Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

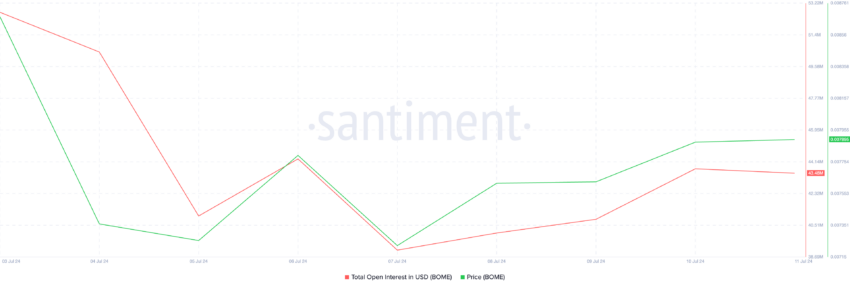

The open interest of the popular Solana-based meme coin Book of Meme (BOME) cratered to a four-month low of $39 million on July 7.

Witnessing a slight uptick since then, BOME’s open interest has risen by 10% in the past three days.

Book of Meme Sees Renewed Interest

An asset’s open interest measures the total number of its outstanding options or futures contracts that have not been settled. When it spikes, it means that more traders are entering into new positions.

The surge in BOME’s open interest after plunging to a year-to-date low is due to the growth in the meme coin’s price that has since followed. Exchanging hands at $0.0078 as of this writing, BOME’s price has risen by 8% since July 7. With rising prices, the uptick in the token’s open interest signals an uptick in its derivatives market activity.

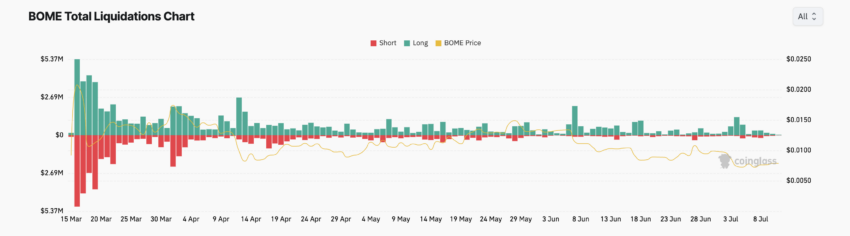

When an asset’s open interest increases along with its price, it often confirms the strength and continuation of the uptrend. Interestingly, despite the growth in BOME’s price in the past three days, it has recorded more long liquidations than short ones.

Read More: BOOK OF MEME (BOME) Price Prediction 2024/2025/2030

Liquidations occur in an asset’s derivatives market when the asset’s value moves against the position held by a trader. When this happens, the trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations occur when traders who have taken long positions are forced to sell their holdings at a lower price to cover their losses as the price falls. It occurs when the value of an asset suddenly drops, and traders who have open positions in favor of a price rally are forced to exit their positions.

Therefore, BOME’s price rise, accompanied by a surge in long liquidations, might seem counterintuitive. However, it may be due to margin calls.

When trading with leverage, traders must maintain a minimum account balance compared to the loan amount. If the price dips momentarily, even during a general rise, it could trigger a margin call, forcing them to sell some of their holdings to meet the minimum balance requirement.

BOME Price Prediction: Will the Uptrend Continue?

An assessment of BOME’s Moving Average Convergence Divergence (MACD) on a one-day chart reveals a potential bullish crossover.

The indicator measures an asset’s price trends and momentums and identifies potential buying and selling opportunities.

A bullish crossover exists when the MACD line crosses above the signal line. This intersection indicates that the shorter moving average is gaining on the longer one, signifying a shift in momentum toward the upside.

In BOME’s case, this is about to happen. If the crossover is successful, it may push the meme coin’s price to $0.0081.

However, if this is a false signal, the token’s price might fall to $0.0077.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link