The current **Bitcoin price** action has many investors questioning its sustainability. A prominent analyst has now issued a cautionary note. This insight comes from Axel Adler Jr., a respected contributor at CryptoQuant, a leading on-chain analytics platform. His latest analysis suggests that Bitcoin’s recent upward movement is likely a temporary phenomenon, not a definitive reversal of its broader trajectory. Understanding this perspective is crucial for anyone navigating the volatile **crypto market trend**.

CryptoQuant Analysis: Decoding the Market Structure Shift

Adler’s assessment hinges on a significant shift in the market structure. He points to the Composite Index, a technical indicator, which has fallen below -0.4. This specific threshold typically signals a dominant downtrend in the market. Consequently, the recent upward movement, often perceived as a recovery, is instead interpreted as a simple bounce. It does not indicate a resumption of a broader uptrend. Investors should consider this expert **CryptoQuant analysis** when evaluating their positions.

The Composite Index aggregates various data points to provide a holistic view of market momentum. A reading below -0.4 suggests that bearish forces currently outweigh bullish ones. Therefore, while the **Bitcoin price** might see short-term gains, the underlying sentiment remains cautious. This detailed analysis helps clarify why the present **BTC rebound** might be fleeting.

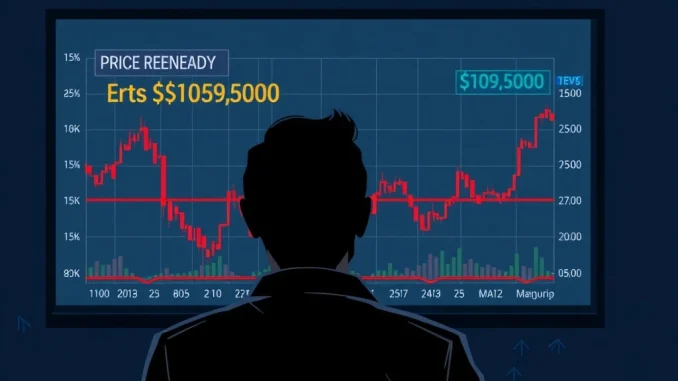

Key Bitcoin Support: The $109.5K Level

A critical element of Adler’s analysis is the identification of **Bitcoin support** at $109,500. This level is not merely an arbitrary figure; it represents a significant point where buying pressure is expected to prevent further declines. Maintaining this support is paramount for any bullish aspirations. If the **Bitcoin price** holds above $109,500, a potential uptrend could target the $117,700 resistance level. Conversely, a decisive break below this support could signal further downside.

On September 24, Bitcoin briefly touched $111,000 around 4:00 a.m. UTC. It then recovered to trade near $112,400, showing a modest 0.39% gain from the previous day’s close. This fluctuation highlights the ongoing battle between buyers and sellers around these crucial levels. Monitoring this **Bitcoin support** level is vital for traders and long-term holders alike.

Understanding the Temporary BTC Rebound

Many market participants often mistake a bounce for a full recovery. However, Adler’s insights suggest a more nuanced reality. A temporary **BTC rebound** often occurs within a larger downtrend. It can be fueled by short covering, minor positive news, or simply market volatility. Such bounces provide opportunities for bears to re-enter positions or for early bulls to be trapped. Therefore, caution remains the watchword for investors.

For an uptrend to truly resume, two conditions would ideally need to be met:

- The **Bitcoin price** must firmly hold above the $109,500 support.

- The Composite Index needs to recover and move back above zero.

Until these conditions are met, the current positive price action should be viewed with skepticism. This perspective is essential for making informed decisions in the current **crypto market trend**.

Broader Crypto Market Trend Implications

Bitcoin’s performance often dictates the direction of the broader cryptocurrency market. If the analyst’s warning about a temporary **BTC rebound** proves accurate, it could signal continued volatility and potential downward pressure across altcoins. The overall **crypto market trend** would likely remain bearish until Bitcoin demonstrates a more robust and sustained recovery.

Investors should pay close attention to on-chain data and technical indicators. These tools provide deeper insights beyond mere price movements. The **CryptoQuant analysis** offers a valuable framework for understanding the current market dynamics. It emphasizes the importance of key support and resistance levels. Furthermore, it highlights the underlying market structure. This proactive approach helps investors mitigate risks.

FAQs

What does Axel Adler Jr.’s analysis suggest about Bitcoin’s current price action?

Axel Adler Jr. suggests that Bitcoin’s current rebound is likely temporary. He believes it is a simple bounce within a dominant downtrend, rather than a sustained recovery.

Why is the Composite Index important in this analysis?

The Composite Index, a technical indicator, has fallen below -0.4. This signals a dominant downtrend. For a true uptrend to resume, the index would need to recover above zero.

What is the key Bitcoin support level identified by the analyst?

The key **Bitcoin support** level identified is $109,500. Holding above this level is crucial for any potential uptrend targeting $117,700.

What would need to happen for a broader Bitcoin uptrend to resume?

For a broader uptrend to resume, the **Bitcoin price** must hold above $109,500, and the Composite Index must recover to above zero.

How does this analysis impact the overall crypto market trend?

If Bitcoin’s rebound is temporary, it suggests continued caution for the broader **crypto market trend**. Bitcoin’s performance often influences altcoin movements, implying potential ongoing volatility.

Where can I find more information on CryptoQuant analysis?

More detailed **CryptoQuant analysis** and insights from contributors like Axel Adler Jr. can typically be found on the CryptoQuant platform or their official publications.