Are you watching the Bitcoin market? Recent data points suggest a significant shift is underway, potentially marking the return of bullish momentum. For anyone following Bitcoin sentiment, the latest update from on-chain analytics firm CryptoQuant is particularly noteworthy.

What is Driving the Shift in Bitcoin Sentiment?

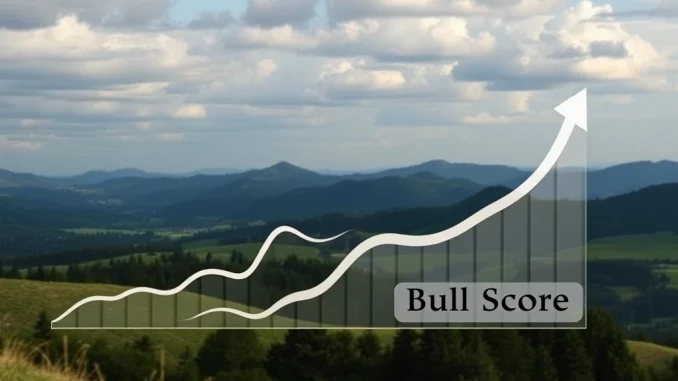

CryptoQuant recently highlighted a dramatic change in market sentiment on X (formerly Twitter). Their key indicator, the Bull Score, has seen a remarkable increase. This score is designed to gauge the overall bullishness or bearishness of the market based on various on-chain and market metrics.

Here’s what the data revealed:

- The Bull Score jumped sharply from a low of 20.

- It surged all the way to 80.

- A score of 80 is typically associated with strong bullish momentum.

- This shift is attributed, in part, to rising spot demand for Bitcoin.

Why Does a Bull Score of 80 Matter for Bitcoin Price?

The Bull Score is not just a random number; it’s a composite indicator used by platforms like CryptoQuant to provide insights into market conditions. When the score reaches high levels, like 80, it historically correlates with periods where the market is poised for potential upward movement. It suggests that underlying factors, such as accumulation by investors or increasing demand on exchanges, are creating a favorable environment for price appreciation.

For the average investor, this metric acts as a signal:

- A low score (like 20) might indicate caution or potential downside risk.

- A high score (like 80) suggests confidence is returning and the path of least resistance could be upwards.

- Combined with observed rising spot demand, it paints a picture of real buying pressure entering the BTC market.

Actionable Insight: Navigating the Bullish Signal

While no indicator is a guarantee, a significant jump in a reputable metric like the Bull Score from CryptoQuant is worth paying attention to. It provides a data-driven perspective on market psychology and demand. For those interested in the potential trajectory of Bitcoin price, this shift suggests a more optimistic outlook is gaining traction.

Key takeaway:

- Monitor further updates from CryptoQuant and other on-chain analysts.

- Observe how Bitcoin sentiment evolves following this signal.

- Consider how rising spot demand might impact liquidity and price action.

This development indicates that despite previous uncertainty, the underlying structure of the BTC market may be strengthening, laying the groundwork for potential future gains.

Summary: Bullish Winds for Bitcoin?

The jump in CryptoQuant’s Bull Score from 20 to a strong 80 is a compelling piece of evidence suggesting a notable shift in Bitcoin sentiment. Coupled with reports of rising spot demand, this indicator points towards increasing bullish momentum in the BTC market. While market dynamics can change rapidly, reaching a Bull Score of 80 is historically a positive signal that grabs the attention of traders and investors alike, hinting at the potential for further appreciation in Bitcoin price.