The cryptocurrency world is a constant race for innovation, speed, and scalability. For years, Solana has been celebrated for its lightning-fast transaction speeds, attracting a vibrant ecosystem of developers and users. But a formidable challenger is emerging from the academic rigor of the Cardano blockchain. Brace yourselves, because Cardano’s Leios upgrade, set for 2026, is not just an incremental improvement; it’s a bold declaration of intent to redefine the landscape of high-performance blockchains.

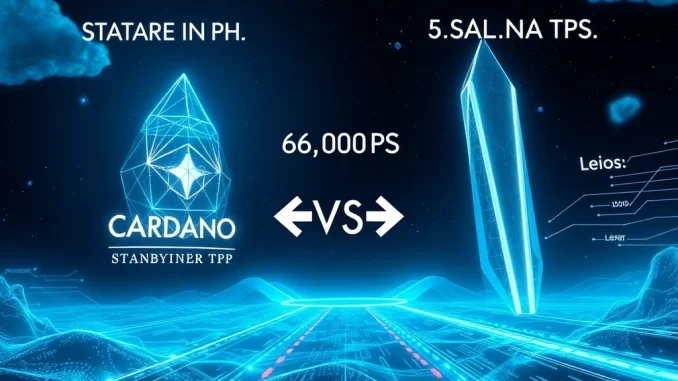

Can Cardano Leios Truly Outpace Solana TPS?

Cardano’s ambitious Leios upgrade, slated for 2026, is designed to propel the blockchain into an entirely new performance league. Currently, Cardano processes approximately 250 transactions per second (TPS), a figure that, while respectable, pales in comparison to Solana’s capabilities, which often boasts thousands of TPS under optimal conditions. The Leios update aims to bridge this significant performance gap, targeting a theoretical threshold of 65,000 transactions per second. This isn’t just a numbers game; it’s about fundamentally enhancing scalability, a critical factor for mass adoption and the expansion of decentralized finance (DeFi) and decentralized application (DApp) ecosystems on Cardano.

Input Output (IOHK), the engineering firm behind Cardano, emphasizes that Leios introduces a revolutionary new architecture. This design is specifically crafted to support widespread adoption without compromising the core tenets of blockchain technology: security and decentralization. The current limitations in Cardano’s throughput have, to some extent, hindered its broader appeal and the rapid growth of its DeFi sector. Leios seeks to remove these bottlenecks, creating a more responsive and efficient network.

Here’s a quick comparison of their current and projected performance:

| Blockchain | Current Average TPS | Leios Target TPS (Cardano) | Total Value Locked (TVL) |

|---|---|---|---|

| Cardano (ADA) | ~250 | Up to 65,000 (with Leios) | ~$360 million |

| Solana (SOL) | ~3,000 – 65,000 (theoretical peak) | N/A | ~$9.7 billion |

The Road Ahead: Challenges and Opportunities for Blockchain Speed

While the theoretical potential of Leios is immense, analysts caution that execution risks and broader market conditions will ultimately dictate its success. Cardano’s development model, characterized by its academic rigor and peer-reviewed approach, is often cited as both a strength and a potential weakness. This meticulous methodology ensures technical soundness but can also lead to delays in implementing key features, as seen in past upgrades.

Developers plan to roll out the Leios upgrade in carefully managed phases, allowing for extensive testing and optimization. Early benchmarks are promising, suggesting the protocol could indeed support thousands of TPS under optimal conditions. However, the real challenge lies in whether Leios alone will be enough to significantly differentiate Cardano in an increasingly competitive landscape where Solana has already established a strong foothold through its high throughput and proactive developer incentives.

The success of the Leios upgrade hinges significantly on its ability to attract substantial DApp and DeFi activity. Currently, Cardano’s Total Value Locked (TVL) stands at approximately $360 million, a stark contrast to Solana’s impressive $9.7 billion. This gap highlights the need for not just technological advancement, but also robust ecosystem growth and developer adoption.

What Does This Mean for ADA Price Prediction?

For investors, the Leios upgrade presents a compelling narrative for the future of ADA. Technical indicators have shown some bullish signals, with ADA’s 9-day and 21-day exponential moving averages (EMAs) recently crossing above the 200-day EMA. However, the cryptocurrency has also seen a recent retreat from its $0.83 resistance level, indicating ongoing market volatility.

Some forecasts suggest ADA could retest the psychological $1 level, with $1.18 as a potential upside target if the upgrade progresses positively and market sentiment remains strong. More ambitious predictions, such as a 50x price increase leading to a $1.5 trillion market cap, remain highly speculative. Analysts consistently note that such sustained growth is contingent upon real-world adoption, strategic partnerships, and the successful integration of Leios into a thriving ecosystem, rather than just technical prowess alone.

It’s crucial for investors to remember that technological advancements, while vital, do not guarantee a price surge. Regulatory developments, broader macroeconomic trends, and the overall growth of the Cardano ecosystem will play equally critical roles in determining ADA’s long-term trajectory. While the potential for significant gains exists, it’s tempered by execution risks and the highly competitive nature of the crypto market. Investors should exercise caution and conduct thorough due diligence, perhaps even exploring diversified portfolios that include short-term opportunities alongside long-term plays.

Expanding DeFi Ecosystems: Cardano’s Vision Beyond Speed

Input Output’s documentation emphasizes that Leios is not a standalone solution but an integral part of a broader strategy. This strategy aims to seamlessly integrate on-chain and off-chain innovations, creating a more robust and versatile network. Cardano’s vision extends beyond mere transaction speed; it’s about building a sustainable, secure, and decentralized platform capable of supporting a new generation of financial services and applications.

The academic, peer-reviewed development model, though sometimes slow, is intended to build a foundation of unparalleled security and reliability. This methodical approach is designed to minimize vulnerabilities and ensure the long-term stability of the network, which is particularly appealing for institutional adoption and large-scale enterprise solutions. If Leios can deliver on its promise of high throughput while maintaining this foundational integrity, it could significantly expand Cardano’s appeal to developers looking to build robust and secure DeFi ecosystems and enterprise-grade DApps.

The success of Leios will also depend on the community’s engagement and the ability of the Cardano Foundation and IOHK to foster a vibrant developer community. Attracting top talent and providing user-friendly tools will be paramount in translating theoretical TPS into real-world utility and adoption. This means not just fast transactions, but also low fees, reliable smart contracts, and a welcoming environment for innovation.

The Bottom Line: A New Era for Cardano?

The Cardano team consistently stresses that the Leios upgrade is a significant step, but not the final destination, in scaling the network’s infrastructure. If executed effectively, Leios has the potential to solidify Cardano’s position as a viable, top-tier competitor in the next phase of blockchain adoption. It could unlock new possibilities for decentralized applications, complex financial instruments, and global payment systems that require high throughput and unwavering security.

However, its long-term success will ultimately depend on more than just raw speed. It will hinge on the seamless execution of the upgrade, the ability to attract and retain a thriving developer community, the continued growth of its DeFi and DApp ecosystems, and effective navigation of the ever-evolving regulatory landscape. The race for blockchain dominance is far from over, and Cardano’s Leios upgrade marks a crucial turning point in its quest to challenge the high-speed giants.

Frequently Asked Questions (FAQs)

What is the Cardano Leios upgrade?

The Cardano Leios upgrade is a major planned update for the Cardano blockchain, scheduled for 2026. Its primary goal is to significantly enhance the network’s transaction processing capabilities, aiming for a theoretical throughput of up to 65,000 transactions per second (TPS) to improve scalability and support mass adoption.

How will Leios impact Cardano’s speed compared to Solana?

Currently, Cardano processes around 250 TPS, while Solana can handle thousands. Leios is designed to close this gap by introducing a new architecture that could theoretically match or even exceed Solana’s high-speed capabilities, making Cardano a more direct competitor in terms of raw transaction throughput.

What are the potential benefits of the Leios upgrade for Cardano’s ecosystem?

The Leios upgrade is expected to attract more developers and users by providing a highly scalable and efficient platform. This could lead to a significant expansion of Cardano’s decentralized finance (DeFi) and decentralized application (DApp) ecosystems, fostering innovation and increasing Total Value Locked (TVL) on the network.

What are the risks associated with the Leios upgrade?

Key risks include execution challenges due to the complexity of the upgrade, potential delays in rollout, and the highly competitive nature of the blockchain market. Even with increased speed, Cardano will need to effectively attract developers and users to truly differentiate itself and achieve widespread adoption.

How might Leios affect the ADA price prediction?

The successful implementation of Leios could be a bullish catalyst for ADA, potentially leading to price increases as network utility and adoption grow. However, price movements will also depend on broader market conditions, regulatory developments, and the overall growth of Cardano’s ecosystem beyond just technical upgrades.

When is the Cardano Leios upgrade expected to be completed?

The Leios upgrade is currently scheduled for 2026. It is expected to be rolled out in phases to allow for thorough testing and optimization, ensuring network stability and security throughout the process.