The world of cryptocurrency is no stranger to rapid shifts and unexpected surges, but few recent developments have captured the attention of traders and investors quite like the meteoric rise of Bonkfun within the Solana memecoin ecosystem. If you’ve been following the decentralized finance (DeFi) space, especially on Solana, you’ve likely heard the whispers – now, those whispers have turned into a roaring testament to a significant market realignment. What was once a landscape dominated by one key player, Pumpfun, has seen a dramatic overhaul, with Bonkfun emerging as the undisputed leader. This isn’t just about trading volume; it’s about a fundamental shift in liquidity, strategy, and community engagement that’s reshaping the entire memecoin market on Solana.

The Unstoppable Ascent of Bonkfun: A New Era for Crypto Launchpads

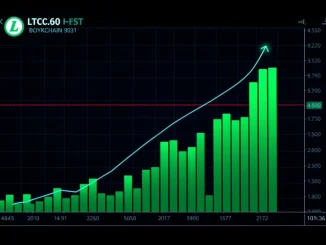

In a stunning turn of events, Bonkfun has not just competed with but thoroughly surpassed Pumpfun, its primary rival in the Solana-based token launchpad arena. Recent data reveals Bonkfun’s staggering 24-hour trading volume of $127.5 million, a figure that absolutely dwarfs Pumpfun’s reported $6 million during the same period. This isn’t merely a temporary spike; it signals a profound and perhaps permanent realignment in the Solana memecoin market.

So, what’s fueling this unprecedented surge? Bonkfun’s success can be attributed to several key factors:

- Deflationary Tokenomics: A cornerstone of Bonkfun’s strategy is its unique deflationary model. The platform strategically utilizes a portion of its launchpad revenues to burn a massive amount of BONK tokens – an impressive 500 billion tokens in a recent instance. This ‘buy and burn’ mechanism is designed to reduce the circulating supply of BONK, thereby increasing its scarcity and bolstering its value for holders. It’s a direct incentive for participation and holding.

- Rapid Innovation & Responsiveness: The semi-anonymous team behind Bonkfun has demonstrated remarkable agility, pushing out rapid updates and improvements to the platform. This responsiveness to market demands and user feedback has cultivated a strong sense of trust and reliability within its community.

- Record-Breaking Fee Generation: Bonkfun isn’t just moving volume; it’s generating substantial revenue. The platform recently hit a record with $1.95 million in 24-hour fees. This robust fee generation not only funds operations but also powers the token burn initiatives, creating a virtuous cycle for the ecosystem.

This momentum has not gone unnoticed. Industry observers, including Solana-based platforms like Raydium, have highlighted Bonkfun’s ascent to the top of the meme coin rankings. Over the past three weeks, Bonkfun has consistently maintained a dominant market share, ranging from 60% to 80%, with daily trading volumes frequently exceeding $100 million. This sustained performance points to a structural shift rather than a fleeting trend.

What Happened to Pumpfun? Navigating Challenges in the Memecoin Market

While Bonkfun celebrates its triumph, the narrative for Pumpfun tells a different story. Once the go-to crypto launchpad for new Solana memecoins, Pumpfun has seen its market share dwindle significantly. The platform’s struggles are evident in its declining daily token launches, which have fallen below 10,000. This downturn highlights the inherent challenges in sustaining market momentum in the highly competitive and volatile memecoin market.

Pumpfun’s decline raises questions about its future strategy. Analysts speculate that the platform may need to introduce new trading incentives or innovative features to regain its footing. However, concrete strategies or announcements from Pumpfun remain elusive. The lack of proactive measures could further entrench Bonkfun’s lead, making it increasingly difficult for Pumpfun to reclaim its former glory.

The competitive landscape among crypto launchpads is fierce. Platforms must constantly innovate, offer compelling features, and adapt to evolving user preferences. Pumpfun’s current predicament serves as a stark reminder that even established players can quickly lose ground if they fail to keep pace with the rapid innovation cycles characteristic of the crypto space.

The Great Liquidity Migration: Impact on Solana Memecoin Dynamics

One of the most significant consequences of Bonkfun’s rise is the pronounced liquidity migration observed across the Solana memecoin ecosystem. A staggering 55% of all new token launches are now occurring on Bonkfun, indicating a clear preference among developers and early investors for the newer platform. This shift isn’t just about where new tokens are launched; it’s about where the capital, attention, and trading activity are flowing.

This liquidity shift has several implications:

- Increased Dominance: As more projects choose Bonkfun, its network effect strengthens, attracting even more users and further solidifying its market leadership.

- Developer Preference: Developers are gravitating towards platforms that offer better visibility, higher liquidity, and potentially more robust tools or community support. Bonkfun’s rapid updates and fee generation seem to be a major draw.

- Trader Behavior: Traders follow liquidity. As new, exciting projects launch on Bonkfun and gain traction, traders are naturally migrating to that platform to find the next big opportunity.

The concentration of liquidity on Bonkfun suggests a growing centralization of the Solana memecoin launch process. While this can offer efficiency and deeper pools for trading, it also highlights the need for a healthy, competitive environment to prevent a single point of failure or excessive control.

BONK Token and Long-Term Value: A Focus on Sustainability

Beyond the immediate excitement of high trading volumes, Bonkfun‘s integration of buy/burn mechanics for its native BONK token suggests a strategic focus on long-term value retention for BONK holders. Unlike many ephemeral memecoins, Bonkfun’s operational model directly contributes to the scarcity and potential appreciation of BONK. The platform’s success in generating substantial fees directly translates into more BONK tokens being removed from circulation, creating a deflationary pressure that could benefit holders over time.

This approach stands in contrast to many projects that rely solely on hype or speculative trading. By tying the success of the crypto launchpad directly to the value of its underlying token through sustainable mechanisms, Bonkfun aims to build a more robust and resilient ecosystem. This focus on utility and value accrual is a critical differentiator in the often-fickle memecoin market.

Investor Outlook and the Future of Solana’s Memecoin Ecosystem

The current landscape presents a fascinating case study for investors. The question on everyone’s mind is whether Pumpfun can mount a comeback or if Bonkfun will cement its leadership as the dominant crypto launchpad on Solana. While Pumpfun’s rumored incentives might offer a glimmer of hope, the path to regaining lost ground will be challenging.

Investors are closely monitoring several key indicators:

- Pumpfun’s Innovation: Will Pumpfun introduce compelling new features, better fee structures, or more attractive incentives for developers and traders?

- Bonkfun’s Sustained Growth: Can Bonkfun maintain its impressive volume and market share, or will it face new challengers or market saturation?

- Broader Solana Ecosystem Health: The overall health and growth of the Solana blockchain will continue to influence the success of its memecoin market.

Historical patterns in the crypto world suggest cyclical shifts in platform dominance, but Bonkfun’s consistent volume growth and strategic tokenomics point towards a potentially long-term structural change. The financial implications are clear: Bonkfun’s ability to attract liquidity and generate fees positions it as a key driver of innovation and capital flow within the Solana memecoin space. However, the competitive landscape remains fluid, and future developments will undoubtedly continue to shape trader behavior and platform adoption.

Conclusion: A New Chapter in the Memecoin Saga

The story of Bonkfun‘s dramatic rise over Pumpfun is more than just a tale of shifting market share; it’s a testament to the dynamic, often unpredictable nature of the cryptocurrency world. Bonkfun’s strategic use of deflationary tokenomics, rapid development, and effective fee generation has allowed it to capture a significant portion of the Solana memecoin market, reshaping the landscape for new token launches. While Pumpfun faces an uphill battle to regain its footing, the competitive pressure could spur innovation across the entire crypto launchpad sector.

This shift underscores the importance of adaptability and innovation in a rapidly evolving market. For traders and developers alike, understanding these underlying dynamics is crucial for navigating the opportunities and risks inherent in the vibrant Solana ecosystem. The memecoin saga continues, and Bonkfun has certainly written an exciting new chapter.

Frequently Asked Questions (FAQs)

1. What is Bonkfun and how has it surpassed Pumpfun?

Bonkfun is a Solana-based token launchpad that has surpassed Pumpfun in the memecoin market by achieving a significantly higher 24-hour trading volume ($127.5 million vs. $6 million). Its success is attributed to deflationary tokenomics (burning BONK tokens with revenues), rapid platform updates, and record-breaking fee generation, attracting a 55% share of new token launches.

2. What are the key differences in tokenomics between Bonkfun and Pumpfun?

Bonkfun distinguishes itself with a deflationary tokenomic model that actively uses a portion of its launchpad revenues to burn its native BONK tokens. This mechanism aims to reduce supply and increase value. While Pumpfun’s specific tokenomics are not detailed in the provided text, its struggles suggest it may lack a similar robust value accrual mechanism that directly benefits its token holders or the platform’s sustainability in the same way.

3. What does the ‘liquidity migration’ mean for Solana memecoin traders?

The ‘liquidity migration’ means that a significant majority (55%) of new token launches and associated trading activity are now concentrated on Bonkfun. For Solana memecoin traders, this implies that the most active and potentially profitable new projects are more likely to be found and traded on Bonkfun, making it the primary platform to monitor for emerging opportunities.

4. What challenges does Pumpfun face in regaining its market share?

Pumpfun faces significant challenges, including a dwindling market share, a decline in daily token launches, and intense competition from Bonkfun. To regain ground, it would likely need to introduce compelling new trading incentives, innovative features, or a revised strategy to attract developers and traders back to its platform, though no concrete plans have been announced.

5. How does Bonkfun’s success impact the broader Solana ecosystem?

Bonkfun’s success reinforces Solana’s position as a leading blockchain for memecoin activity, showcasing its capability to handle high transaction volumes and foster rapid innovation. It demonstrates the dynamism within the Solana ecosystem and highlights the platform’s role as a primary battleground for memecoin development and trading, with minimal ripple effects observed in Ethereum or Bitcoin markets.