Is Bitcoin gearing up for its next big leap? Recent on-chain data and market movements are hinting at a strong bullish resurgence. Let’s dive into the key indicators – Bitcoin whale activity and booming ETF inflows – that are fueling optimism in the crypto sphere.

Unveiling Bitcoin Whale Activity: A Massive Outflow Signals Accumulation

On March 25th, the cryptocurrency market witnessed a significant event: the largest Bitcoin exchange outflow in seven months. A staggering 27,740 BTC, valued at approximately $2.4 billion, was withdrawn from exchanges. This massive exodus wasn’t just random shuffling; it was largely orchestrated by the big players – the Bitcoin whales.

According to insights from Cointelegraph, these substantial withdrawals are a strong indicator of accumulation. Why would whales move such vast amounts of Bitcoin off exchanges? Typically, it’s for long-term holding in cold storage, signaling a belief in future price appreciation rather than immediate selling pressure. One standout example is a major investor who added a whopping 2,400 BTC to their holdings, pushing their total stash beyond 15,000 BTC. This kind of Bitcoin whale activity speaks volumes about renewed confidence and accumulation trends among deep-pocketed investors.

ETF Inflows: The Institutional Stamp of Approval

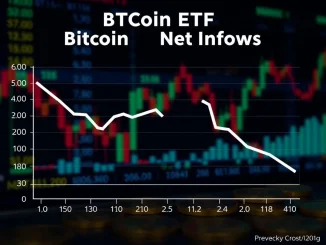

Adding fuel to the bullish fire are the consistent and substantial ETF inflows into spot Bitcoin ETFs. For eight consecutive days, these ETFs have seen positive net inflows, amassing nearly $897 million. This continuous influx of capital is a powerful signal of growing institutional investment in Bitcoin.

Why are ETF inflows so crucial?

- Accessibility for Institutions: ETFs provide a regulated and familiar investment vehicle for institutions and traditional investors to gain exposure to Bitcoin without directly holding the cryptocurrency.

- Increased Demand: Sustained inflows indicate a strong and growing demand for Bitcoin from institutional players, which can significantly impact price dynamics.

- Legitimacy and Confidence: The success of spot Bitcoin ETFs further legitimizes Bitcoin as an asset class and boosts overall market confidence.

The combined force of ETF inflows and Bitcoin whale activity paints a picture of robust demand and accumulation, suggesting a solid foundation for potential upward price movement.

Bitcoin Price Technical Levels: Road to Recovery or Resistance Ahead?

While on-chain metrics and institutional interest are encouraging, technical analysis remains crucial for gauging the immediate path forward for Bitcoin price. For the bullish momentum to truly solidify and for a potential bull run to resume, Bitcoin needs to conquer key technical levels.

Here are the critical price points to watch:

- 20-Week EMA ($88,682): Holding above the 20-week Exponential Moving Average (EMA) is a vital sign of medium-term bullishness. It indicates that the current price is sustaining above the average price over the past 20 weeks, suggesting a healthy uptrend.

- Yearly Open Around $93,300: Reclaiming the yearly open price is psychologically significant. It signifies overcoming the starting point of the year and establishing a positive trajectory for the year ahead.

If Bitcoin can successfully hold above the 20-week EMA and reclaim the yearly open, it would reinforce the bullish narrative supported by whale accumulation and ETF inflows. However, failure to breach these levels could indicate potential resistance and a need for further consolidation before the next upward move.

Navigating the Bullish Wave: Key Takeaways

The confluence of Bitcoin whale activity and strong ETF inflows presents a compelling case for bullish momentum in the Bitcoin market. These indicators suggest:

- Strong Accumulation: Whales are accumulating Bitcoin, indicating long-term confidence.

- Institutional Adoption: Consistent ETF inflows highlight growing institutional interest and demand.

- Positive Market Sentiment: These factors collectively contribute to a positive shift in market sentiment.

However, it’s crucial to remember that the cryptocurrency market is inherently volatile. While these bullish signals are encouraging, monitoring technical levels and broader market conditions remains essential. Will Bitcoin successfully breach the key resistance levels and embark on a new bull run? The coming weeks will be critical in determining the trajectory. Stay informed, stay vigilant, and navigate the crypto waves wisely!