoin as a form of digital gold or a hedge against economic uncertainty.

- Currency Devaluation: Trade wars can lead to currency devaluations in affected countries. In such scenarios, Bitcoin could become more attractive as a store of value compared to weakening fiat currencies.

The impact of trade war fears on Bitcoin is complex and can be multifaceted. It’s essential to monitor how traditional markets react to trade war developments and assess whether Bitcoin acts as a risk-on or risk-off asset during these periods of economic uncertainty.

Bitcoin ETF Watch: Will Spot ETF Inflows Fuel the Next Bull Run?

Spot Bitcoin ETF (Exchange Traded Fund) inflows are a closely watched metric, seen by many as a crucial indicator of institutional interest in Bitcoin. This week, the focus is on whether these ETFs will witness significant capital inflows. Positive inflows can signal growing institutional adoption and potentially drive up Bitcoin’s price.

Why are Bitcoin ETF inflows important?

- Institutional Adoption: Spot Bitcoin ETFs provide a regulated and accessible way for institutional investors to gain exposure to Bitcoin. Inflows into these ETFs indicate increasing institutional adoption of Bitcoin as an asset class.

- Demand and Supply Dynamics: Significant ETF inflows represent increased demand for Bitcoin. Given Bitcoin’s limited supply, rising demand can exert upward pressure on its price.

- Market Sentiment Indicator: ETF inflows are often seen as a barometer of overall market sentiment towards Bitcoin. Strong inflows can boost confidence and attract further investment from both institutional and retail investors.

Tracking the daily inflows and outflows of spot Bitcoin ETFs can provide valuable insights into the prevailing institutional sentiment and potential price movements for Bitcoin. Keep an eye on reports from major ETF providers and analyze the trends in capital allocation.

Dollar Weakness: Is the DXY Decline a Tailwind for Bitcoin’s Bullish Case?

The U.S. Dollar Index (DXY), which measures the dollar’s strength against a basket of other major currencies, has been declining. Historically, a weaker dollar has often been associated with increased bullish sentiment for Bitcoin. Is this trend set to continue and provide a boost to BTC this week?

How does the DXY impact Bitcoin?

- Inverse Correlation: There’s often an inverse correlation between the DXY and Bitcoin. A weaker dollar can make Bitcoin, priced in dollars, more attractive to investors holding other currencies.

- Inflation Hedge Narrative: A declining dollar can raise concerns about inflation. In such environments, investors may turn to assets like Bitcoin, which is perceived by some as an inflation hedge or a store of value outside of the traditional fiat system.

- Global Liquidity: A weaker dollar can contribute to increased global liquidity, as it becomes cheaper for other countries to access dollar-denominated assets. This increased liquidity can flow into various markets, including cryptocurrencies.

Monitoring the DXY’s movements and understanding its potential impact on Bitcoin is crucial for gauging short-term price fluctuations and overall market direction. A continued decline in the DXY could indeed provide a tailwind for Bitcoin’s bullish aspirations.

Global Money Supply Expansion: Will M2 Breaking Records Fuel Bitcoin’s Rise?

The global M2 money supply, a measure of the amount of money in circulation, is seeking to break all-time highs. Expansionary monetary policies and increased money supply can have significant implications for asset prices, including Bitcoin. Could this surge in global liquidity propel Bitcoin to new heights?

The M2 money supply and its link to Bitcoin:

- Inflationary Pressures: Increased money supply can lead to inflation over time, as more money chases the same amount of goods and services. Bitcoin, with its fixed supply, is often seen as a hedge against inflation.

- Asset Price Inflation: Excess liquidity in the system can flow into various asset classes, including stocks, real estate, and cryptocurrencies, driving up prices.

- Decreased Purchasing Power: As fiat currencies potentially lose purchasing power due to inflation, assets like Bitcoin, with limited supply, could become more appealing as stores of value.

The potential for global M2 money supply to break all-time highs is a significant macroeconomic factor that could provide a strong tailwind for Bitcoin and the broader crypto market trends. Keep an eye on global monetary policy developments and their potential impact on Bitcoin’s long-term trajectory.

The Week Ahead: Navigating the Bitcoin Landscape

This week presents a fascinating confluence of factors that could significantly influence Bitcoin’s price action and the overall crypto market trends. From technical breakouts and Bitcoin ETF inflows to global economy uncertainties and macroeconomic forces, understanding these critical Bitcoin trends is essential for making informed decisions in the dynamic world of cryptocurrency. Stay vigilant, stay informed, and be prepared to adapt to the ever-evolving crypto landscape. The week ahead promises to be anything but dull!