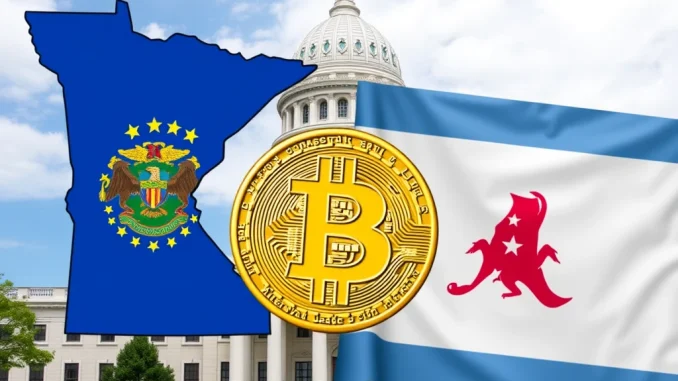

Exciting developments are unfolding in the cryptocurrency space as two US states, Minnesota and Alabama, are taking bold steps towards Bitcoin adoption. Lawmakers in both states have introduced groundbreaking bills that could pave the way for state investments in Bitcoin (BTC). This move signals a potential shift in how states view and utilize digital assets, potentially setting a precedent for others to follow. Let’s dive into the details of these proposed legislations and what they could mean for the future of crypto adoption.

Why are Minnesota and Alabama Considering State Investment in Bitcoin?

The core question is: what’s driving Minnesota and Alabama to explore Bitcoin as a viable investment option for state funds? Several factors could be at play, reflecting a growing understanding and acceptance of cryptocurrency’s potential:

- Diversification of State Investment Portfolios: Traditional investment portfolios often include stocks, bonds, and real estate. Adding cryptocurrency like Bitcoin could offer diversification, potentially reducing risk and enhancing returns.

- Harnessing Bitcoin’s Growth Potential: Despite its volatility, Bitcoin has demonstrated significant long-term growth. States might be looking to capitalize on this potential appreciation to boost state funds.

- Future-Proofing State Finances: As the digital economy expands, embracing digital assets like Bitcoin could be seen as a forward-thinking approach to ensure state financial systems are prepared for the future.

- Attracting Tech-Savvy Talent and Businesses: Pro-crypto policies can make states more attractive to innovative businesses and a tech-oriented workforce, fostering economic growth.

Minnesota’s Bold Move: The Minnesota Bitcoin Act

In Minnesota, the proposed legislation is titled the “Minnesota Bitcoin Act” (HF 2946), introduced by Republican Representative Bernie Perryman. This act is quite comprehensive and proposes significant changes regarding state investment in digital assets. Here’s a breakdown of what the Minnesota Bitcoin Act entails:

- State Investment Board Authority: The act would empower the state investment board to allocate funds to Bitcoin and potentially other cryptocurrencies. This signifies a major shift, treating cryptocurrencies as legitimate investment assets.

- Crypto in Retirement Plans for State Employees: A particularly noteworthy aspect is the provision allowing state employees to include crypto assets in their retirement plans. This could open up cryptocurrency exposure to a large segment of the population within the state.

- Broader Cryptocurrency Inclusion (Potentially): While the focus is on Bitcoin, the act mentions “other cryptocurrencies,” suggesting a possibility for the state to invest in a wider range of digital assets in the future, depending on the interpretation and implementation.

Alabama’s Dual Approach to Crypto Legislation

Alabama is taking a slightly different but equally significant approach with two parallel bills. Republican Senator Will Barfoot introduced Senate Bill 283, and a bipartisan group in the House, led by Republican Mike Shaw, filed the identical House Bill 482. These bills signal a bipartisan interest in exploring crypto legislation within Alabama. Key aspects of Alabama’s proposed bills include:

- State Investment in Cryptocurrencies: Similar to Minnesota, Alabama’s bills aim to allow the state to invest in cryptocurrencies, marking a departure from traditional investment norms.

- Focus on Bitcoin (BTC): While the wording allows for cryptocurrency investments, the bills essentially limit these investments to Bitcoin. This indicates a cautious approach, prioritizing the most established and widely recognized cryptocurrency.

- Bipartisan Support: The House bill’s bipartisan nature suggests a broader consensus on the potential benefits of incorporating digital assets into the state’s financial strategy.

What are the Potential Benefits of State Bitcoin Investment?

If these bills become law, what could be the potential upsides for Minnesota and Alabama? Exploring BTC investment at the state level could unlock several benefits:

- Enhanced Returns: Bitcoin’s historical performance suggests the potential for significant returns, which could boost state funds and reduce reliance on traditional tax revenue.

- Inflation Hedge: Some argue that Bitcoin can act as a hedge against inflation due to its limited supply. State investments could potentially protect against inflationary pressures.

- Technological Innovation Hubs: Embracing crypto can position Minnesota and Alabama as forward-thinking states, attracting blockchain and cryptocurrency companies and fostering technological innovation.

- Public Perception and Modernization: Adopting modern financial technologies can enhance a state’s image as progressive and adaptable in the eyes of its citizens and the wider world.

Challenges and Considerations for State Crypto Adoption

While the potential benefits are compelling, it’s crucial to acknowledge the challenges and considerations that come with crypto adoption at the state level:

- Volatility Risks: Bitcoin is known for its price volatility. States need robust risk management strategies to mitigate potential losses.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving. States must navigate this uncertainty carefully to ensure compliance and avoid legal pitfalls.

- Security Concerns: Safeguarding state-owned Bitcoin holdings from theft and hacking is paramount. Robust security infrastructure and protocols are essential.

- Public Education and Understanding: Public understanding of cryptocurrency is still limited. States may need to invest in public education to build trust and support for these initiatives.

The Road Ahead for State Crypto Legislation

The introduction of these bills in Minnesota and Alabama marks a significant step towards mainstream cryptocurrency adoption. It’s important to remember that these are just proposals. They will need to go through legislative processes, including committee reviews, debates, and votes, before potentially becoming law. The progress of these bills will be closely watched by the crypto community and other states considering similar measures.

Conclusion: A New Chapter for State Finance and Bitcoin?

The initiatives in Minnesota and Alabama represent a potentially pivotal moment in the intersection of state finance and digital assets. Whether these bills succeed or not, they highlight a growing recognition of Bitcoin and cryptocurrencies as legitimate and potentially beneficial assets, even for conservative state investment strategies. These developments could inspire other states to explore similar paths, potentially ushering in a new era of state-level crypto adoption and transforming how public funds are managed in the digital age. Keep an eye on these states – they might just be leading the charge into a future where Bitcoin plays a role in state economies.