Attention, crypto traders and enthusiasts! A notable event just occurred in the institutional trading world: **CME Bitcoin futures** opened today with a significant upward move, creating what’s known as a ‘gap’. This opening price often captures the market sentiment developed over the weekend when traditional futures markets are closed.

Understanding the Latest **Bitcoin Futures Gap**

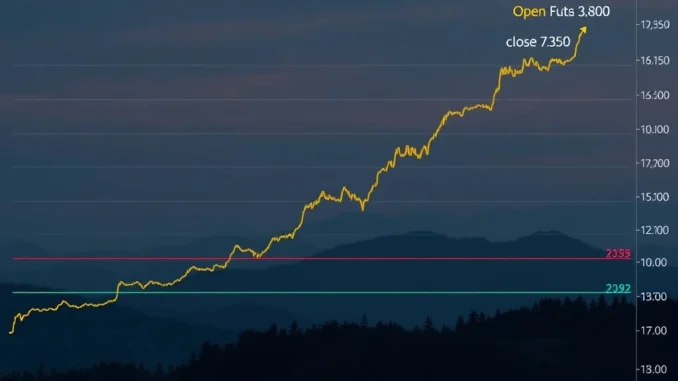

Let’s break down the specifics of this recent development. Bitcoin futures on the Chicago Mercantile Exchange (CME) saw their latest contract open at $106,550. This figure stands $1,490 higher than the previous week’s closing price of $105,060.

For those unfamiliar, a CME gap occurs because the CME Bitcoin futures market doesn’t trade 24/7 like the spot Bitcoin market. When the futures market closes for the weekend (or holidays), the price of Bitcoin continues to trade on various exchanges worldwide. If Bitcoin’s price moves significantly during this closure period, the futures contract will open at a price different from its last close, leaving a ‘gap’ on the price chart.

Why Do These Gaps Happen?

The primary reason for a **Bitcoin futures gap** on CME is the difference in trading hours. While the underlying asset (Bitcoin) is traded globally around the clock, the regulated futures market has specific operating hours. Any major price discovery or volatility in the spot market between the CME’s close on Friday and its open on Sunday evening (or Monday morning, depending on your timezone) results in this gap.

What Does This $1,490 Higher Gap Signal?

A gap opening higher, as we’ve seen today with **CME Bitcoin futures**, generally indicates strong buying pressure or positive market sentiment emerged while the futures market was closed. The market participants trading on the CME are effectively ‘catching up’ to the price level established on the global spot markets over the weekend.

This specific $1,490 gap is quite substantial and immediately becomes a point of interest for traders performing **Bitcoin price analysis**.

**CME Gap Trading**: Strategies and Significance

The concept of a ‘CME gap’ is a key element for many traders, particularly those focused on technical analysis. A widely discussed idea is that CME gaps tend to ‘fill’. This means the price often revisits the level of the gap closure eventually. However, it’s crucial to understand that this is not a guaranteed outcome and can take days, weeks, or even months, or sometimes never happens.

Traders often look at CME gaps for potential trading opportunities or as indicators:

- Potential Price Targets: The previous close ($105,060 in this case) might be seen as a potential downside target if the price decides to ‘fill’ the gap.

- Support/Resistance: The edges of the gap can sometimes act as future support or resistance levels.

- Sentiment Indicator: A large gap can reinforce the observed market sentiment from the weekend. An upward gap like this one suggests bullishness prevailed.

Engaging in **CME gap trading** requires careful consideration of risk management, as relying solely on a gap filling can be speculative.

Connecting to Broader **Crypto Market News**

This significant upward gap in **CME Bitcoin futures** is more than just a technical anomaly; it’s a data point reflecting the broader sentiment captured in recent **crypto market news**. A $1,490 jump from Friday’s close to Sunday’s open suggests that weekend trading on spot markets was notably positive. This aligns with any bullish narratives, positive regulatory news, or significant accumulation trends that may have occurred outside of CME trading hours.

Keeping an eye on these institutional movements provides valuable context, as **CME Bitcoin futures** are often seen as a gauge of institutional participation and sentiment in the Bitcoin market.

What Could Happen Next?

Based on historical observations of **Bitcoin futures gap** behavior, here are a few possibilities:

- Immediate Gap Fill: The price could drop shortly after opening to ‘fill’ the gap back down to $105,060.

- Partial Fill: The price might retrace some, but not all, of the gap.

- Gap Holds as Support: The price could continue moving higher, with the top of the gap ($106,550) potentially acting as a support level if there’s a pullback.

- Gap Never Fills (or takes a long time): The price might continue on its trajectory, leaving the gap open for an extended period.

Each scenario has implications for short-term **Bitcoin price analysis** and trading strategies.

Conclusion: The $1,490 Gap Demands Attention

The $1,490 higher open for **CME Bitcoin futures** is a significant technical event that has immediately captured the attention of traders and analysts. It highlights the influence of weekend spot market activity on institutional trading platforms and provides potential clues for future price movements. While the idea of gaps ‘filling’ is popular in **CME gap trading**, it’s just one factor among many to consider in comprehensive **Bitcoin price analysis**. As the market unfolds, observing how this gap is treated by traders will be a key piece of **crypto market news** to follow.