The world of cryptocurrency often intersects with complex regulatory battles. Recently, a significant accusation emerged from the U.S. political sphere, drawing attention to a prominent figure in digital assets. CFTC Quintenz, the nominee for chairman of the U.S. Commodity Futures Trading Commission, has made serious allegations. He claims that Gemini founders, the renowned Winklevoss brothers, actively sought to impede his confirmation process. This situation highlights ongoing tensions between regulators and the rapidly evolving crypto industry. It signals a potential flashpoint in the ongoing debate over digital asset oversight.

The Core of the CFTC Quintenz Controversy

Brian Quintenz, a nominee for a crucial regulatory role, found himself at the center of a political storm. He accused Tyler and Cameron Winklevoss, the influential Winklevoss brothers behind the Gemini crypto exchange, of attempting to obstruct his path to becoming CFTC chairman. This dispute, detailed in text messages Quintenz released, stems from a prior civil lawsuit involving Gemini and the CFTC. The core issue revolves around the extent of future crypto regulation. Furthermore, it touches upon the independence of regulatory appointments.

Unpacking the Allegations: Obstruction and Demands

Quintenz’s claims are specific and direct. According to the text messages he shared on X, the Winklevoss brothers voiced their dissatisfaction with the ongoing civil lawsuit. They reportedly sought assurances from Quintenz that the CFTC would not impose overly burdensome regulations on their company. Quintenz states he refused these demands. Consequently, he alleges, the brothers contacted then-President Donald Trump. Their goal, he claims, was to request a halt to his CFTC nomination. This alleged interference quickly escalated the issue. It brought the private interactions into public scrutiny.

Gemini Founders and the Pursuit of Crypto Regulation Clarity

The Gemini founders have consistently advocated for clear crypto regulation. They often express a desire for regulatory frameworks that foster innovation while protecting consumers. Gemini, under the leadership of the Winklevoss brothers, has tried to position itself as a compliant and regulated entity within the crypto space. They aim to build trust through adherence to established financial laws. However, this specific incident casts a different light on their approach. The alleged demands for regulatory assurances and subsequent political lobbying raise questions about the boundaries of industry engagement. It suggests a more aggressive stance than typically portrayed.

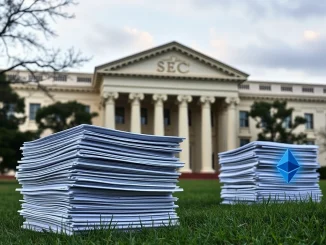

The Role of the CFTC in Digital Assets

The Commodity Futures Trading Commission (CFTC) plays a vital role in the U.S. financial system. It regulates commodity futures and options markets. Over time, its jurisdiction has expanded to include certain digital assets. Specifically, the CFTC considers Bitcoin and Ethereum as commodities. Therefore, the agency actively monitors and regulates derivatives tied to these cryptocurrencies. The chairman’s position is crucial in shaping the CFTC’s enforcement priorities and regulatory stance. A strong leader guides the agency’s direction. Consequently, the **CFTC nomination** process is highly scrutinized. Stakeholders from various industries, including crypto, closely watch these appointments.

Political Interference and Confirmation Delays Impacting CFTC Quintenz

The timeline of events supports Quintenz’s narrative. In July, the Senate Agriculture Committee had scheduled a confirmation vote for Quintenz. However, the White House unexpectedly requested its postponement. This delay occurred shortly after the alleged communication between the Winklevoss brothers and President Trump. Such political intervention in a regulatory appointment is highly unusual. It underscores the high stakes involved in shaping the future of crypto regulation in the United States. The incident created ripples through Washington D.C. and the digital asset community. It highlighted the power dynamics at play.

The Broader Context of Regulatory Lobbying

Lobbying is a common practice in Washington. Industries frequently engage with lawmakers and officials to advocate for their interests. The cryptocurrency sector is no exception. Companies and industry groups spend significant resources influencing policy. They aim to shape favorable regulatory environments. However, direct attempts to obstruct a presidential nomination, if proven, cross a different line. Such actions could be perceived as undue influence. They may even be seen as an abuse of power. This particular accusation against the Gemini founders could invite increased scrutiny on all crypto-related lobbying efforts. Transparency in these interactions becomes paramount.

Broader Implications for CFTC and Crypto Regulation

This incident carries significant implications for both the CFTC and the future of crypto regulation. First, it could affect the confirmation process for CFTC Quintenz. Even if ultimately confirmed, the allegations may cast a shadow over his tenure. Second, it highlights the intense pressure regulators face from the crypto industry. Many firms desire clear rules, yet they also seek to avoid burdensome oversight. This tension often creates friction. The incident may prompt regulators to adopt a more cautious approach. They might increase scrutiny on companies perceived as attempting to influence appointments inappropriately. Furthermore, it could embolden critics of the crypto industry. They might argue for stricter controls. Ultimately, this situation underscores the ongoing struggle to balance innovation with necessary consumer protection and market integrity.

Navigating Regulatory Scrutiny: Lessons for Crypto Firms

The allegations against the Winklevoss brothers offer valuable lessons for other crypto firms. Transparent and ethical engagement with regulators is essential. Companies should advocate for their positions through legitimate channels. They must avoid actions that could be interpreted as obstruction or undue influence. The regulatory landscape for digital assets is still evolving. Therefore, maintaining a reputation for integrity is crucial. Firms must build trust with policymakers. This trust facilitates constructive dialogue and helps shape effective regulation. Perceived attempts to bypass or manipulate the system can severely damage credibility. This can lead to more stringent oversight, not less. The incident serves as a stark reminder of these risks. It emphasizes the importance of careful strategy in regulatory affairs.

The accusation by CFTC Quintenz against the Gemini founders represents a notable moment in the ongoing saga of cryptocurrency and regulation. It underscores the high stakes involved in shaping the future of digital assets. While the allegations are serious, they also bring to light the complexities of regulatory appointments and industry lobbying. As the crypto market matures, such confrontations may become more common. However, they also emphasize the need for clear communication and ethical conduct from all parties. The outcome of this dispute could influence future interactions between regulators and the burgeoning crypto industry for years to come.

Frequently Asked Questions (FAQs)

1. Who is Brian Quintenz and what is his role?

Brian Quintenz is a nominee for chairman of the U.S. Commodity Futures Trading Commission (CFTC). He previously served as a Commissioner at the CFTC. His nomination is crucial for guiding the agency’s policy on various financial markets, including digital assets.

2. What is the U.S. Commodity Futures Trading Commission (CFTC)?

The CFTC is an independent agency of the U.S. government. It regulates the U.S. derivatives markets, including futures, options, and swaps. It also has jurisdiction over certain cryptocurrencies deemed commodities, like Bitcoin and Ethereum.

3. Who are the Winklevoss brothers and what is Gemini?

Tyler and Cameron Winklevoss, commonly known as the Winklevoss brothers, are entrepreneurs and investors. They are the co-founders of Gemini, a New York-based cryptocurrency exchange and custodian. Gemini is known for its focus on regulatory compliance.

4. What are the core allegations made by CFTC Quintenz against the Gemini founders?

Brian Quintenz alleges that the Winklevoss brothers attempted to obstruct his CFTC nomination. He claims they expressed dissatisfaction with a civil lawsuit between Gemini and the CFTC and demanded assurances regarding future crypto regulation. When he refused, he claims they contacted President Donald Trump to halt his confirmation.

5. How might this incident impact future crypto regulation?

This incident could increase scrutiny on how crypto firms engage with regulators and policymakers. It might lead to more cautious approaches from regulatory bodies. They may become wary of perceived undue influence. It underscores the need for clear and ethical lobbying practices within the industry.

6. What is the current status of Brian Quintenz’s CFTC nomination?

According to the provided information, the Senate Agriculture Committee had planned a confirmation vote for Quintenz. However, it was postponed at the request of the White House following the alleged interference. The ultimate status of his nomination would depend on subsequent political and Senate proceedings.