Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

Thanks to the support of retail investors, ONDO’s price has managed to stay out of the list of the biggest losers.

However, whales dont seem to care much about this as they continue to offload their holdings to create a selling pressure potentially.

ONDO Investors to the Rescue

ONDO price action is an interesting case as, generally, when investors panic, the whales save the crypto asset from sharp declines. However, in the case of these altcoins, retail investors are saving the day.

Over the last couple of days, whale addresses holding between 10 million and 100 million ONDO have dumped more than 132 million ONDO worth more than $141 million. This move was potentially in order to secure their gains and offset their losses.

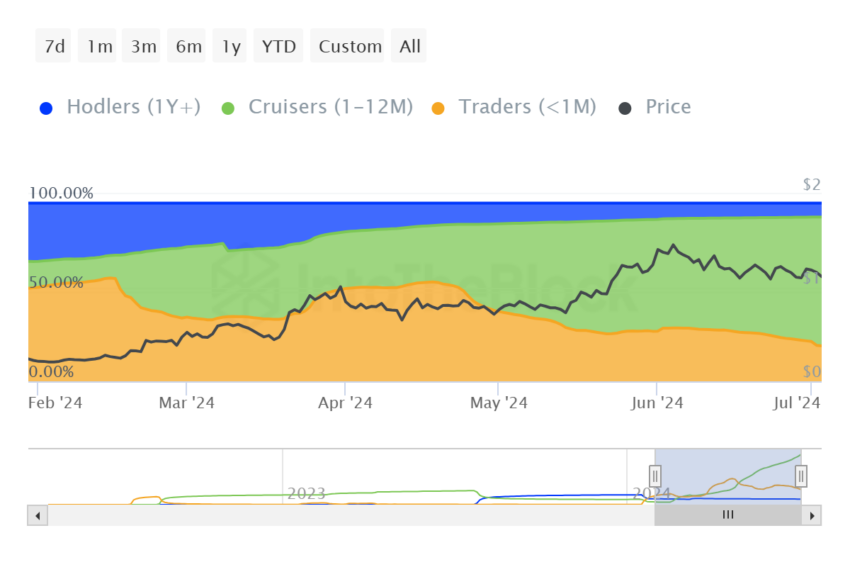

However, this did not sit well with other investors who have been attempting to prevent a severe price drawdown. Retail investors have been focusing on HODLing over selling for any reason. This is evident in the rise in mid-term holders (holding the supply for more than a month).

This cohort of investors has risen from 34% to 72% in terms of domination over the circulating supply. At the same time, short-term holders that are prone to selling have lost their dominance, slipping from 53% to 22%.

Read More: How To Invest in Real-World Crypto Assets (RWA)

This is how ONDO price has managed to prevent losing critical support and instead consolidate.

ONDO Price Prediction: Preventing a Fall

ONDO’s price has been consolidated for the last two weeks, and during this duration, support at $1.07 has been tested multiple times. While the altcoin has not broken below it yet, a push from the whales could do that.

However, retail investors’ support could prevent it, enabling the price to bounce back from this support. The likely outcome is continued consolidation for ONDO.

Read More: Real-World Asset (RWA) Backed Tokens Explained

Nevertheless, a dip below the support line at $1.07 could result in a massive drawdown. This would invalidate the bullish thesis, sending the crypto asset below $1.00.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link