The cryptocurrency world is buzzing with anticipation as Bitcoin price shows incredible resilience and potential for an unprecedented surge. Recent analyses suggest that if a critical support level holds, Bitcoin could be on its way to $130,000, fueled by a relentless wave of institutional investment. This isn’t just speculative chatter; it’s a narrative backed by strong technical indicators and significant shifts in the broader crypto market. For anyone tracking digital assets, understanding these dynamics is crucial to navigating what could be a truly transformative period.

Understanding the Bitcoin Price Dynamics: The $110,000 Threshold

At the heart of the current bullish sentiment lies a pivotal technical level: the $110,000 support zone. Analysts are closely watching this threshold, which has emerged as a crucial battleground between buyers and sellers. The ability of Bitcoin to sustain its position above this point is seen as a strong indicator of underlying strength and growing buyer confidence.

- Critical Support Zone: The area between $114,900 and $114,000 has shown remarkable resilience, demonstrating increased liquidity and a robust demand floor. This narrowing support zone suggests that buyers are stepping in quickly to prevent significant pullbacks.

- Technical Signals: While specific technical patterns are not detailed, the general consensus points to signals that reinforce an upward trajectory, provided key levels are defended. A breach below $110,000, however, could invalidate this bullish outlook, triggering a potential correction.

- Market Psychology: The continued holding of this support level builds psychological confidence among investors, encouraging further accumulation and reducing the likelihood of panic selling.

This steadfast support forms the bedrock upon which more ambitious Bitcoin forecasts are being built, setting the stage for what could be a remarkable price discovery phase.

The Unstoppable Force of ETF Inflows: A Supply Squeeze Brewing?

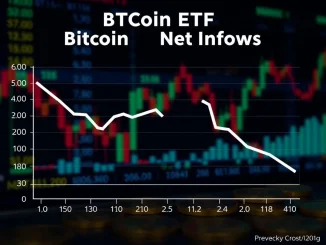

Perhaps the most compelling argument for Bitcoin’s potential surge comes from the unprecedented institutional activity, particularly through spot Bitcoin Exchange-Traded Funds (ETFs). These investment vehicles have fundamentally altered the supply-demand dynamics of Bitcoin.

Raoul Pal, the visionary founder of Real Vision, succinctly captured the essence of this phenomenon, stating that ETF inflows are currently absorbing virtually all newly mined Bitcoin supply. This creates a fascinating and potentially explosive scenario:

| Factor | Impact on Bitcoin Price |

|---|---|

| ETF Demand | Massive capital influx from institutional investors, providing a steady stream of buying pressure. |

| Mined Supply | Limited and predictable, especially post-halving, creating a scarcity effect. |

| Supply Squeeze | When demand from ETFs significantly outpaces the rate at which new Bitcoin is mined, a supply squeeze becomes almost inevitable. This forces prices higher as buyers compete for limited available supply. |

| Investor Confidence | Institutional adoption lends legitimacy and stability, attracting more traditional investors. |

This dynamic, where institutional demand consistently outstrips mining output, positions the $110,000 level not just as a technical support, but as a critical threshold for the continuation of this bullish momentum. It highlights a fundamental shift from retail-driven speculation to institutionally-backed accumulation, providing a more robust foundation for price appreciation.

Broader Crypto Market Rally and Macroeconomic Tailwinds

Bitcoin’s impressive performance isn’t occurring in isolation. The broader crypto market has also shown significant signs of life, with Ethereum and leading altcoins like Solana and Dogecoin posting notable gains. This synchronized rally suggests a renewed risk-on sentiment pervading financial markets.

- Bitcoin’s Milestone: Bitcoin recently surpassed $120,000, marking its highest level since 2021, a clear signal of strong investor confidence returning to the asset class.

- Altcoin Performance: The positive movement in Ethereum, Solana, and Dogecoin often indicates a broadening of the rally beyond just Bitcoin, as capital flows into other digital assets, seeking higher returns.

- Federal Reserve’s Influence: A significant driver of this rally is speculative trading ahead of the U.S. Federal Reserve’s July meeting. Expectations of interest rate cuts have fueled a ‘risk-on’ environment, making assets like cryptocurrencies more attractive compared to traditional, lower-yielding investments.

- Global Liquidity Expansion: Beyond rate cuts, some analysts, like Bambra, point to a broader global liquidity expansion as a major catalyst. Increased money supply globally tends to flow into risk assets, including cryptocurrencies, pushing valuations higher. This perspective suggests that the current rally is part of a larger macroeconomic trend that could see Bitcoin reach targets of $300,000–$500,000 in the long term.

The interplay between Bitcoin’s individual strength and these broader market and macroeconomic factors creates a powerful narrative for continued growth.

Navigating Volatility and Diverse Bitcoin Forecasts

While optimism abounds, the path to higher prices is rarely smooth. The cryptocurrency market remains inherently volatile, and several factors could introduce short-term turbulence or even significant corrections.

- Market Shocks: A recent $9 billion Bitcoin sale by Galaxy Digital, for instance, triggered a short-term sell-off, prompting some traders to reallocate capital to Ethereum, highlighting the market’s sensitivity to large transactions.

- Regulatory Developments: The regulatory landscape continues to evolve. While El Salvador’s revised Bitcoin law signals growing adoption, skepticism from institutions like JPMorgan toward crypto firms can add uncertainty and impact investor sentiment.

- The Fed’s Verdict: The outcome of the Federal Reserve’s July 29–30 meeting is seen as pivotal. A rate cut could indeed catalyze a breakout above $130,000, validating the ‘risk-on’ sentiment. Conversely, a hawkish stance, indicating a continuation of higher rates, might trigger a correction as investors pull back from riskier assets.

Despite these potential headwinds, multiple forecasts continue to paint a bullish long-term picture. An anonymous Reddit contributor projected a base-case scenario of $135,000 by year-end, while Bambra’s outlook extends significantly further, suggesting targets of $300,000–$500,000 amidst global liquidity expansion. These varying Bitcoin forecasts underscore the range of possibilities and the conviction of long-term holders.

What Does This Mean for the Future of Bitcoin News?

The current confluence of strong technical support, overwhelming institutional demand via ETFs, and favorable macroeconomic conditions paints a compelling picture for Bitcoin’s future. The $110,000 level stands as a critical test, a line in the sand that could determine whether Bitcoin continues its parabolic ascent or faces a temporary setback.

The broader crypto market, with its $3.89 trillion total market capitalization and Bitcoin’s impressive 60% dominance, provides a fertile ground for speculative activity. However, investors must remain vigilant. Recent whale transactions and ongoing regulatory scrutiny serve as reminders of the inherent risks. The next few weeks, particularly around the Federal Reserve meeting, will be crucial in shaping the immediate trajectory of Bitcoin and the wider digital asset space. The narrative for Bitcoin news is likely to remain dominated by price action and institutional adoption.

Conclusion: A Defining Moment for Bitcoin

Bitcoin stands at a fascinating juncture. The convergence of robust technical support, unprecedented institutional ETF inflows, and a potentially accommodating macroeconomic environment creates a powerful bullish cocktail. While volatility and regulatory uncertainties persist, the foundational demand for Bitcoin appears stronger than ever. If the $110,000 support holds firm, the path to $130,000, and potentially beyond, looks increasingly plausible. Investors should stay informed, monitor key levels, and understand that while the potential rewards are significant, so too are the inherent risks in this dynamic market.

Frequently Asked Questions (FAQs)

Q1: What is the significance of the $110,000 support level for Bitcoin?

The $110,000 support level is considered a critical technical threshold. If Bitcoin can consistently hold above this level, it signals strong buyer confidence and increased liquidity, reinforcing a bullish trend. A breach below it could indicate a weakening of the upward momentum and potentially trigger a correction.

Q2: How are Bitcoin ETFs influencing its price?

Spot Bitcoin ETFs are allowing institutional investors to gain exposure to Bitcoin without directly holding the asset. The massive capital inflows from these ETFs are absorbing a significant portion, if not all, of the newly mined Bitcoin supply. This imbalance between high demand and limited supply creates a ‘supply squeeze,’ which naturally drives the Bitcoin price higher.

Q3: What role does the U.S. Federal Reserve play in Bitcoin’s price movements?

The Federal Reserve’s monetary policy decisions, particularly regarding interest rates, have a significant impact on risk assets like Bitcoin. Expectations of rate cuts often fuel a ‘risk-on’ sentiment, making cryptocurrencies more attractive. Conversely, a hawkish stance (higher rates) can lead to capital flowing out of riskier assets, potentially causing a correction in the crypto market.

Q4: Are there any risks to Bitcoin reaching $130,000?

Yes, the path to higher prices is not without risks. These include:

- Volatility: Sudden large sales (like the Galaxy Digital example) can cause short-term pullbacks.

- Regulatory Uncertainty: Evolving regulations or negative sentiment from major financial institutions can impact investor confidence.

- Macroeconomic Shifts: Unexpected changes in global liquidity or central bank policies could alter market dynamics.

- Technical Breakdown: A sustained breach below key support levels like $110,000 could invalidate bullish forecasts.

Q5: What are some of the long-term Bitcoin forecasts mentioned?

While the article focuses on a potential surge to $130,000, some analysts and contributors have offered even higher long-term Bitcoin forecasts. These include a base-case projection of $135,000 by year-end by an unidentified Reddit contributor, and more ambitious targets of $300,000–$500,000 by Bambra, attributed to broader global liquidity expansion.