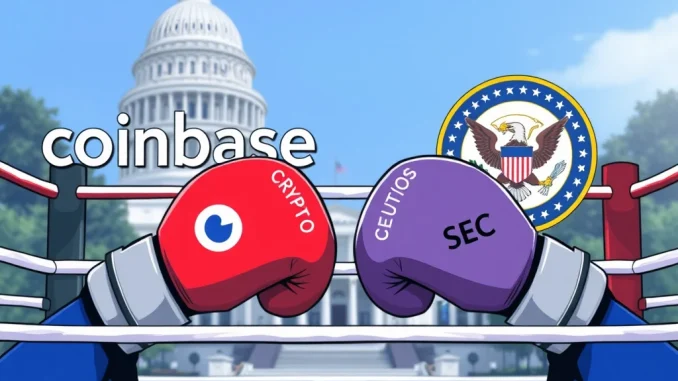

The cryptocurrency world is holding its breath as one of the industry giants, Coinbase, steps into the regulatory ring. In a bold move, Coinbase Exchange is directly engaging with the U.S. Securities and Exchange Commission (SEC), urging them to finally bring much-needed clarity to crypto regulations in the United States. This isn’t just about Coinbase’s future; it’s about the entire digital asset market and its potential to thrive within a well-defined legal framework. Let’s dive into what Coinbase is proposing and why this could be a pivotal moment for the crypto industry.

Why is Coinbase Pushing for Crypto Regulations Now?

For years, the crypto industry has operated in a gray area in the U.S., particularly regarding how digital assets are classified and regulated. The SEC, responsible for overseeing securities markets, has been perceived by many as taking a somewhat ambiguous and sometimes enforcement-heavy approach to crypto regulations. This lack of clear guidelines creates uncertainty, stifles innovation, and makes it difficult for businesses like Coinbase to operate with confidence and plan for the future.

Coinbase’s recent push for crypto clarity is happening at a crucial time. Here’s why this moment is so significant:

- Congressional Efforts are Underway: The U.S. Congress is actively discussing and working on legislation related to digital assets. Coinbase wants to ensure the SEC’s stance aligns with these legislative efforts, creating a cohesive regulatory landscape.

- SEC’s Shifting Stance: As mentioned by The Block, the SEC’s approach to crypto has seen shifts, particularly across different administrations. Coinbase is likely seeking to establish clear, consistent rules that transcend political changes and provide long-term stability.

- Market Growth and Stability: Uncertainty in SEC regulations can lead to market volatility and hinder growth. Clear rules are seen as essential for fostering a stable and thriving digital asset market in the U.S., attracting further investment and innovation.

Coinbase’s Key Recommendations to the SEC: A Breakdown

So, what exactly is Coinbase asking the Coinbase SEC interaction to achieve? Their recommendations are structured and targeted, focusing on key areas of ambiguity. Let’s break down the core proposals:

1. Distinguishing Digital Commodities from Securities

One of the biggest sticking points in crypto regulations is the classification of digital assets. Are they securities, commodities, or something else entirely? Coinbase is urging the SEC to clearly differentiate between digital commodities and securities. This distinction is crucial because securities are subject to stricter regulations and registration requirements under SEC jurisdiction, while commodities often fall under the purview of the Commodity Futures Trading Commission (CFTC).

Why is this important?

- Clarity for Businesses: Knowing whether an asset is a security or commodity dictates which regulatory framework applies, allowing businesses to comply effectively.

- Appropriate Regulation: Commodities and securities have different characteristics and risk profiles. Separate classifications would allow for more tailored and appropriate regulation for each type of digital asset.

2. Deferring to U.S. Congress on Regulatory Ambiguities

Coinbase recognizes that some aspects of crypto regulations are inherently complex and may require legislative solutions. Therefore, they are advocating for the SEC to defer to the U.S. Congress on areas where regulatory ambiguities exist. This acknowledges that Congress, as the legislative body, is best positioned to create new laws and frameworks to address these complex issues.

What does this mean in practice?

- Collaboration and Alignment: It promotes collaboration between the SEC and Congress, ensuring regulatory efforts are aligned with broader legislative goals.

- Comprehensive Solutions: Congress can enact comprehensive legislation that addresses the nuances of the digital asset space, potentially going beyond the SEC’s existing regulatory powers.

3. Recognizing Secondary Market Transactions of Digital Commodities

Coinbase is specifically requesting the SEC to acknowledge that secondary market transactions of digital commodities should not be classified as securities transactions. This is a critical point for exchanges like Coinbase, which facilitate the trading of digital assets on the secondary market.

Why is this distinction vital for the crypto market?

- Facilitating Trading: Classifying secondary market commodity transactions as securities transactions could impose onerous regulatory burdens on exchanges, potentially hindering trading activity.

- Market Efficiency: Recognizing the difference ensures that secondary markets for digital commodities can function efficiently and without undue regulatory friction.

4. Allowing Tokenization of Traditional Securities

In a forward-thinking recommendation, Coinbase is also advocating for the SEC to allow the tokenization of traditional securities. Tokenization involves representing traditional assets like stocks or bonds as digital tokens on a blockchain. This could unlock significant benefits for the financial markets.

What are the potential advantages of tokenized securities?

- Increased Efficiency and Lower Costs: Tokenization can streamline processes, reduce intermediaries, and lower transaction costs associated with traditional securities trading.

- Enhanced Accessibility and Liquidity: Tokenized securities can be fractionalized, making them more accessible to a wider range of investors and potentially increasing liquidity.

- Innovation in Financial Products: Tokenization can pave the way for innovative new financial products and services, further integrating digital assets into the mainstream financial system.

The Path Forward: Will the SEC Listen to Coinbase’s Demand for Crypto Clarity?

Coinbase’s assertive stance is a clear signal of the industry’s growing impatience for regulatory certainty. The call for SEC regulations clarity is not just about Coinbase’s interests; it reflects the broader needs of the entire digital asset ecosystem. Whether the SEC will heed these recommendations remains to be seen. However, this move by Coinbase puts significant pressure on the regulatory body to engage constructively and provide the much-needed framework for responsible innovation and growth in the crypto space.

The coming months will be crucial. Will the SEC respond with clear, pragmatic guidelines that foster innovation while protecting investors? Or will regulatory ambiguity continue to cast a shadow over the burgeoning digital asset market? The world is watching, waiting to see if this Coinbase SEC engagement will be a catalyst for positive change in crypto regulations.

Conclusion: A Crucial Moment for Crypto Regulations

Coinbase’s proactive approach to engaging with the SEC on crypto regulations is a vital step towards creating a more transparent and predictable environment for digital assets in the U.S. By clearly outlining their recommendations, Coinbase is not only advocating for their own business but also for the long-term health and prosperity of the entire crypto industry. The demand for crypto clarity is now louder than ever, and the SEC’s response will be instrumental in shaping the future of digital assets in the United States and potentially globally. This is a story to watch closely as it unfolds, as it could very well define the next chapter of cryptocurrency’s evolution.