Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

Uniswap’s (UNI) price had a rather interesting 24 hours as the Ethereum-based altcoin escaped the bears.

The question now is whether, with the help of investors, it can continue its journey of recovering its March losses.

Uniswap – Good to Buy?

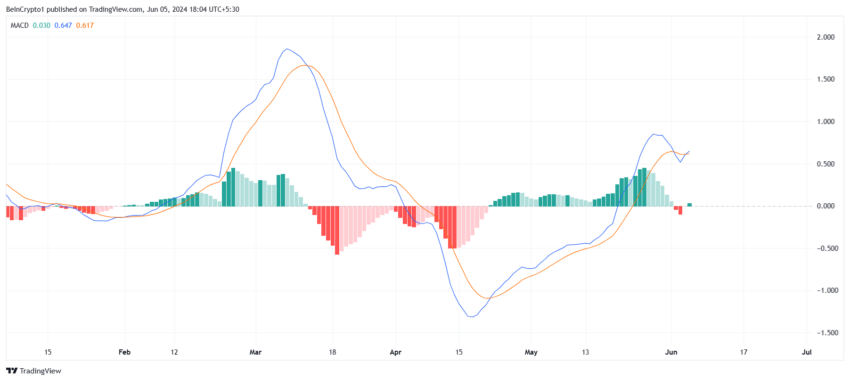

Uniswap’s price rise was bullish, as it put the altcoin back in the growth race and saved it from a downtrend. This is reflected in the Moving Average Convergence Divergence (MACD) indicator.

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It helps identify potential buy or sell signals based on crossovers, divergences, and the strength of the trend.

UNI observed a bearish crossover a day before the rise, its first in over a month and a half. However, as the rally restored the bullish crossover, the indicator quickly put this to rest.

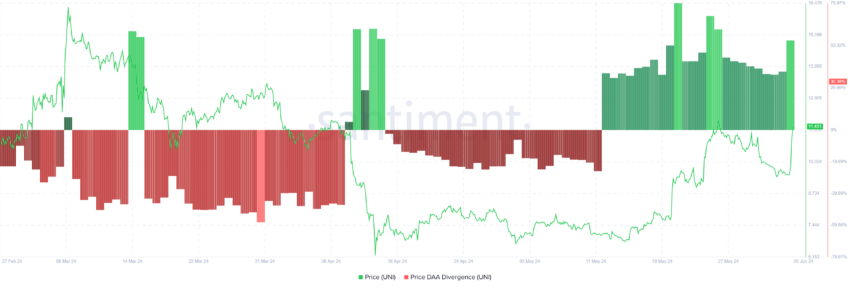

This rise also inflicted optimism among investors, with participation going up. As a result, the price daily active addresses (DAA) divergence began flashing a buy signal. Price DAA divergence refers to the discrepancy between a cryptocurrency’s price movement and the number of unique addresses actively transacting daily.

Read More: How To Buy Uniswap (UNI) and Everything You Need To Know

It is flashing a bullish sign for the altcoin, which could favor its rise.

UNI Price Prediction: Multi-Week Barrier Stands Strong

Uniswap’s price has been trading below the $11.6 resistance level for nearly two months. The altcoin was vulnerable to further decline, hovering below $10 yesterday before rallying by 20% in 24 hours. This rise brought it closer to the key resistance.

Breaching this barrier is important as it would enable UNI to reclaim $12 as support and head towards breaking past $13.1.

Read More: Uniswap (UNI) Price Prediction 2023/2025/2030

However, failure to do so may cost the altcoin this 20% rise, as Uniswap’s price could fall back to $10 or lower. Testing the critical support at $9.0 will invalidate the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link