The cryptocurrency world often buzzes with bold predictions. Recently, a specific Bitcoin price prediction has sparked considerable debate. While many anticipate significant gains, one analyst warns that a rapid surge to BTC $250K within just three months could signal an alarming market event: a Bitcoin blow-off top. This perspective challenges the common narrative of perpetual upward momentum, suggesting caution is paramount for investors.

Understanding the Bearish BTC $250K Signal

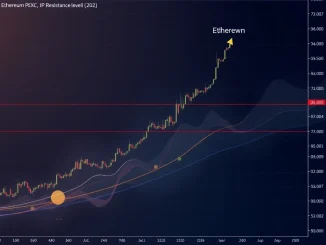

Macroeconomic analyst Mel Mattison recently presented a counter-intuitive view. He described the current Bitcoin market cycle as undergoing a healthy adjustment phase. However, he warned against an “overheated rally.” Such a rapid ascent, for example, to BTC $250K in a short period, might not be a sign of robust health. Instead, it could precede a sharp and sudden price collapse. Cointelegraph highlighted this analysis, emphasizing the potential for a blow-off top scenario.

A blow-off top describes a specific market phenomenon. It features a dramatic, parabolic price increase. This surge is often fueled by intense speculation and FOMO (fear of missing out). Following this peak, prices then experience a rapid, significant decline. This pattern can liquidate many leveraged positions. It also traps late investors at inflated prices. Mattison’s analysis therefore serves as a crucial warning. It encourages investors to evaluate market momentum carefully.

Decoding the Bitcoin Market Cycle

Every financial asset, including Bitcoin, moves through distinct market cycles. These cycles involve phases of accumulation, growth, distribution, and correction. Mattison suggests Bitcoin is currently in a healthy cyclical adjustment phase. This phase allows for sustainable growth. It prevents the market from becoming overly extended. Conversely, an overheated rally skips necessary consolidation. It pushes prices upwards too quickly. This often creates an unstable foundation.

Understanding the Bitcoin market cycle is vital for investors. It helps in making informed decisions. Historically, Bitcoin has seen several such cycles. Each cycle often culminates around a halving event. The halving reduces new BTC supply. This scarcity can drive prices higher. However, rapid, unsustainable pumps often lead to sharp corrections. Therefore, a measured pace is generally preferred by long-term investors.

Historical Context of Bitcoin Blow-Off Top Events

Bitcoin’s history includes instances resembling a Bitcoin blow-off top. For example, the 2013 and 2017 bull runs saw dramatic peaks. These were followed by significant price retracements. In 2013, BTC soared to over $1,000. It then quickly fell by over 80%. Similarly, after hitting nearly $20,000 in late 2017, Bitcoin entered a prolonged bear market. This historical data supports the analyst’s concerns. It shows that extreme short-term gains can be unsustainable.

These historical patterns teach valuable lessons. They highlight the risks associated with parabolic growth. A market needs time to consolidate gains. It also requires new capital to enter gradually. Without this, a sudden influx of speculative money can create a bubble. This bubble eventually bursts, causing a blow-off top. Hence, prudent investors monitor market sentiment closely. They also look for signs of irrational exuberance.

Expert Crypto Market Analysis and Alternative Views

Mattison’s crypto market analysis offers a cautious perspective. He forecasts BTC could reach $150,000 by February of next year. This prediction suggests a more gradual, sustainable growth path. It contrasts sharply with the idea of a $250,000 surge in three months. Other analysts also provide varied insights. Some focus on institutional adoption. Others track on-chain metrics. Still others consider global liquidity conditions.

A comprehensive crypto market analysis involves many factors. These include supply-demand dynamics. They also cover regulatory developments. Investor sentiment plays a significant role too. Furthermore, technical indicators often guide trading decisions. Different experts weigh these factors differently. This leads to a range of price targets and timelines. Investors should consider multiple viewpoints. They must also conduct their own research.

Macroeconomic Factors Shaping Bitcoin’s Future

Global macroeconomic conditions heavily influence Bitcoin’s trajectory. Inflation rates, for instance, impact Bitcoin’s appeal as a hedge. High inflation can push investors towards scarce assets. Interest rate decisions by central banks also matter. Higher rates can make traditional investments more attractive. This might divert capital from riskier assets like crypto. Geopolitical events also create uncertainty. They can affect market stability.

Therefore, a robust Bitcoin price prediction must integrate these external factors. Bitcoin has shown increasing correlation with traditional markets. This means global economic health affects its performance. A strong global economy might foster risk-on sentiment. This could benefit Bitcoin. Conversely, economic downturns might lead to sell-offs. Understanding this interplay is crucial for any serious market participant.

Navigating Volatility: Investor Strategies and Risks

The prospect of BTC $250K – whether as a target or a warning – underscores Bitcoin’s inherent volatility. Investors must develop sound strategies. Long-term holders often adopt a “HODL” approach. They ride out short-term fluctuations. Short-term traders, conversely, aim to profit from price swings. Both strategies carry specific risks. Risk management remains paramount for everyone.

Avoid emotional decisions, especially during rapid price movements. Fear of missing out (FOMO) often drives irrational buying. This typically happens near market tops. Conversely, panic selling occurs during sharp declines. Diversifying portfolios can mitigate risks. Investing only what you can afford to lose is another golden rule. These practices help investors navigate Bitcoin’s dynamic landscape. They also protect capital from unexpected market shifts.

The debate around a rapid ascent to BTC $250K highlights critical aspects of the cryptocurrency market. While ambitious targets excite many, expert analysis suggests caution. A swift, unsustainable surge could trigger a Bitcoin blow-off top. Instead, a healthy Bitcoin market cycle emphasizes gradual, sustainable growth. As macroeconomic analyst Mel Mattison suggests, a more measured pace towards targets like $150,000 by early next year appears more aligned with market health. Investors should prioritize understanding market dynamics. They must also adopt prudent strategies. This approach will better prepare them for Bitcoin’s volatile future.

Frequently Asked Questions (FAQs)

Q1: What does a “Bitcoin blow-off top” mean?

A1: A Bitcoin blow-off top refers to a rapid and significant price surge, often parabolic, followed by an equally sharp and sudden price collapse. This pattern is typically driven by speculative buying and can lead to substantial losses for investors who buy at the peak.

Q2: Why would BTC hitting $250K in three months be considered a bearish signal?

A2: According to analyst Mel Mattison, such a rapid ascent to BTC $250K in a short timeframe suggests an “overheated rally.” This unsustainable growth could trigger a blow-off top, indicating a lack of healthy market consolidation and setting the stage for a sharp correction rather than continued upward momentum.

Q3: How does this prediction relate to the overall Bitcoin market cycle?

A3: This prediction emphasizes the importance of a healthy Bitcoin market cycle. A rapid, uncorrected surge contradicts a “healthy cyclical adjustment phase,” which involves more gradual growth and consolidation. Sustainable growth is generally preferred over parabolic pumps for long-term market stability.

Q4: What is Mel Mattison’s alternative Bitcoin price prediction?

A4: Macroeconomic analyst Mel Mattison suggests a more conservative Bitcoin price prediction. He believes BTC could reach $150,000 by around February of next year. This forecast implies a more measured and sustainable growth trajectory compared to the rapid $250,000 surge discussed.

Q5: What factors contribute to a comprehensive crypto market analysis?

A5: A thorough crypto market analysis considers numerous factors. These include macroeconomic conditions (inflation, interest rates), supply-demand dynamics, regulatory changes, on-chain metrics, technical indicators, and overall investor sentiment. Analysts often weigh these elements differently to form their predictions.

Q6: What should investors do to navigate potential volatility?

A6: Investors should prioritize risk management. This involves avoiding emotional decisions driven by FOMO, diversifying portfolios, and only investing capital they can afford to lose. Understanding the Bitcoin market cycle and adopting a long-term perspective can also help in navigating inherent market volatility.