Is the Bitcoin bull run taking an unexpected breather, or are we witnessing the start of a deeper downturn? Recent market activity suggests a growing sense of unease among traders as Bitcoin’s price has tumbled, and spot Exchange Traded Fund (ETF) outflows have surged. Let’s dive into what’s fueling this bearish sentiment and how savvy traders are navigating these turbulent waters.

What’s Triggering the Bitcoin Price Decline?

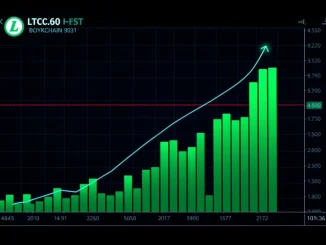

Bitcoin has experienced a significant 20% drop since a notable political event, sparking concerns across the crypto sphere. This price decline isn’t happening in a vacuum; several factors are converging to create a perfect storm of selling pressure:

- Surging Bitcoin ETF Outflows: The most immediate pressure comes from the dramatic increase in outflows from spot Bitcoin ETFs. A staggering $2.1 billion has been withdrawn in just six trading days. This exodus indicates that institutional and retail investors are pulling back, reducing demand and pushing prices down.

- Heightened Hedging Activity: Experienced traders are not sitting idle. Bloomberg reports a significant uptick in hedging activity, particularly through put options. These put options, specifically at the $70,000 strike price and expiring on February 28th, signal that a considerable number of traders are anticipating—and preparing for—further price drops.

- Bybit Exchange Hack: Security breaches in the crypto world always rattle investor confidence. The recent hack of Bybit Exchange adds to the negative sentiment, reminding the market of the inherent risks associated with digital assets and centralized platforms.

- Macroeconomic Headwinds: Broader economic concerns are also playing a role. Worries about potential tariffs and persistent inflation are dampening overall market sentiment. These macroeconomic factors create uncertainty and can lead investors to reduce exposure to riskier assets like cryptocurrencies.

Urgent Hedging Strategies: Put Options in Focus

In times of market uncertainty, risk management becomes paramount. The increased activity in Bitcoin put options is a clear indicator that traders are proactively seeking to protect their portfolios. Let’s break down why put options are a popular hedging tool in this scenario:

- What are Put Options? A put option gives the buyer the right, but not the obligation, to sell an asset (in this case, Bitcoin) at a specified price (the strike price) on or before a certain date (the expiration date).

- Hedging with Put Options: By buying put options, traders essentially insure their Bitcoin holdings against potential price declines. If the price of Bitcoin falls below the strike price, the put option becomes more valuable, offsetting losses in their spot holdings.

- $70,000 Strike Price Significance: The focus on $70,000 put options expiring on February 28th suggests that a segment of the market believes Bitcoin could potentially test or even fall below this level in the near term. This doesn’t guarantee a price drop to $70,000, but it highlights a level of concern and precautionary positioning.

- Cost of Hedging: It’s important to remember that hedging isn’t free. Buying put options involves paying a premium. Traders weigh the cost of this premium against the potential losses they are trying to avoid. The current surge in put option activity suggests that many traders deem the cost of hedging worthwhile given the perceived risks.

Alarming Bitcoin ETF Outflows: A Deeper Dive

The spotlight is firmly on the accelerating Bitcoin ETF outflows. While ETFs were initially seen as a catalyst for wider Bitcoin adoption, the recent trend reversal is raising eyebrows. Why are we seeing such significant withdrawals?

| Factor | Impact on ETF Outflows |

|---|---|

| Profit Taking | Investors who bought into Bitcoin ETFs earlier in the year might be taking profits after the initial price surge, especially as broader market sentiment turns cautious. |

| Risk Aversion | Increased market volatility and macroeconomic uncertainties are driving investors towards safer assets, leading them to reduce exposure to volatile assets like Bitcoin, even through ETFs. |

| Alternative Investments | Some investors might be reallocating capital to other asset classes that are currently perceived as more attractive or offering better risk-adjusted returns. |

| Market Correction Fears | Concerns about a broader market correction, not just in crypto but across all asset classes, could be prompting investors to reduce overall portfolio risk and liquidate positions, including ETF holdings. |

The continuous selling pressure from these outflows adds downward momentum to Bitcoin’s price and reinforces the bearish outlook in the short term.

Navigating the Turbulent Crypto Market: Is This a Buying Opportunity or a Bear Trap?

The current crypto market landscape presents a complex picture. On one hand, the price decline could be viewed as a buying opportunity for long-term investors who believe in Bitcoin’s fundamental value. On the other hand, the confluence of negative factors—ETF outflows, hedging activity, and macroeconomic headwinds—suggests the potential for further downside.

Key Considerations for Traders:

- Monitor ETF Flows: Keep a close watch on Bitcoin ETF outflow data. Continued outflows will likely exert further downward pressure. A reversal in this trend could signal a potential shift in market sentiment.

- Analyze Hedging Activity: Track put option volumes and strike prices to gauge market expectations and potential price levels traders are anticipating.

- Stay Informed on Macroeconomics: Pay attention to inflation data, tariff discussions, and overall economic indicators, as these factors can significantly impact crypto markets.

- Manage Risk Prudently: In volatile periods, prioritize risk management. Consider using hedging strategies, diversifying your portfolio, and avoiding excessive leverage.

Conclusion: A Cautious Outlook for Bitcoin

The recent Bitcoin price decline, fueled by accelerating ETF outflows and broader market anxieties, has understandably led to increased hedging activity. While the long-term trajectory of Bitcoin remains a subject of debate, the short-term outlook appears cautiously bearish. Traders are wisely preparing for potential further price drops, and a watchful, data-driven approach is crucial for navigating this uncertain crypto market. Whether this dip proves to be a fleeting correction or the start of a deeper slump remains to be seen, but for now, caution is the prevailing sentiment.