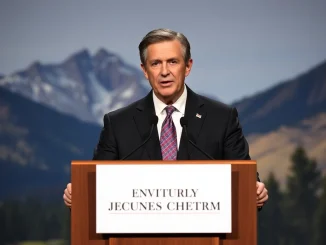

While the cryptocurrency market often dances to its own beat, the broader macroeconomic landscape significantly influences investor sentiment and asset valuations. Therefore, understanding key signals from institutions like the Chicago Fed is crucial. Recently, Federal Reserve Bank of Chicago President Austan Goolsbee delivered a pointed message regarding the delicate balance of monetary policy, specifically cautioning against premature rate cuts. His insights offer valuable context for all investors monitoring economic stability.

Chicago Fed’s Stance on Monetary Policy

Federal Reserve Bank of Chicago President Austan Goolsbee has openly expressed reservations. He warned against the dangers of swiftly reducing interest rate cuts. His comments highlight a cautious approach within the Federal Reserve. This stance emphasizes data dependency over anticipatory moves. Goolsbee’s position underscores the ongoing debate. Policymakers must decide when and how to adjust borrowing costs. This decision directly impacts the broader financial system. The Chicago Fed plays a vital role in shaping this national discussion. Furthermore, their perspective often influences market expectations.

Understanding the Debate on Interest Rate Cuts

Goolsbee’s recent remarks, reported by the Financial Times, offer clear insights. He supported a 25-basis-point rate cut at the last FOMC meeting. However, he remains hesitant to back further reductions. This measured approach stems from a specific concern. Cutting rates too quickly could imply inflation will resolve without further action. Such an assumption, he argues, carries risks. It might lead to a resurgence of price pressures. Therefore, the pace of future interest rate cuts becomes a critical point of contention. The Fed aims for a ‘soft landing’ for the U.S. economy outlook, balancing inflation control with economic growth. This strategy requires careful calibration.

Navigating the U.S. Economy Outlook

The current U.S. economy outlook presents a complex picture. Inflation has shown signs of easing. However, it remains above the Fed’s 2% target. Goolsbee points out that a moderate cooling in the job market is not necessarily a sign of imminent recession. This nuanced view challenges common interpretations. Many observers might equate any employment slowdown with a sharp downturn. The Chicago Fed President suggests a different perspective. He believes the economy can absorb a gradual deceleration. This avoids a severe contraction. Policymakers continuously analyze incoming economic data. Their goal is to ensure stability. This vigilance is paramount for sustained economic health.

The Employment Market: A Key Indicator

The employment market is a central focus for the Federal Reserve. It offers crucial insights into economic health. Goolsbee noted that the job market is cooling moderately. This observation suggests a healthy rebalancing, not a crisis. Wage growth, while still present, has moderated. This helps alleviate inflationary pressures. Furthermore, job openings have decreased from their peaks. Yet, unemployment rates remain historically low. These indicators collectively paint a picture. The labor market is normalizing. It avoids the rapid deterioration seen before recessions. Thus, a slowdown in employment does not automatically signal a sharp downturn for the U.S. economy outlook. It rather suggests a sustainable adjustment.

Broader Implications of Premature Rate Cuts

The implications of premature rate cuts extend beyond inflation. They can influence asset bubbles. They also affect financial stability. Lower rates typically encourage more borrowing. This can fuel speculative investments. For example, in the crypto space, lower interest rates often make riskier assets more attractive. This is because the opportunity cost of holding cash decreases. If the Fed cuts rates too soon, it risks re-igniting inflation. This could force them to reverse course later. Such policy reversals create market uncertainty. This uncertainty can deter investment. It can also harm consumer confidence. Therefore, Goolsbee’s caution aims to prevent future instability. It ensures a more predictable economic path.

President Goolsbee’s remarks provide a vital perspective. He advocates for patience and data-driven decisions. The Chicago Fed maintains a vigilant watch over economic indicators. Their priority is long-term stability. The current U.S. economy outlook requires careful navigation. The Federal Reserve seeks to achieve its dual mandate. This includes maximum employment and price stability. Consequently, the timing of future interest rate cuts will remain a key factor. This approach is critical for sustainable economic growth and a resilient employment market.

Frequently Asked Questions (FAQs)

Q1: What is President Goolsbee’s primary concern regarding interest rates?

A1: Chicago Fed President Austan Goolsbee is primarily concerned about cutting interest rates too quickly. He believes this could be based on the mistaken assumption that inflation will resolve on its own, risking a re-acceleration of price pressures.

Q2: Did Goolsbee support the last FOMC rate cut?

A2: Yes, according to the Financial Times, President Goolsbee supported the 25-basis-point rate cut at the most recent FOMC meeting. However, he is hesitant to endorse further reductions at this time.

Q3: How does Goolsbee view the current employment market?

A3: Goolsbee views the current employment market as cooling moderately. He emphasizes that this slowdown does not necessarily indicate a sharp downturn or an imminent recession for the U.S. economy.

Q4: Why is the timing of rate cuts so important for the U.S. economy?

A4: The timing of interest rate cuts is crucial because premature reductions can risk re-igniting inflation, fueling asset bubbles, and creating market uncertainty. Conversely, delaying cuts too long can stifle economic growth. The Fed aims for a balanced approach to ensure long-term stability.

Q5: What is the Chicago Fed’s role in monetary policy?

A5: The Chicago Fed, like other regional Federal Reserve banks, contributes to the Federal Reserve System’s monetary policy decisions. Its president participates in FOMC meetings, offering regional economic insights and voting on interest rate adjustments and other policy measures.