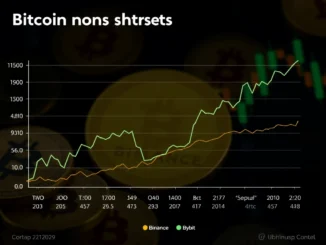

The cryptocurrency world is buzzing today as the Bitcoin price has experienced a significant downward move, breaking a notable psychological and technical level. According to real-time market monitoring from Coin Pulse, the leading digital asset, BTC, has fallen below the $103,000 mark, catching many market participants off guard.

This sudden shift highlights the inherent volatility within the crypto market, reminding investors that even established assets like Bitcoin are subject to rapid price changes. At the time of reporting, the BTC price on the high-volume Binance USDT market was trading at $102,929.43, confirming the breach of the $103,000 threshold.

What Triggered This Bitcoin Drop?

Understanding the exact catalyst for a sudden Bitcoin drop is often complex, as it can be influenced by a confluence of factors. While no single event has been definitively pinpointed as the sole cause for this move below $103,000, market analysts are considering several possibilities:

- Macroeconomic Factors: Global economic indicators, inflation data, or shifts in central bank policies can impact investor risk appetite, leading to outflows from riskier assets like cryptocurrencies.

- Market Sentiment: A general shift towards fear or uncertainty (often measured by indicators like the Crypto Fear & Greed Index) can trigger selling pressure.

- Technical Factors: Failing to hold key support levels or triggering stop-loss orders once a certain price point is breached can accelerate a downward move.

- Large Sell Orders: Significant sell-offs by large holders (whales) can impact liquidity and drive prices down rapidly, especially in thinner order books.

- Regulatory News: Uncertainty or negative news regarding cryptocurrency regulation in major economies can dampen enthusiasm and lead to selling.

It’s crucial to remember that the market is interconnected, and a combination of these elements likely contributed to the recent Bitcoin price action.

What Does This Mean for Your Portfolio?

A significant price drop like this naturally raises questions and concerns for investors and traders. The implications vary depending on your investment horizon and strategy.

Challenges:

- Unrealized Losses: Holders who bought at higher prices may see their portfolio value decrease, resulting in unrealized losses.

- Increased Uncertainty: Price volatility can create anxiety and make decision-making more difficult.

- Potential for Further Downside: Breaking a support level like $103,000 could potentially lead to testing lower price points.

Potential Opportunities:

- Buying the Dip: Long-term investors might see this as an opportunity to acquire BTC at a lower price point.

- Dollar-Cost Averaging (DCA): This event reinforces the strategy of consistently investing a fixed amount over time, mitigating the risk of buying only at market peaks.

- Identifying Support Levels: Traders can analyze charts to identify potential next support zones where the price might stabilize.

Staying informed with reliable BTC news is essential during such volatile periods.

Actionable Insights During a Bitcoin Drop

Navigating market downturns requires a calm and strategic approach. Here are a few actionable insights to consider:

- Review Your Strategy: Revisit your initial investment thesis for Bitcoin. Are the long-term fundamentals still intact? Does this price drop change your long-term outlook?

- Manage Risk: Ensure you are not overexposed to Bitcoin or the crypto market as a whole. Consider setting stop-loss orders if you are actively trading to limit potential downside.

- Do Your Own Research (DYOR): Avoid making impulsive decisions based on fear or hype. Take the time to research the potential reasons for the drop and evaluate the market conditions objectively.

- Consider Your Time Horizon: Short-term price fluctuations are part of the crypto market. If you are a long-term investor, focusing on the bigger picture might be more beneficial than reacting to daily moves.

- Stay Informed: Follow reputable sources for BTC news and analysis to understand the market landscape.

This sudden move is a reminder that the Bitcoin price is influenced by a complex interplay of factors, and volatility is a constant feature of the asset class.

Looking Ahead: What’s Next for the Bitcoin Price?

Following a significant drop, market participants will be closely watching key levels for signs of stabilization or further movement. Identifying potential support zones below $103,000 will be critical. Increased trading volume on the downside could indicate conviction behind the sell-off, while a quick bounce back on high volume could signal strong buying interest stepping in.

The overall sentiment in the broader crypto market will also play a significant role. Recovery or continued weakness in other major cryptocurrencies often correlates with Bitcoin’s trajectory.

Compelling Summary

In summary, the Bitcoin price has experienced an alarming drop, falling below the $103,000 level according to Coin Pulse data from the Binance USDT market. This Bitcoin drop highlights the inherent volatility of the crypto market and serves as a reminder of the risks involved. While challenging for existing holders, it may present opportunities for those looking to enter or increase their position. As the market digests this move, staying informed with reliable BTC news, managing risk, and adhering to a well-thought-out strategy remain paramount for navigating the unpredictable landscape of the Bitcoin price.

Keep a close eye on market developments as the situation unfolds.