Get ready for a significant upgrade in how you move stablecoins! Circle, the issuer behind the popular USDC stablecoin, has just announced a major expansion for its Cross-Chain Transfer Protocol (CCTP) V2. This powerful protocol now officially supports the Solana blockchain, opening up exciting new possibilities for native USDC transfers across multiple ecosystems.

What is Circle CCTP V2 and Why Does it Matter?

Before diving into the Solana news, let’s quickly touch on what CCTP V2 is. In simple terms, it’s Circle’s secure, permissionless protocol designed for the native transfer of USDC across different blockchain networks. Unlike traditional bridges that often rely on wrapped or synthetic versions of assets, CCTP allows users to burn USDC on a source chain and have an equivalent amount minted natively on a destination chain.

This native transfer mechanism is crucial because it:

- Reduces counterparty risk associated with wrapped assets.

- Ensures users always hold authentic, native USDC.

- Improves liquidity flow between disparate blockchain ecosystems.

CCTP V2 is a significant evolution of the protocol, designed to be more efficient and developer-friendly.

Circle Solana Integration: A Game Changer?

The big news is the addition of **Solana USDC** support to CCTP V2. This integration means that for the first time, users and applications can move native USDC directly between Solana and other supported CCTP chains without relying on traditional, often more complex, bridging solutions.

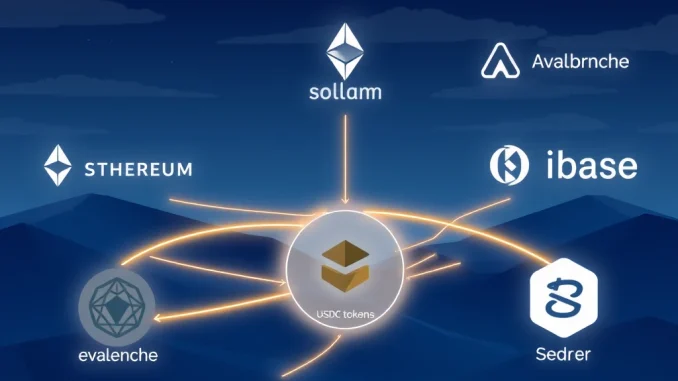

Circle shared the announcement on X, confirming that Solana joins a growing list of networks already integrated with CCTP V2. These currently include:

- Arbitrum

- Avalanche

- Base

- Ethereum

Adding Solana to this lineup is a major step for cross-chain interoperability, particularly for USDC, which is a widely used stablecoin across the crypto landscape.

How Does USDC Cross-Chain Transfer Work with Solana?

The process leveraging the **Cross-Chain Transfer Protocol** is designed to be straightforward, although the underlying technology is complex. Here’s a simplified look:

- A user initiates a transfer request from a dApp integrated with CCTP on a source chain (e.g., Ethereum).

- The specified amount of native USDC is burned on the source chain.

- A message is sent securely via a network of attesters (independent validators) to the destination chain (e.g., Solana).

- Once the message is verified, an equivalent amount of *native* USDC is minted on the destination chain, available to the user.

This burn-and-mint mechanism is what differentiates CCTP from locking assets on one chain and issuing wrapped tokens on another. For **Circle Solana** users, this means easier access to USDC originating from or destined for major EVM chains.

What Are the Benefits of Circle CCTP Supporting Solana?

The integration of **Circle CCTP** with Solana brings several key advantages:

- Enhanced Liquidity: Easier movement of USDC means improved liquidity within the Solana ecosystem and better capital efficiency across connected chains.

- Seamless User Experience: Users can move native USDC directly, reducing the need to manage different wrapped versions of the stablecoin.

- Increased Developer Opportunities: dApps on Solana can integrate CCTP V2 to enable direct USDC deposits and withdrawals from other chains, simplifying user onboarding and cross-chain strategies.

- Improved Capital Efficiency: Businesses and traders can move significant amounts of USDC more efficiently between these networks.

- Native Asset Security: By transferring native USDC, users benefit from the security model of the CCTP protocol itself, avoiding potential risks associated with certain wrapped assets.

Comparing CCTP and Traditional Solana Bridges

While various bridges already connect Solana to other chains, CCTP offers a unique value proposition specifically for USDC:

| Feature | Circle CCTP (for USDC) | Traditional Bridges |

|---|---|---|

| Asset Type on Destination | Native USDC | Often Wrapped USDC (e.g., USDCet) |

| Mechanism | Burn on Source, Mint on Destination | Lock on Source, Mint Wrapped on Destination |

| Security Model | Protocol-level attestation | Varies greatly (multi-sig, validator sets, etc.) |

| Primary Focus | Native USDC transfers | Often supports various assets (tokens, NFTs) |

For applications heavily reliant on native USDC, CCTP provides a direct and potentially more secure pathway compared to managing wrapped versions.

What Does This Mean for the Solana Ecosystem?

The addition of **Circle Solana** support via CCTP V2 is a significant positive development. Solana’s DeFi ecosystem, known for its speed and low transaction costs, can now benefit from more fluid access to USDC liquidity originating from large markets like Ethereum and Arbitrum. This could potentially attract more users and capital to Solana dApps, fostering further growth and innovation within the network.

Looking Ahead: The Future of Cross-Chain Transfer Protocol

The expansion of the **Cross-Chain Transfer Protocol** to include Solana signals Circle’s commitment to building a highly interconnected stablecoin ecosystem. As more chains are integrated, the ability to move native USDC seamlessly across the blockchain landscape becomes increasingly powerful. This interoperability is key to unlocking the full potential of decentralized finance and making stablecoins truly borderless.

Ready to Experience Seamless USDC?

If you’re a user or developer in the Solana ecosystem, this is an exciting development. Look out for dApps integrating **Circle CCTP** to facilitate native USDC transfers. For developers, exploring the CCTP V2 documentation is the next step to leveraging this powerful new capability.

Conclusion

Circle’s integration of Solana into its Cross-Chain Transfer Protocol V2 marks a pivotal moment for USDC and cross-chain interoperability. By enabling native **USDC cross-chain** transfers between Solana and other major networks like Ethereum, Arbitrum, Avalanche, and Base, Circle is simplifying the movement of value and fostering a more connected blockchain world. This move is set to benefit users, developers, and the broader DeFi ecosystem on Solana and beyond, paving the way for a future where stablecoins flow freely and efficiently across networks.