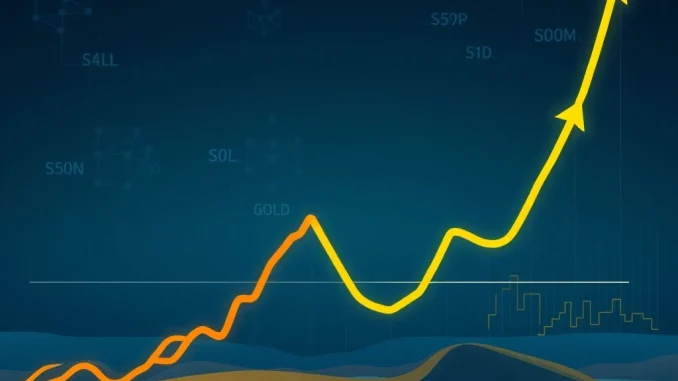

In the often-turbulent world of finance, periods of extreme calm are rare—and often precede significant shifts. Today, we’re witnessing an extraordinary phenomenon: **Bitcoin volatility**, alongside that of traditional assets like the S&P 500 and gold, has plummeted to levels not seen since the tumultuous period of 2020-2022. This synchronized tranquility isn’t a sign of stagnation; rather, it’s a powerful signal that a major **market inflection point** could be on the horizon. For savvy investors, understanding these converging trends is paramount to navigating what comes next.

Understanding the Bitcoin Volatility Paradox: Calm Before the Storm?

For an asset known for its wild price swings, Bitcoin’s current subdued **volatility** is a head-scratcher for many. Historically, such periods of low fluctuation in crypto markets have been the calm before a storm, often preceding dramatic price movements, whether upwards or downwards. This time, however, the silence is amplified by similar trends across traditional financial landscapes.

COINOTAG research highlights that Bitcoin’s current volatility metrics are near historic lows, mirroring conditions last observed years ago. This compression of price action suggests that market energy is building, ready to be released in a decisive direction. But what’s fueling this unprecedented calm, and why should investors pay close attention?

Is a Global Market Inflection Point Upon Us?

The convergence of low **Bitcoin volatility**, subdued S&P 500 movements, and quiet gold markets points to a potential global **market inflection point**. This isn’t just about one asset; it’s about a synchronized compression across diverse asset classes, hinting at a systemic shift. When markets become this ‘coiled,’ the subsequent move can be swift and substantial, affecting portfolios across the board.

Analysts are warning that if crucial support levels across these assets fail, we could see a rapid surge in cross-asset volatility. This creates a critical juncture for investors, demanding vigilance and strategic positioning. The implications extend beyond just Bitcoin, impacting traditional portfolios as well.

Synchronized Calm: The S&P 500 and Gold’s Role

It’s not just crypto making headlines with its low volatility. The **S&P 500**, the benchmark for U.S. equities, and gold, the traditional safe haven, are also experiencing historically low levels of price fluctuation. This synchronized behavior is particularly noteworthy. Typically, when one asset class is calm, another might be volatile, offering diversification benefits. However, when all three are moving in lockstep towards lower volatility, it suggests a broader market dynamic at play.

This collective calm in the **S&P 500** and gold markets, combined with Bitcoin’s similar trend, suggests that macro forces are at work, compressing risk across the board. Such periods have historically been precursors to significant breakouts or corrections, making it essential for investors to monitor these traditional indicators alongside crypto metrics.

Deciphering Gold Volatility and Its Correlation

The subdued **gold volatility** adds another layer to this complex market puzzle. Gold, often seen as a hedge against inflation and market uncertainty, typically sees increased volatility during periods of economic stress or geopolitical tension. Its current calm, alongside Bitcoin and equities, suggests either a collective anticipation of stability or a deep-seated uncertainty that has led to a ‘wait and see’ approach from large market participants.

The BTC/gasoline ratio, which measures Bitcoin’s performance against energy markets, has also reached levels last observed in 2017. COINOTAG analysts highlight that such ratios historically align with major Bitcoin price inflections. This intriguing correlation suggests that energy market dynamics might also be playing a subtle role in the broader cross-asset volatility compression, influencing not just Bitcoin but potentially the underlying drivers of **gold volatility** too.

Unlocking the Power of On-Chain Signals

For Bitcoin specifically, **on-chain signals** are providing crucial insights into the impending shift. A critical on-chain “air gap”—a price zone with minimal historical trading activity—has emerged as Bitcoin rapidly moved from $110K to $117K. This area now acts as a pivotal support level. If Bitcoin’s price falls below this gap, experts caution it could trigger accelerated volatility and a possible trend reversal. COINOTAG analysts emphasize that this zone is a key focal point for near-term market stability.

These **on-chain signals** offer a unique, transparent view into market participant behavior, unlike traditional market indicators. They can reveal where strong support or resistance lies, and where large movements of capital are occurring, providing an edge in predicting the next phase of Bitcoin’s price action and its potential ripple effects across the broader market.

What Does This Mean for Investors? Actionable Insights

Periods of low volatility rarely persist long-term. For investors, this synchronized calm across Bitcoin, the S&P 500, and gold presents both a challenge and an opportunity. Here are key strategies:

- Monitor Key Technical Levels: Pay close attention to the identified ‘air gap’ for Bitcoin and critical support/resistance levels for the S&P 500 and gold. A break below or above these levels could signal the direction of the next major move.

- Diversify Wisely: While volatility is low across the board, maintaining a diversified portfolio remains crucial. Consider assets that might react differently to a sudden market shift.

- Track Real-Time Signals: Stay updated on on-chain metrics, funding rates, and other real-time indicators that can provide early warnings of a shift in sentiment or momentum.

- Prepare for Volatility: Acknowledge that a period of low volatility often precedes a significant increase. Have a plan for how you’ll react to sharp price movements, whether they are breakouts or corrections.

COINOTAG’s analysis underscores the importance of Bitcoin’s on-chain metrics and cross-asset correlations in predicting the next phase of market activity. The convergence of Bitcoin’s price action, the BTC/gasoline ratio, and synchronized volatility across asset classes creates a high-probability scenario for a market shift. Analysts urge close observation of support levels and on-chain indicators to anticipate potential breakouts or reversals.

Conclusion: Navigating the Imminent Shift

The current landscape of historically low volatility across Bitcoin, the S&P 500, and gold is a powerful indicator that the global financial markets are at a pivotal juncture. This unprecedented calm is unlikely to last, setting the stage for potentially dramatic price movements. By understanding the underlying dynamics, paying attention to critical on-chain signals, and preparing for increased volatility, investors can position themselves to navigate this impending shift successfully. The time for vigilance is now.

Frequently Asked Questions (FAQs)

Q1: What does it mean when Bitcoin volatility hits multi-year lows?

When Bitcoin volatility reaches multi-year lows, it indicates a period of unusual price stability and reduced price swings. Historically, such calm periods often precede significant price movements, as market energy builds up before being released in a decisive direction, either upwards or downwards.

Q2: Why is the synchronization of low volatility across Bitcoin, S&P 500, and gold significant?

The synchronized low volatility across these diverse asset classes (Bitcoin, S&P 500, and gold) is highly significant because it suggests a broader, systemic market dynamic. It indicates that a global market inflection point might be approaching, where major shifts could occur across multiple asset types simultaneously, rather than in isolation.

Q3: What is the BTC/gasoline ratio and why is it important?

The BTC/gasoline ratio measures Bitcoin’s performance relative to energy markets. Its importance lies in its historical correlation with major Bitcoin price inflections. When this ratio reaches certain levels, as it did in 2017 and is doing now, it suggests a potential turning point for Bitcoin’s price dynamics, often preceding significant moves.

Q4: What is an on-chain “air gap” and how does it affect Bitcoin’s price?

An on-chain “air gap” refers to a price zone where there has been minimal historical trading activity for Bitcoin. When Bitcoin rapidly moves through such a zone, it creates a lack of established support or resistance. This area then becomes a critical pivotal level; if the price falls below it, it can trigger accelerated volatility and a potential trend reversal due to the absence of historical buy or sell orders to cushion the move.

Q5: How should investors prepare for a potential market inflection point?

Investors should prepare by monitoring key technical levels (especially Bitcoin’s on-chain ‘air gap’), maintaining a diversified portfolio, tracking real-time market signals (like on-chain data), and having a pre-defined strategy for reacting to increased volatility. Vigilance and adaptability are key during such periods of market compression.