The cryptocurrency market is buzzing! Bitcoin price has just made a significant move, climbing above the $97,000 mark. What’s driving this latest surge? According to reports, a major catalyst appears to be the news of planned U.S.-China talks set to take place in Switzerland.

Understanding the Impact of U.S.-China Talks on Market Sentiment

Why would diplomatic discussions between two global powers affect the price of a digital asset like Bitcoin? It boils down to market sentiment. When major economic players like the United States and China signal a willingness to resolve trade disputes, it generally reduces global economic uncertainty. This fosters a more optimistic outlook among investors, encouraging what’s known as ‘risk-on’ behavior.

Peter Chung, head of research at Presto Research, highlighted this connection in comments to The Block. He noted that the announcement of the meeting significantly raised expectations for a resolution to ongoing trade tensions. This positive development made investors more comfortable taking on risk.

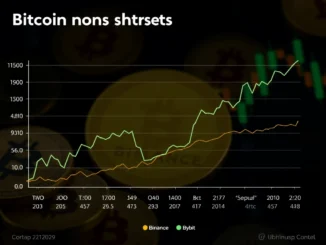

Evidence of this shift was visible across different asset classes. Following the news, gold, often seen as a safe-haven asset during uncertain times, saw a decline. Simultaneously, riskier assets like Nasdaq futures and Bitcoin rallied, reflecting the increased risk-on appetite in the market.

An Unexpected Rally? Navigating Geopolitical Uncertainty

Interestingly, the timing of this upward movement surprised some market watchers. Nick Ruck, Research Director at LVRG Research, commented that the rally was somewhat unexpected. Investors had reportedly been reducing their risk exposure in anticipation of a potential U.S. Federal Reserve interest rate decision, which could introduce volatility.

However, Ruck also pointed to broader factors that could continue to support Bitcoin’s ascent. He suggested that ongoing geopolitical uncertainty, such as the conflict between India and Pakistan, combined with macroeconomic volatility, could push Bitcoin price to new highs. This perspective reinforces the narrative of Bitcoin acting as a potential hedge against traditional market risks and global instability.

Key Takeaways:

- Planned U.S.-China trade talks boosted market sentiment, encouraging risk-on investing.

- This led to a rally in Bitcoin and Nasdaq futures, while gold declined.

- The timing was unexpected by some given anticipation of a Fed rate decision.

- Experts believe continued geopolitical uncertainty could further drive Bitcoin price higher as a hedge.

What Does This Mean for Investors?

This recent price action underscores how sensitive the crypto market can be to global macroeconomic and geopolitical events. While the U.S.-China talks provided a positive trigger for risk-on behavior, other uncertainties remain. Investors should continue to monitor global news headlines, particularly those related to trade, international relations, and central bank policies, as these factors can significantly influence market sentiment and, consequently, Bitcoin price.

Conclusion: Bitcoin’s Dual Nature

Bitcoin’s rally past $97,000, fueled by hopes for trade resolution, highlights its growing integration into the global financial landscape. It reacted positively to a traditional risk-on signal. Yet, expert commentary also reminds us of its potential role as a safe haven during geopolitical uncertainty. This dual nature makes Bitcoin a fascinating asset to watch as it navigates the complex interplay of global diplomacy, economic policy, and investor psychology.