The cryptocurrency market is constantly buzzing with activity, and all eyes remain fixed on Bitcoin’s price movements. As the flagship digital asset navigates volatile waters, a key technical level is under scrutiny, potentially dictating its near-term trajectory. Will Bitcoin hold strong, or is a significant correction on the horizon?

Bitcoin Price Faces a Crucial Test

According to well-known Crypto analyst Justin Bennett, Bitcoin (BTC) is currently at a critical juncture. He highlights the $106,000 level as a vital support area. In his view, the market’s reaction at this point will be decisive. Holding this level could pave the way for continued upside, while failure could trigger a notable downturn. This type of assessment is central to Technical analysis, where historical price data and chart patterns are used to forecast future movements.

What Happens If Bitcoin Support Breaks?

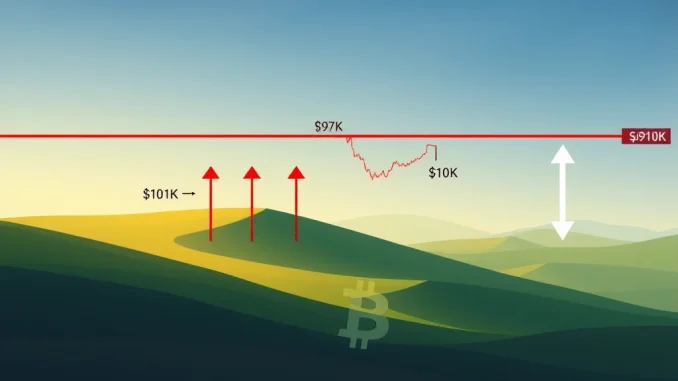

Bennett warns that if Bitcoin support at $106,000 fails to hold and confirms a breakdown, the path could open up for successive drops. Based on his BTC prediction, potential downside targets include:

- $101,000: The first significant support level below $106K.

- $97,000: A subsequent support zone if $101K doesn’t hold.

- $92,000: A more substantial drop target if the bearish momentum accelerates.

A move towards these levels would represent a significant correction from recent highs and could test the resolve of market participants.

The Bullish Scenario: Can the BTC Prediction Shift Upwards?

It’s not all doom and gloom. Bennett also outlines the conditions under which this bearish outlook would be invalidated. If the Bitcoin price manages to rally from its current position (around $107,560 at the time of the original report) and, more importantly, reclaims the $110,000 level, the picture changes. A confirmed move back above $110K would suggest that the bulls are back in control, potentially signaling a continuation towards challenging previous all-time highs.

Key Levels to Watch

For anyone following the Bitcoin price, the message is clear: pay close attention to these key levels identified through Technical analysis:

- $106,000: Crucial support. Holding this is vital for avoiding a significant drop.

- $110,000: Key resistance. Reclaiming this level would invalidate the bearish outlook and favor upside continuation.

Summary: Navigating Bitcoin’s Next Move

The market stands at a critical juncture, with the Bitcoin price testing important technical boundaries. Crypto analyst Justin Bennett’s insights provide a roadmap based on Technical analysis. A failure to hold $106,000 Bitcoin support could trigger a cascade towards $101K, $97K, and potentially $92K. Conversely, a strong move reclaiming $110,000 would invalidate the bearish BTC prediction and open the door for further gains. Traders and investors should monitor these levels closely as they will likely determine Bitcoin’s direction in the coming days or weeks.